Europe Admits QE Has Failed, Promises More Of It

Interest-Rates / Quantitative Easing Oct 23, 2015 - 02:49 PM GMTBy: John_Rubino

New Age monetary policy has begun to resemble the form of insanity in which a patient repeats the same behavior while expecting a different outcome.

New Age monetary policy has begun to resemble the form of insanity in which a patient repeats the same behavior while expecting a different outcome.

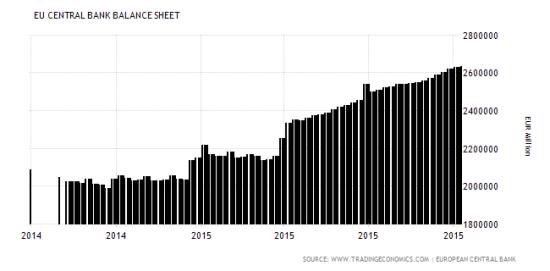

Throughout the developed world, interest rates are at record lows and central banks continue to pump out newly-created currency. Yet growth remains tepid, inflation is nonexistent and debt of every type continues to mount. And instead of recognizing that somewhere in their guiding theory lurks a fatal flaw, governments and central banks just keep upping the ante. Today it was Europe, where central banks have been expanding their balance sheets (i.e. running the printing presses) aggressively…

EU central bank balance sheet

…and forcing down interest rates…

German 2 year note

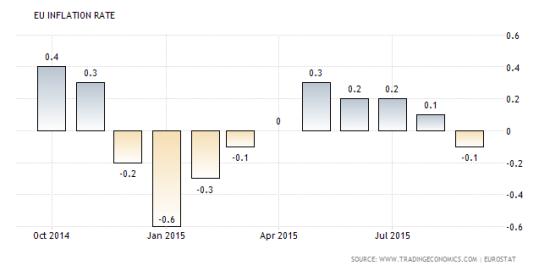

…to no avail. Europe’s inflation rate has been falling all year…

EU inflation rate

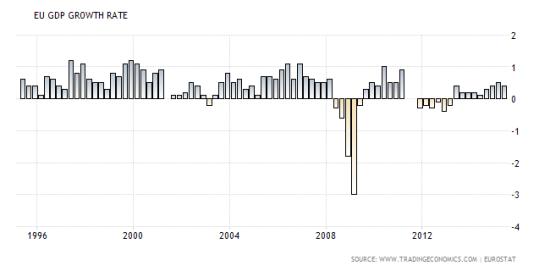

… and GDP growth remains below 1% annualized. That’s nowhere near fast enough to keep up with the accumulation of government debt and unfunded liabilities. The hole in which the EU found itself during the Great Recession keeps getting deeper despite ZIRP and QE.

EU growth rate

So what does the European Central Bank do? It promises even easier money:

The dollar spiked as the euro tanked, of course, adding to the headwinds that have caused a brutal corporate earnings season — and the emerging market/commodities complex turmoil Draghi blamed for tepid European growth. For those seeking QE’s fatal flaw, that would be a good place to start.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.