Hedging HAL With Gold

Commodities / Gold and Silver 2015 Nov 03, 2015 - 03:32 PM GMT In the month of October, there were thirteen two hour blocks during which gold traded in a range greater than $10 – not an alarming price range to be sure, but collectively, these high activity moments represent the most volatile trading periods for the gold price all month – by far. What’s more interesting is that a whopping ten of the thirteen occurred well within the first hour of trading on the COMEX (6AM MST), frequently on little to no news of any consequence, at a time when most normal people are barely making their way to the coffee machine. By contrast, only three occurred later in the trading day – the first corresponded with the release of the Fed Minutes (Oct 8), the second with an important numbers miss, and the third the release of the Fed policy statement (Oct 28) – in other words, during times when price volatility was justified, reasonable, and expected. Welcome to the world of algorithmic trading – the new normal for all financial markets.

In the month of October, there were thirteen two hour blocks during which gold traded in a range greater than $10 – not an alarming price range to be sure, but collectively, these high activity moments represent the most volatile trading periods for the gold price all month – by far. What’s more interesting is that a whopping ten of the thirteen occurred well within the first hour of trading on the COMEX (6AM MST), frequently on little to no news of any consequence, at a time when most normal people are barely making their way to the coffee machine. By contrast, only three occurred later in the trading day – the first corresponded with the release of the Fed Minutes (Oct 8), the second with an important numbers miss, and the third the release of the Fed policy statement (Oct 28) – in other words, during times when price volatility was justified, reasonable, and expected. Welcome to the world of algorithmic trading – the new normal for all financial markets.

We have been closely covering the subject of computerized/algorithmic trading at our site since the April, 2012 edition of our News & Views newsletter which featured the essay, ‘Extraordinary Delusions and The Madness of Machines‘. I must admit even I was a little stunned to find the evidence of it at work so obvious. And then I read Gillian Tett’s article in the Financial Times over the weekend entitled, “How humans can wrest control of the markets back from computers.”

A couple of quotes from the article:

“Even if the definition is a little arbitrary, these swings are clearly becoming far more frequent — and not just in oil markets. Investors were shocked this year when a flash crash in U.S. equities caused the price of some exchange traded funds to plummet for a brief period. Almost exactly a year ago, similar convulsions erupted in the Treasuries market.”

“But Mr Massad points to another culprit: algorithms such as those used by high-frequency traders. This is the vital piece of the puzzle. In the past few years, use of automated computer programs has expanded so fast that the CFTC says they are now involved in 50 per cent of all trades for metals and energy futures, and 67 per cent of Treasury futures. If the markets were like the spaceship in the movie, 2001: A Space Odyssey, it would be Hal, the craft’s wilful computer, at the controls.”

“‘The crucial point is that these automated trading programs — like HAL — lack human judgment. When a crisis erupts and prices churn, computers do not simply ‘take a long coffee break’, as Mr Massad says, and wait for common sense to return; instead they tend to accelerate trading, fuelling those flash crash swings.'”

50% of all trades?! Wow.

If you can’t beat ’em, join ’em?

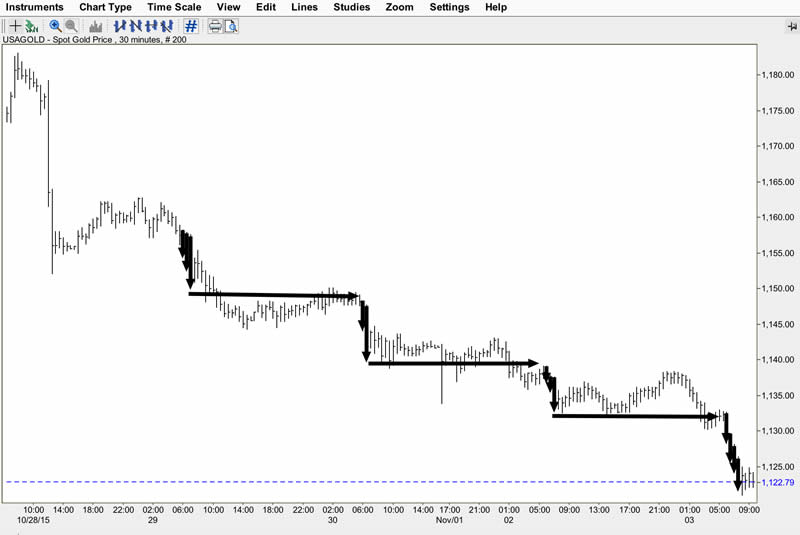

It is worth noting that computer algorithms are not necessarily of bearish bias with regards to gold. In fact, in the ten trading instances where algorithmic/high frequency trading was the most likely culprit, seven actually pushed the price higher as gold prices accelerated off the bottom to start the month. But true to the tenor of the Tett’s article, the next three pushed it lower, ultimately reversing the trend. It is increasingly clear that algorithms can work fantastically to accentuate (or <gasp> manipulate) short-term trends. Look no further than the last four days in gold!

I mean, come on! It’s almost ridiculous. The four day range started at $1155 on the high and now stands near the $1123 low. Literally the entirety of the $32 range was realized in the cumulative trading over the first hour of all four days! It’s as if all trading globally after 6:45 AM MST was functionally useless in regards to price discovery. But as the FT article notes, a computer that trades solely on a predetermined set of interdependent data streams (a.k.a. what it thinks the Fed will do) will inevitably fail in a situation where common sense and deductive logic are antecedents to a prudent decision.

As a brief aside, I might add here that I’m becoming increasingly convinced that algorithmic trading is the single most influential force pushing markets in a ‘supportive direction’ of a ‘credible’ Fed. Would any reasonable person really be leveraging positions in long dollar, short yen, short gold, short euro just because the Fed said they are ‘once again’ going to look at raising rates a paltry .25% in December. IT DOESN’T AMOUNT TO ANYTHING! Yet the price action over the past week would suggest the Fed is on the cusp of a ‘lunar landing’ of monetary policy. Pfffft I say!

In the end, we are quickly learning that algorithms will ultimately succeed in creating their own little profit making situations (and leave investors scratching their heads in the meanwhile). But accentuating the prevailing trend will only eventually foster either an unusually favorable buying opportunity, or an unusually strong uptrend. And the truth is, despite all the ‘noise’ we might have to endure in the meanwhile, both of those outcomes ought to be considered a favorable result for both would-be and existing physical gold owners. In the end, the best way to hedge HAL is to buy and own physical metal in the form of coins and bullion that you own outright.

Why? Let’s call it, ‘Human Judgement’

You see, we can look at an artificially low price in the context of more than what the most recent directional trend might say, or the most recent meaningless data release might suggest. We can acknowledge that it doesn’t matter one iota what the Fed says they will do, as they’ve proven time and again that integrity is not a top priority. We can look instead at the real economy, it’s anemic growth, the explosion of the national debt, and a Central Bank run amok as an overarching condemnation of the long term value of the dollar. And we also know that some day, the computers will have to cover their shorts too.

And after all that logical reasoning, those of us brave enough to take action in the face of computer sewn doubt might actually find ourselves in a thankful mood somewhere down the road. I took the liberty of preparing our thank you note:

Dear HAL,

Thank you. Thank you for letting us protect ourselves, to safely tuck away our physical metal while you discounted the price again and again. We wanted you to know that even though you tried, you couldn’t distract us with your day to day antics, or erode our belief in gold. You just never figured out that gold is a store of wealth, not a trade, and falling prices only afforded us the opportunity to buy our monetary insurance on the cheap. And last but not least, thank you for jumping on the band wagon with gold, just like we always knew you eventually would. Your participation pushed the price to levels we never dreamed possible.

Dave

Reader invitation: If you like this type of gold-based analysis, you might want to consider becoming a regular visitor to this page – our live daily newsletter. We publish important information, forecasts, commentary & analysis on the gold market daily. Please bookmark if you have an interest. For free, in-depth analysis and special reports, we invite you to subscribe free of charge to our regular newsletter. New release notifications are sent by e-mail.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.