Day Follows Night : Gold Follows US Bonds

Commodities / Gold and Silver 2015 Nov 05, 2015 - 05:48 AM GMTBy: Dan_Norcini

For the same reason as the Euro was sharply lower today, so was gold, namely, a hawkish Yellen testimony in which see used the words, "living possibility" when referring to a potential December rate hike.

For the same reason as the Euro was sharply lower today, so was gold, namely, a hawkish Yellen testimony in which see used the words, "living possibility" when referring to a potential December rate hike.

With interest rates moving higher on the Ten Year Treasury once more today, ( at 2.23% as I type this), gold simply cannot compete with better returns on interest bearing assets such as notes and bonds as it casts off no yield whatsoever and depends completely on capital gains to produce any sort of increase for its owners.

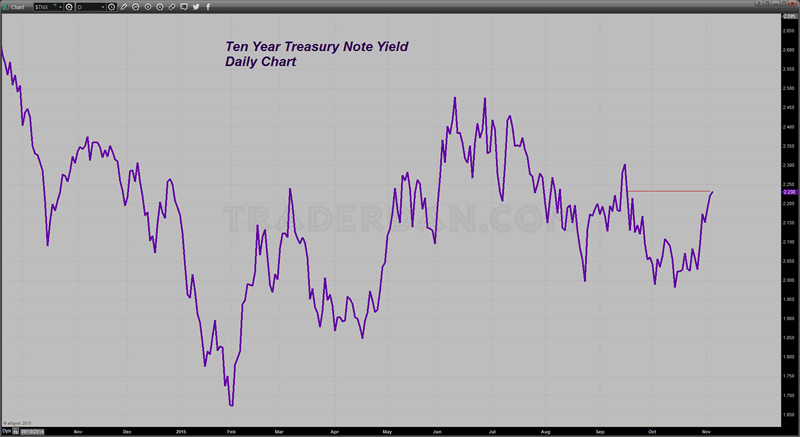

Here is a chart of the yield on the Ten Year Treasury... it is near a 7 week high...

10-Year Treasury Note Yield Daily Chart

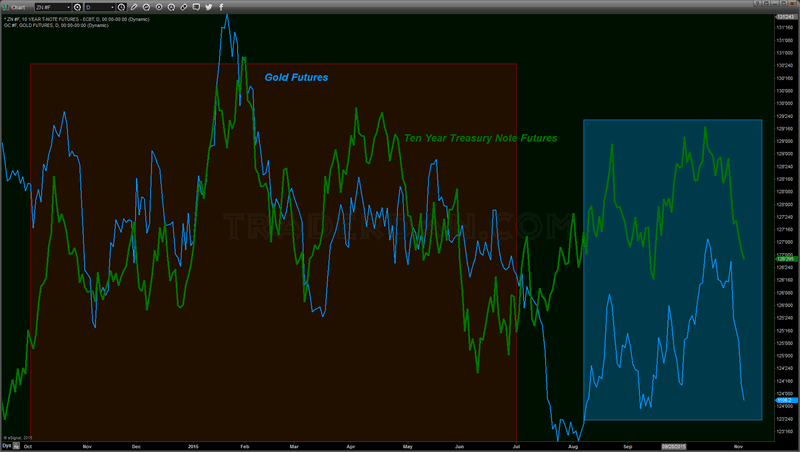

The relationship between gold and the price of the Ten Year Treasury futures contract has resumed with both moving in near perfect sync. Remember as the price of the futures contract moves lower, the actual rate or yield moves higher.

10-Year Treasury Note Futures and Gold Futures Chart

As the yields move higher, gold is moving lower. Nothing sinister - no "malevolent force" as Dennis Gartman foolishly suggested the other day in which he played the gold cult card for his own misreading of the charts on some evil, sinister gold cartel attack, etc. Look, any time any trader is on the wrong side of a move, he is always tempted to blame it on something other than his own analysis. But that is something we expect novice traders to do, not seasoned pros like Mr. Gartman.

I think we can also say with relative confidence at this point is that if interest rates were to fall lower on Friday on the heels of what might be a negative jobs report, gold will simply follow the Ten Year Treasury futures contract as it will most likely rally on a weak number. If the number is very strong, and plays into ideas that the Fed will move in December, then the futures contract for the Ten Year will probably fall lower ( interest rates rising) and gold will follow it down.

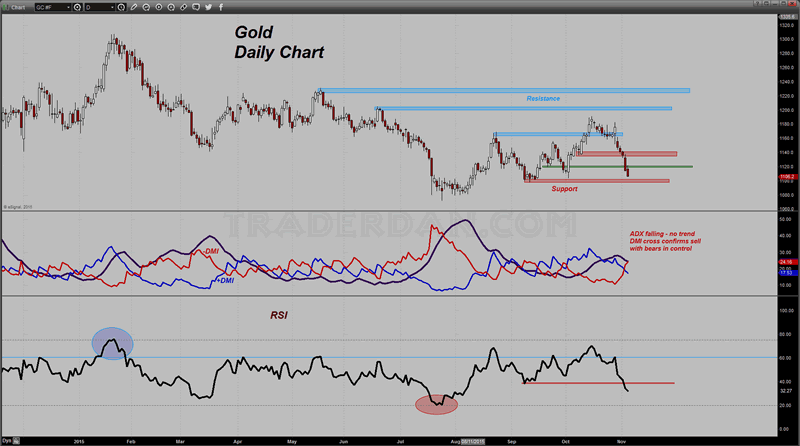

Gold Daily Chart

On the actual gold chart itself, support near round number and psychologically significant $1100 looks like it is going to be tested. There might be some buying in Asia this evening during the hours at which India comes on but Western sentiment towards gold has soured tremendously since last week's hawkish FOMC statement and was further undercut by her hawkish comments today.

If $1100 were to give way, $1080 comes into play.

Both indicators remain in negative technical postures giving the bears the clear advantage. The loss of the level 40 for the RSI points out how weak the market has become.

Severe technical damage has been done to this price chart and it is going to take a Herculean effort on the part of the bulls to turn it around. If they do not get some help from Friday's upcoming payrolls number, they are in big, big trouble as long liquidation is now picking up speed with new shorts coming in as well on the speculative side.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.