Does Bond Market Drive the Gold Price?

Commodities / Gold and Silver 2015 Nov 06, 2015 - 03:22 PM GMTBy: Arkadiusz_Sieron

Many gold market analysts focus on irrelevant, but catchy factors, such as mining production or jewelry demand. Others think gold is a simple inflation or stock market hedge. It is a bit strange that the relationship between the bond and gold markets is not commonly examined, given that bond market is much bigger than stock market, while real interest rates are one of the main drivers of the price of gold. The negative relationship between gold and interest rates imply positive correlations with bond prices, since the price of bonds is negatively related to the yields they offer.

Many gold market analysts focus on irrelevant, but catchy factors, such as mining production or jewelry demand. Others think gold is a simple inflation or stock market hedge. It is a bit strange that the relationship between the bond and gold markets is not commonly examined, given that bond market is much bigger than stock market, while real interest rates are one of the main drivers of the price of gold. The negative relationship between gold and interest rates imply positive correlations with bond prices, since the price of bonds is negatively related to the yields they offer.

Why should the price of gold rise in tandem with bond prices? Well, think of gold as a substitute for Treasuries, especially when yields are near zero. In such an environment, investors may simply prefer to buy gold rather than bonds (that practically pays zero). Yeah, the precious metals do not yield any income at all, but at least they are not made of paper and U.S. government cannot issue them. Hence, there may be a positive relationship between gold and bonds due to the opportunity costs and capital flow from bonds to gold, when prices of bonds become too high (yields become too low). There may be also capital flows in the opposite direction (from gold to bonds) when bond yields increase (bond prices decrease) and provide a better alternative than gold. This is especially true in the case of U.S. Treasuries. They are considered as a safe-haven - but one which pays a yield. In other words, "fear trade" may increase demand for both gold and bonds. The latter are generally anti-cyclical, while gold is noncyclical, but both asset classes may sometimes move in tandem responding to changes in the stock market, as a non-confidence vote in the U.S. economy (this is why people invested in gold and bonds during the last financial crisis). Moreover, the Fed typically increases the money supply by purchasing government bonds and pushing their prices higher. If such purchases are considered as a signal that the U.S. economy is weak (e.g. as in the case of first quantitative easing), the price of gold may rise simultaneously with bond prices.

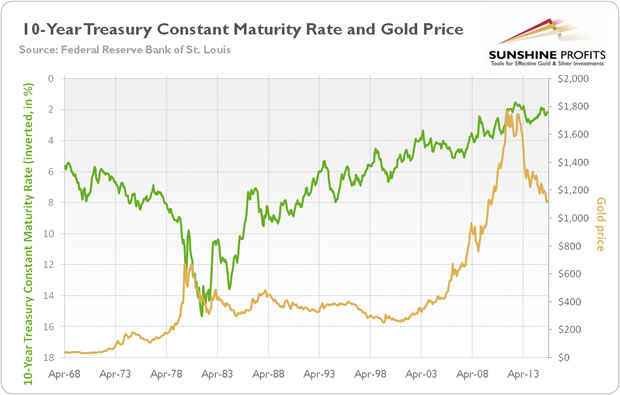

There is one problem with this reasoning: the data does not confirm the positive relationship between gold and the bond market. The chart below presents the price of gold and the 10-Year Treasury constant maturity rate (the 10-Year Treasury is considered as a benchmark in the bond market, or at least in the long-term part of it, as it is one of the most widely held fixed income securities in the world). The rates are in reverse order to show the trend in bond prices (which are inversely related to yields).

Chart 1: 10-Year Treasury Constant Maturity Rate (in percent, green line, left scale, values in reverse order) and the price of gold (yellow line, right scale, London P.M. Fixing)

As one can see, the price of gold was rising in the 70s, despite the fact that bond prices were falling and rates were surging. Since the 1980s, there has been a long upward trend in bond prices, seemingly not related to changes in the gold market, as the shiny metal was in a bear market during the 1980s, the 1990s and in the last few years, and in a bull market during the 2000s. This visual analysis is confirmed by more sophisticated research conducted by Baur and Lucey in their academic paper "Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold", where they found that gold is neither a hedge nor a safe haven for bonds.

Why is there no clear relationship between bond prices and the shiny metal? First, high and accelerating inflation rate affects gold and bonds differently. Usually, when inflation was considered a threat, long-term bonds rates rose and their prices fell. Conversely, many investors buy gold to hedge against inflation. This explains the behavior of bonds and gold in the 1970s. The high and accelerating inflation rate hit the bond market and undermined the confidence in the U.S. dollar, whilst gold was boosted.

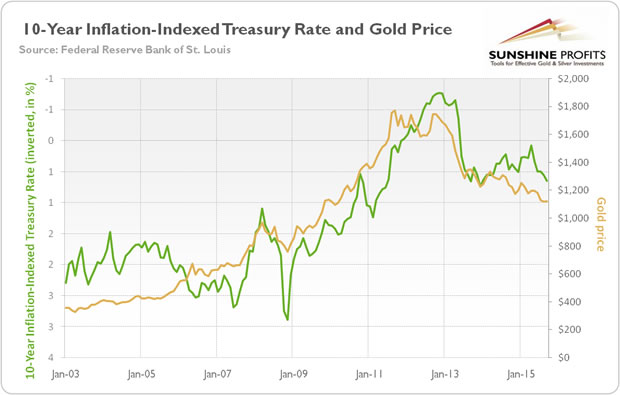

Investors should remember that what really matters for gold are real interest rates, not nominal yields. The chart below shows a significant positive correlation between the price of 10-year inflation-indexed Treasury and the price of gold, or negative relationship with real interest rates (10-year inflation indexed Treasury rate is a proxy of U.S. long-term real interest rate). The rates in the chart are in reverse order to show the trend in bond prices (which are inversely related to yields).

Chart 2: 10-Year Inflation-Indexed Treasury Rate (in percent, green line, left scale, values in reverse order) and the price of gold (yellow line, right scale, London P.M. Fixing)

Second, the rise in demand for the U.S. bonds from foreigners (e.g. due to the global woes) would increase not only bond prices, but also the U.S. dollar exchange rate. If the greenback gets stronger, the price of gold should decline. This is probably why gold was in a bear market in the 1980s and 1990s, while bond prices were rising. Third, if investors fear that U.S. debts become unsustainable, they will sell bonds and buy gold. Given the probable bubble in the bond market, its burst could lead to declines in bond prices and a rising price of gold. In other words, gold and Treasury bonds are often substitutable safe-haven assets (this is why gold prices move more in tandem with bond prices more than they do with stocks). Except the situations when investors lose faith in the U.S. economy - then gold is superior to Treasuries (like in the 1970s or the 2000s, when the ratio of gold to bond prices significantly increased).

To sum up, as in the case of stocks and gold, there is no simple causal link between bond and gold prices. The sometimes observed positive correlation between bond prices and the shiny metal results from substituting bonds with gold and vice versa due to opportunity costs. Another reason is changes in confidence in the fiat dollar-denominated system, which prompts investors to switch funds from the stock market to gold and bonds. The fact that the yellow metal price is not driven by stocks or bonds confirms the thesis that gold is a good portfolio diversifier, and that it should be considered not as an asset class, but rather as a special non-fiat currency - a non-confidence vote in the U.S. economy.

Thank you.

Thank you for reading the above free issue of the Gold News Monitor. If you'd like to receive these issues on a daily basis, please subscribe. In addition to these short daily fundamental reports, we focus on the global economy and the fundamental side of the gold market in our monthly gold Market Overview reports. We also provide Gold & Silver Trading Alerts for traders interested more in the short-term prospects. If you're not ready to subscribe yet, or are unsure which product suits you, we encourage you to sign up for our mailing list and receive other free alerts from us. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.