Gold Price Breakdown Could Result in Slide to $800

Commodities / Gold and Silver 2015 Nov 09, 2015 - 02:11 PM GMTBy: Clive_Maund

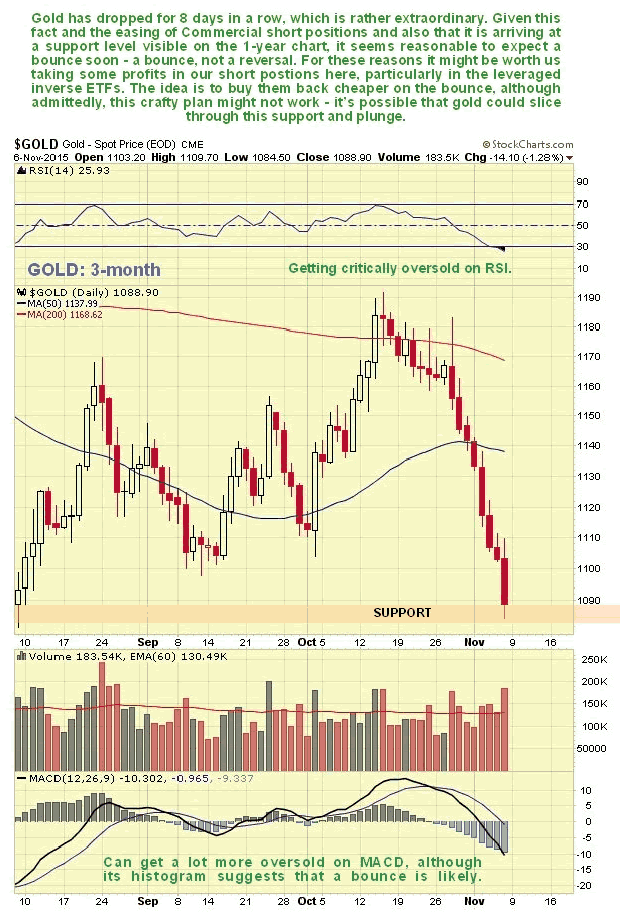

The predictions made in the recent past for the dollar to rally and gold and silver to drop have proven to be correct. Gold has now dropped for 8 days in a row as we can see on its 3-month chart below, which common sense dictates is increasing the chances of a bounce soon, especially as Commercial short positions eased significantly last week and gold is arriving at a support level in an oversold condition. Gold is oversold relative to its moving averages, which are in bearish alignment.

The predictions made in the recent past for the dollar to rally and gold and silver to drop have proven to be correct. Gold has now dropped for 8 days in a row as we can see on its 3-month chart below, which common sense dictates is increasing the chances of a bounce soon, especially as Commercial short positions eased significantly last week and gold is arriving at a support level in an oversold condition. Gold is oversold relative to its moving averages, which are in bearish alignment.

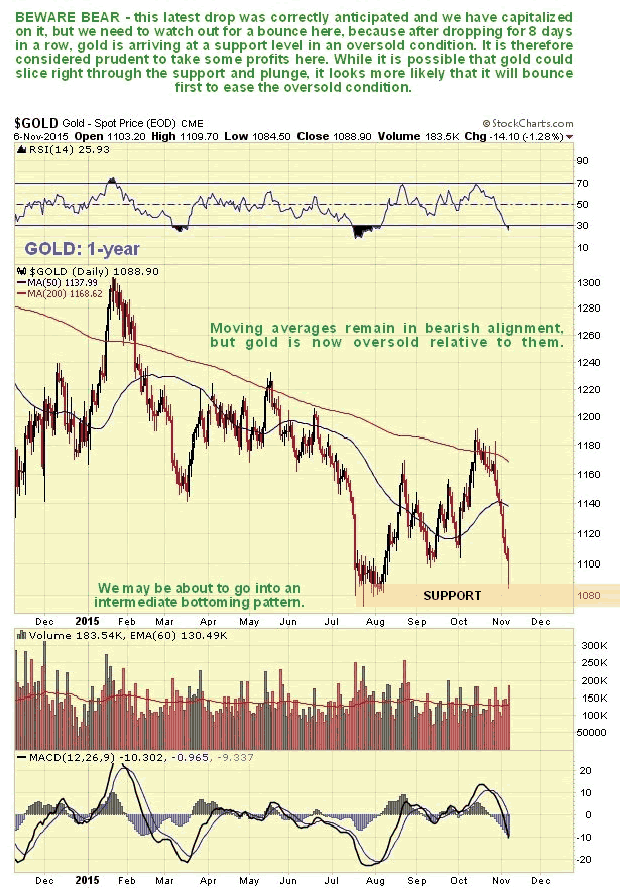

On the 1-year chart we can see why gold's drop may be arrested soon, at least temporarily, because it is arriving at a support level which turned the price back up in July and August, although if a big dollar rally is getting started, this won't arrest the decline for long. What seems a likely scenario is that gold's decline decelerates and it goes into a trading range for a few weeks near to the July lows before it becomes clearer what will happen next.

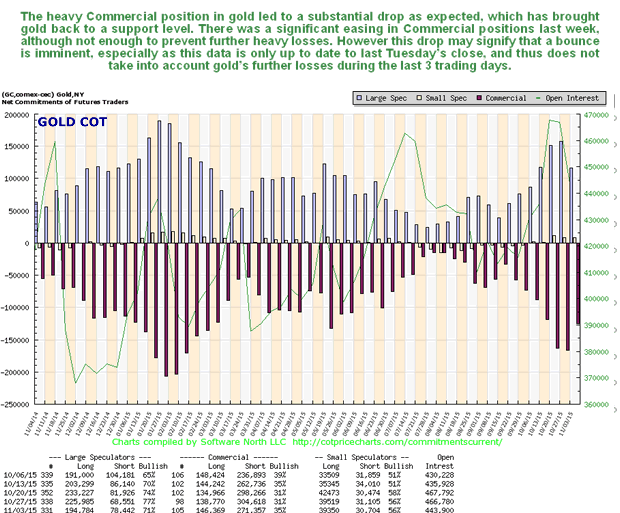

The latest COT chart shows that Commercial shorts, which had risen to a high level, prompting us to take a bearish tack, eased considerably last week, and remember that this chart is only up to date as of last Tuesday, so we can presume their shorts eased more later in the week as gold continued to drop. This is increasing the chances of a bounce here or soon, particularly as gold is now arriving at support in an oversold condition, as mentioned above. There is room for these positions to ease a lot more, which is why, perhaps after a bounce or the formation of a trading range, or both, gold looks set to break lower again.

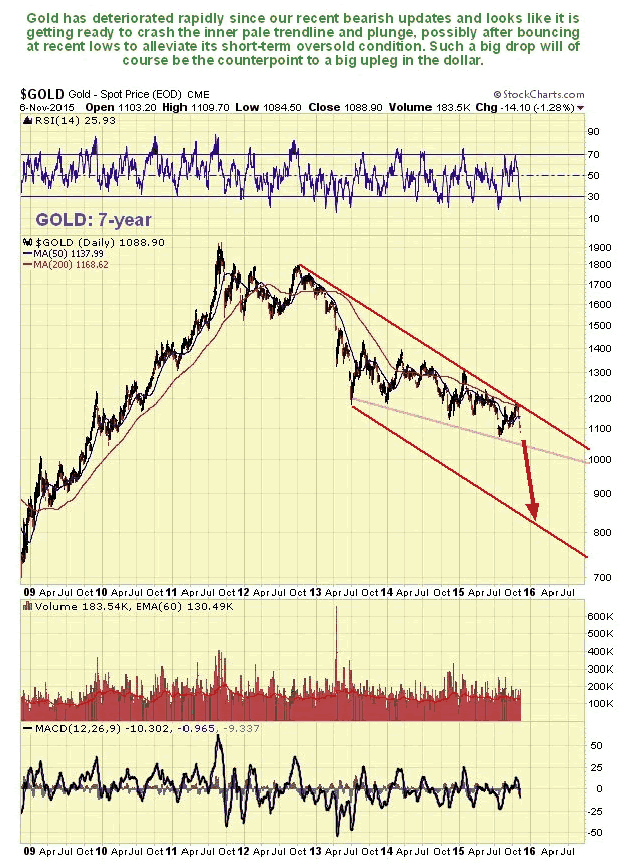

The 7-year chart makes two things very clear. One is that gold remains in a bearmarket regardless of what the cheerleaders claim, as made plain by the fact that it is still stuck in the big downtrend channel shown, which also implies that dollar remains in a bullmarket. The other point this chart makes clear is that we are at a critical juncture here, because if gold breaks down below the pale inner channel shown, then it should drop away steeply towards the lower boundary of the channel, meaning it would target the low $800's.

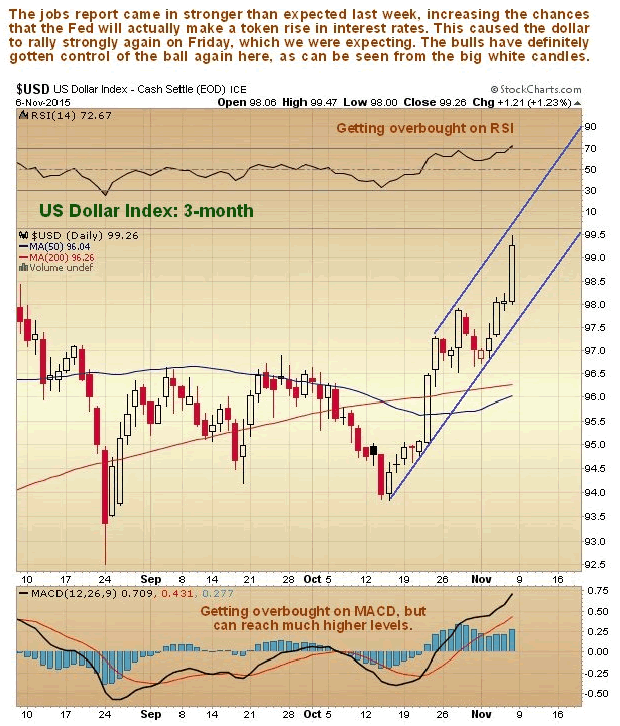

The biggest cause of gold's weakness is of course the strong dollar, so now we will look at that. On the 3-month chart for the dollar index we can see that the bulls have definitely gotten control of the ball, with a new uptrend developing over the past several weeks, punctuated by big white candles, with the latest strength being triggered by a strong jobs report, prompting speculation that the Fed will raise rates soon, although this is really "much ado about nothing" because they will only raise them by 0.25% if they do. Still it would set off fears of a rate rise cycle which could cause the dollar and the stockmarket to part company after their chummy alliance of recent months, with the dollar heading north and the stockmarket heading south. In this scenario gold and stocks drop together, as they did in 2008.

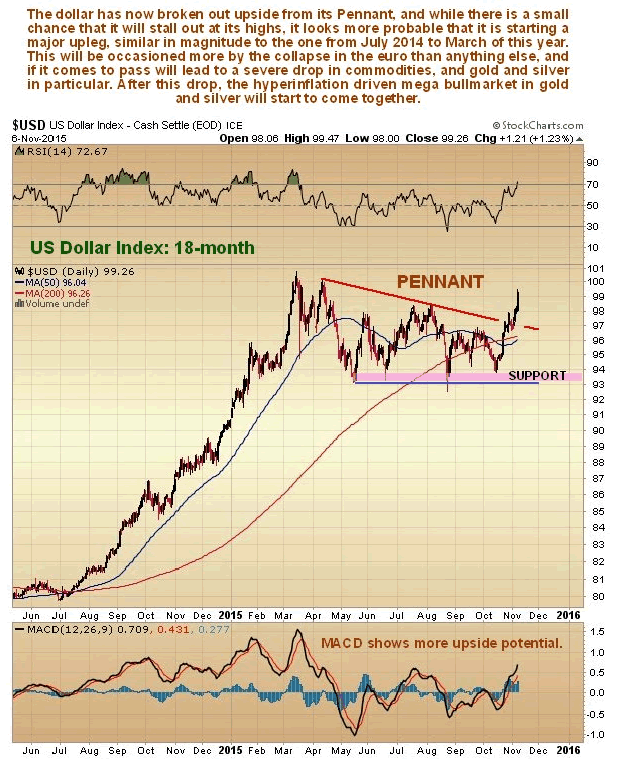

On the 18-month chart we can put the dollar's rise of recent weeks into context. As we can clearly see it looks like it is breaking out upside now from a sizeable bull Pennant with its moving averages swinging back into bullish alignment. The last obstacle for it to overcome is the resistance near to the March - April highs in the 100 area. While this could cap the advance it looks much more likely that it will break out to new highs to mount an advance of similar magnitude to the one preceding the Pennant, which means it would target the 120 area. Needless to say, a big dollar upleg such as this would really "put the cat among the pigeons", causing a lot of chaos and consternation especially in the commodities markets and in Emerging Markets.

The reason that such a big dollar index rally is possible is that the dollar index basket is comprised about 57% of the euro, and the euro is really on the ropes, with the European Union heading for chaos, as its leaders desperately resort to the QE drug to avert an acute liquidity crisis. With the US having backed off from QE, at least for now, that only leaves one direction for the euro to go - down. The acute weakness of the euro in recent weeks is shown on its 3-month chart below, which is the reverse of the strong dollar chart. Long-term charts show that the euro is probably breaking down into another severe downleg.

We will shortly be reviewing what to do with our PM sector inverse ETFs on the site, in which we have racked up substantial gains in the recent past.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2015 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.