The Final Gold Chapter

Commodities / Gold and Silver 2015 Nov 17, 2015 - 09:49 AM GMTBy: Bob_Loukas

This is the final chapter of this intermediate gold Cycle, and it’s likely to get ugly. If you’ve followed the blog these past few months, you would have been prepared for most of this move as it unfolded in real-time. The first post back on October 1st was Gold Cycle Running Out of Steam and was then followed up (Nov 1st) with Don’t Trust Gold Here. In both cases, I highlighted how the Weekly Cycle had topped and how similarly past Cycles behaved . It was why I argued that this Cycle appeared to be no different to the preceding failed, bear market Cycles since 2011. This is where gold finds itself today, standing on a ledge before a significant fall. For the patient (and protected) bulls, it may well become the final chapter of this great bear market.

This is the final chapter of this intermediate gold Cycle, and it’s likely to get ugly. If you’ve followed the blog these past few months, you would have been prepared for most of this move as it unfolded in real-time. The first post back on October 1st was Gold Cycle Running Out of Steam and was then followed up (Nov 1st) with Don’t Trust Gold Here. In both cases, I highlighted how the Weekly Cycle had topped and how similarly past Cycles behaved . It was why I argued that this Cycle appeared to be no different to the preceding failed, bear market Cycles since 2011. This is where gold finds itself today, standing on a ledge before a significant fall. For the patient (and protected) bulls, it may well become the final chapter of this great bear market.

Gold moved relentlessly lower again last week, ignoring normal Daily Cycle timing. The move has given life to my frequent warnings about the persistent, unyielding declines that bear markets often bring. Bear markets are notorious for elevating investors’ hopes through sharp moves higher that quickly give way to crushing declines. And as we’ve witnessed with Gold, the declines can be prolonged to the point that they wear down even the most ardent bulls.

Surprisingly, there is still an endless stream of pundits and investors declaring that Gold’s bear is over. Too many traders seem more preoccupied with catching a possible turn higher than with acknowledging the reality of the past 4 years and understanding Gold’s potential downside. Bullish bias helps to explain why, despite Gold’s sitting at a new 5-year low, sentiment is still not at bearish extremes. In addition, from the latest commitment of traders report (COT), it’s clear that speculators are still offloading bullish Long positions as they begin to accumulate bearish Short positions.

When combined with an Investor Cycle weekly count that easily supports another Daily Cycle, the above two indicators – Sentiment and COT – make me very cautious regarding Gold.

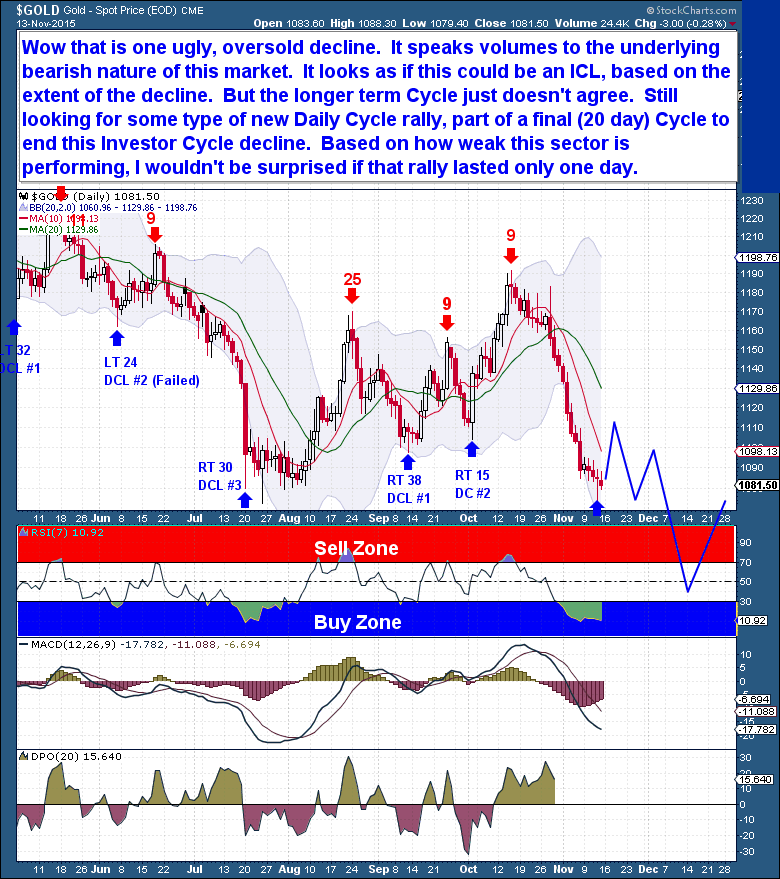

The daily chart shows just how ugly the current action has been, and it speaks volumes about the underlying bearish tone of the precious metals complex. On the surface, the current decline is severe enough to look like the final move into an ICL. But Gold’s longer term Investor Cycle suggests that another DC is needed to complete the IC.

In the immediate term, Gold is clearly oversold and should move higher in a new Daily Cycle rally. But based upon the sector’s clear weakness, it would not be a surprise if the rally lasted only a day. Remember, the next DC should be the last of the current Investor Cycle, and if it’s true to form, should end with twenty sessions of panicked selling.

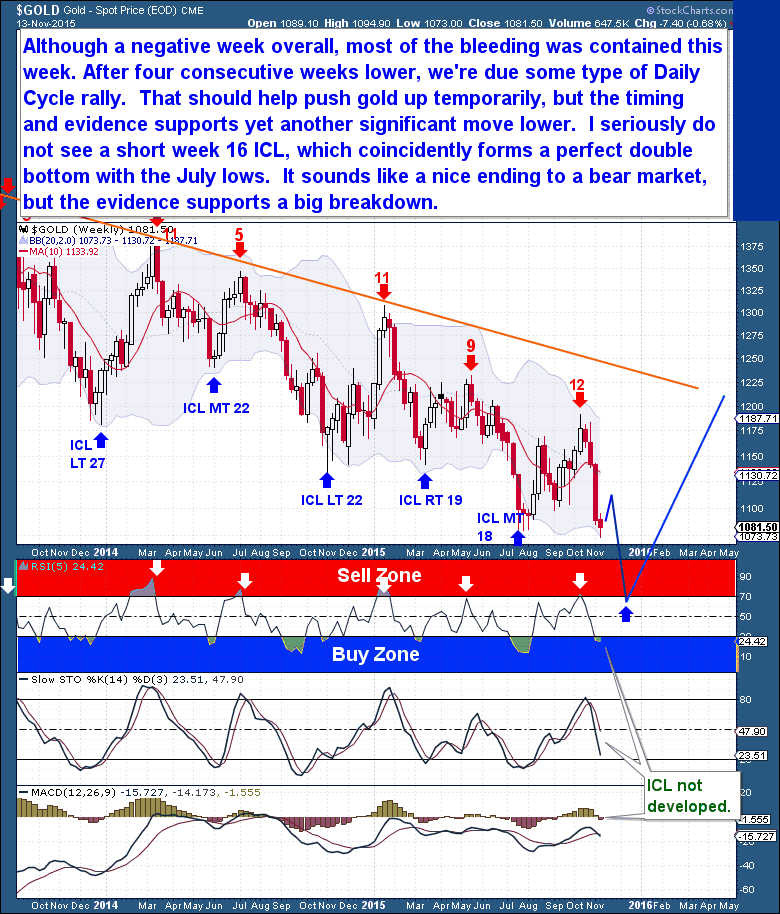

Although Gold’s week was negative overall, the bleeding was fairly contained. And after four consecutive weeks lower, it’s due for a Daily Cycle rally that should push it temporarily higher. The rally could be fast and convincing enough to cause steadfast bulls to again proclaim that a double bottom has occurred.

But because the timing and evidence support another significant move lower, I believe that any rally will be very short lived. The new Daily Cycle rally should be just enough to clear oversold technical levels and allow the Bollinger Bands to expand to accommodate the next big decline.

For those asking whether the current decline could be a short, 16 week ICL, I just don’t see it. A perfect double bottom forming with the July low would wrap a nice bow around the bear market, but the evidence doesn’t support it. It is not impossible by any stretch, but it is very unlikely.

Possible Trading Strategy

Nimble traders could buy a Swing Low (when one arrives), since the Daily Cycle is well past due for a rally. For anyone who takes such a trade, setting tight stops and actively managing/increasing them will be important.

The higher percentage or better risk/reward trade would come from allowing the oversold levels to cool off with a strong 2-3 day rally, and to then consider putting on a Short position. This should be a high percentage trade because of the high likelihood of a big decline into December.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit http://thefinancialtap.com/landing/try#

By Bob Loukas

© 2015 Copyright Bob Loukas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.