Crude Oil Price - Where is it Headed?

Commodities / Crude Oil Nov 20, 2015 - 03:41 PM GMTBy: Sol_Palha

All this talk and turmoil and noise and movement and desire is outside of the veil; within the veil is silence and calm and rest. ~ Bayazid Al-Bistami

On the 19th of this month, two articles were published at the same time, one stating that oil could go to $26 and the other stating that oil is ready to trade to $80. Which one is it going to be, $26 or $80 and how is the average Joe going to be able to discern which one is a depiction of what lies ahead. This is the problem with today's mass media, in their quest to attract eyeballs, bombastic and often conflicting articles are published simultaneously. One almost feels that most of the major sites have only one agenda, quantity over quality.

The idea is to use emotions, Greed or Fear to trigger a reaction. Whether the data supporting the hypothesis is valid or not, appears to be irrelevant. Perhaps this is why more American drink coffee daily than invest in the markets.; over 50% of the public is still sitting on the sidelines.

Psychology is probably the simplest, most misunderstood and most underutilized tool when it comes to trading. The first rule of mass psychology dictates that one put aside one's emotions. You have to cut the power of these useless forces. It is not easy, and it never becomes automatic. You have to fight it, but you know you are close to doing something right when you not overly confident about the decision you are going to make. The second factor is to get rid of the noise factor; use mass media as a source of entertainment or provide you information on what you should not be doing.

Having said, that, let's us attempt to shed some light on what is going on. Let's start off with the fundamentals; for the record we do not place too much emphasis on fundamentals. Fundamental data is presented in a standard format, so anyone with access to it can draw the same conclusion. Thus it negating the edge it is supposed to give an investor. However, if you combine that with Mass psychology and or technical analysis, the outcome improves considerably.

On the fundamental side, the IEA states that it expects oil to trade to $80 by 2020. The IEA also made the following statement.

"The IEA expects all the production in the United States to go down half a million barrels in next year - 500,000 barrels a day. I expect to go down a million barrels a day in 2016 and another million barrels in 2017," he said. "On top of that, I see demand increasing by another 2 million barrels over the next 2 years. So that's already a 4 million barrel swing over the next 22 months. That's going to make a difference with oil prices."

The IEA is notorious for painting a picture that in many instances bears no resemblance to reality. Fundamentals tend to give you a rear view look at what is going on. By the time, the fundamentals improve the market has moved and is trading well of its lows.

If we combine both those articles together, then we draw closer to the truth. We have been stating for some time that we expect crude oil to trade within a wide range, barring some unforeseen events such a full-fledged war in the Middle East. In fact, this is what we said to our subscribers recently.

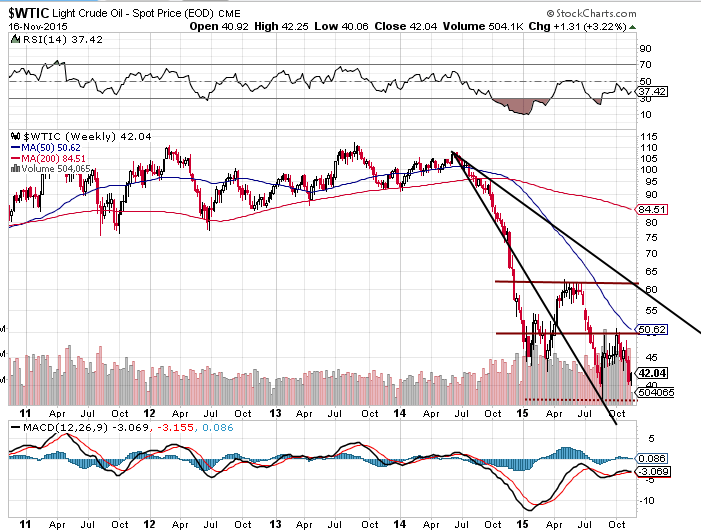

Oil is expected to continuing trading in a wide range (33-60), but will face bouts of resistance at 50.00. Once oil manages a weekly close above 50, it will widen the range to 60-65 ranges. ~ Market Update, Nov 1st, 2015.

What's next for Crude oil?

Crude came within striking distance of $50.00, trading as high as $48.36, before it pulled back. It looks set to test its lows again, with a possible overshoot, to the 32.00 ranges. The ideal set up would be for oil to put in a higher low or generate a positive divergence signal it drops to new lows.

From a technical perspective, oil needs a weekly close above 50.00 to indicate higher prices. A monthly close above 60 on a monthly basis will indicate that a test of $75.00 is in the works. We expect oil to trade in this range for the next several months unless the situation heats up in the Middle East.

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2015 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.