Stock Market Down Monday, Gold Price Bottoming?

Commodities / Gold and Silver 2015 Nov 29, 2015 - 03:17 PM GMTBy: Brad_Gudgeon

Three weeks ago I warned my subscribers that a Mars aspect on November 12th (Mars conjunct Venus in Libra) was indicating an explosive situation ahead, including possible terrorist activity. That very same week on November 13th, the Paris attacks occurred. We have an even more explosive Mars situation beginning on December 6th (Mars square Pluto/Neptune) and again on December 10th (Mars opposite Neptune). Mars entered Libra on November 12th and doesn't leave that sign until early January. Mars is ruled by Aries, which is opposite the peace loving sign of Libra. Mars is conjunct Venus until Dec 4th. Venus is ruled by Libra, so the conflict continues.

Three weeks ago I warned my subscribers that a Mars aspect on November 12th (Mars conjunct Venus in Libra) was indicating an explosive situation ahead, including possible terrorist activity. That very same week on November 13th, the Paris attacks occurred. We have an even more explosive Mars situation beginning on December 6th (Mars square Pluto/Neptune) and again on December 10th (Mars opposite Neptune). Mars entered Libra on November 12th and doesn't leave that sign until early January. Mars is ruled by Aries, which is opposite the peace loving sign of Libra. Mars is conjunct Venus until Dec 4th. Venus is ruled by Libra, so the conflict continues.

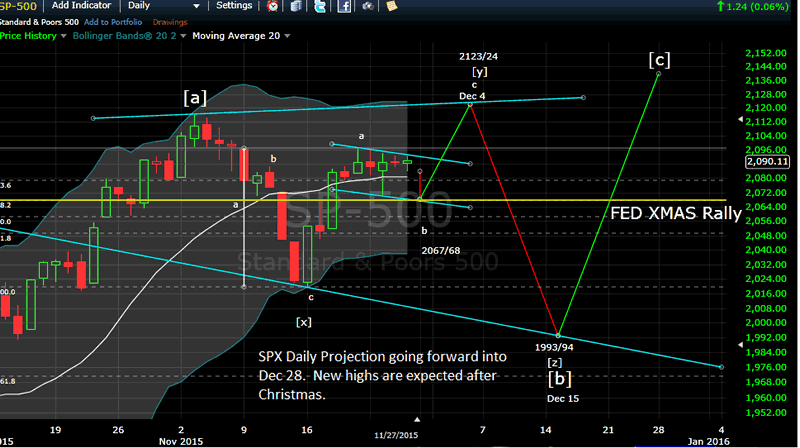

This weekend on the 29th, we have the Sun translating Saturn square Neptune (11/26). The pattern and cycles (Gann 8 TD low) suggest a probable move down to 2067/68 SPX by day's end Monday. The seasonal/cycle pattern then suggests a rally into December 4th. We could possibly see a move up as high as 2023/24. Whatever the price, 12/4 (or nearby) should be a top. With the Sun squaring Jupiter on December 14th, we should see a bottom near that date right (Dec 15?) before the FED announcement. The last two years, a strong 8 trading Christmas rally ensued on or right before the December FED announcement. The set up is the same this year.

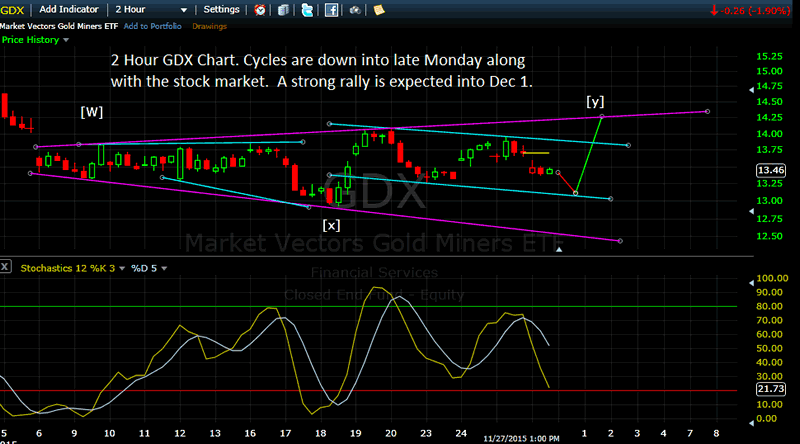

Gold got hit hard (to new bear market lows) on November 27th in what is "normally" a thinly traded session (bear raid?). The funny thing is, the miners (GDX) did not make a new bear market low, creating a case of inter-market bullish divergence (at least for the short term). Gold also made a bullish inverse white hammer on the futures. GDX has a 7 trading low due at the end of the day Monday and December 1 "seasonally" is usually a strong up day. This fits the cycle/wave patterns I'm seeing. Downside for GDX should support in the $13.10/.14 range and upside should run toward $14.24/.28.

We are entering week 19 of the 18-22 week low window. My original thinking last week was that gold would likely break $1000 an ounce this week. This does not seem likely from what I'm now seeing (although it may be possible by mid December).

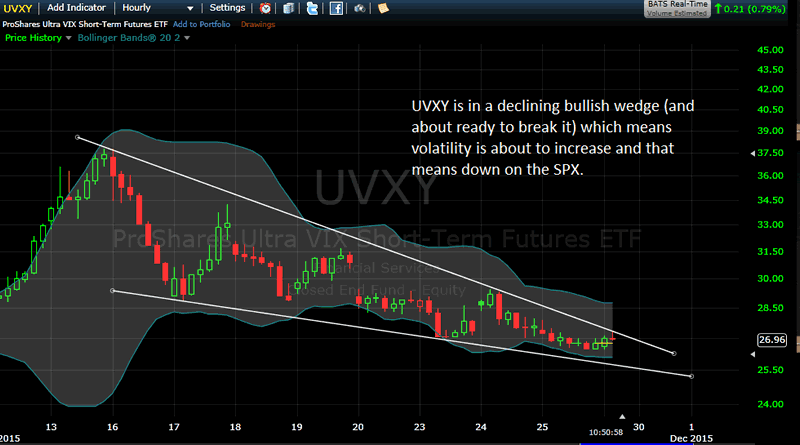

Below are charts of the SPX, GDX and UVXY (a leveraged volatility ETF):

S&P500 Daily Chart

GDX 2-Hour Chart

UVXY Hourly Chart

The price projections are based on past market behavior observance, but not to be taken as trading advice or set in stone (I reserve the right to change my mind as markets fluctuate/I trade the market not the forecast). Seasonal cycles are easier to interpret (within nesting windows) than e-wave amplitudes (price forecasts). Market forecasting is difficult and is done as a general guideline, but subject to change as market forces change. Please keep this in mind.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.