U.S. Dollar and Bonds Sink as ECB Cuts Rates to -0.3%, Pledging More QE Until March 2017

Interest-Rates / ECB Interest Rates Dec 04, 2015 - 12:28 PM GMTBy: Mike_Shedlock

ECB president Mario Draghi's announcement today regarding more QE fell far short of the sky-high expectations of market participants.

ECB president Mario Draghi's announcement today regarding more QE fell far short of the sky-high expectations of market participants.

Draghi Recap

- ECB would continue its ?60bn-a-month bond buying program for another 6 months until March 2017 "or beyond".

- ECB reduced key interest rate to a historic low of minus 0.3 percent.

- ECB pledged to buy more assets with the proceeds of its existing bond purchases.

- ECB announced it would buy municipal bonds in addition to standard government debt.

Japanesque Announcement Not Enough

Somehow that was not enough to excite the market. Here's an amusing quote courtesy of the Financial Times .

"The ECB delivered at the very low end of expectations," said Andrew Balls, chief officer for fixed income at Pimco. "There wasn't much to get excited about?.?.?.?markets were expecting an increase in the monthly purchase size."

Further negative interest rates were "nothing to get excited about". Apparently the only thing that would have satisfied Balls would have been an announcement the ECB would purchase still more European public debt securities.

Why not just buy them all and get it over with? Japan is effectively there right now.

Market Response

- Index of Europe's 300 largest listed companies dropped 2.9%

- Germany's DAX fell 3.0%

- France's CAC 40 lost 3.2%

- UK's FTSE 100 dipped 1.9%

- US S&P 500 down 1.1% (market still open)

- US DOW down 1.0% (market still open)

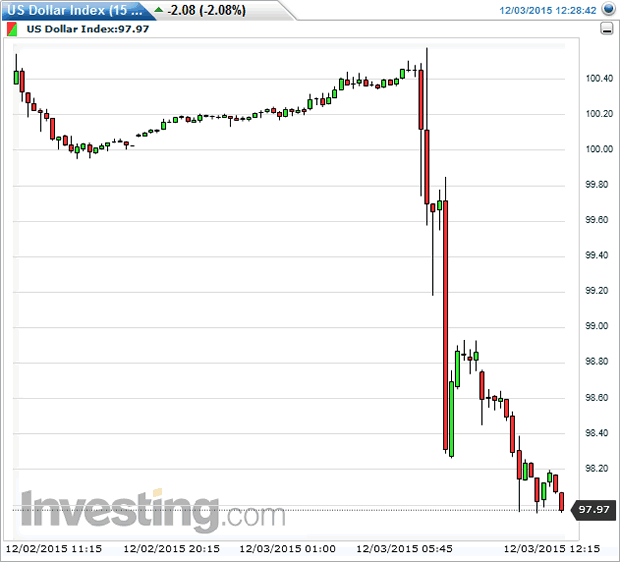

US Dollar 15-Minute Chart

After surging yesterday to a high last seen in March of 2003, the dollar index pluinged 2% over the course of four hours today.

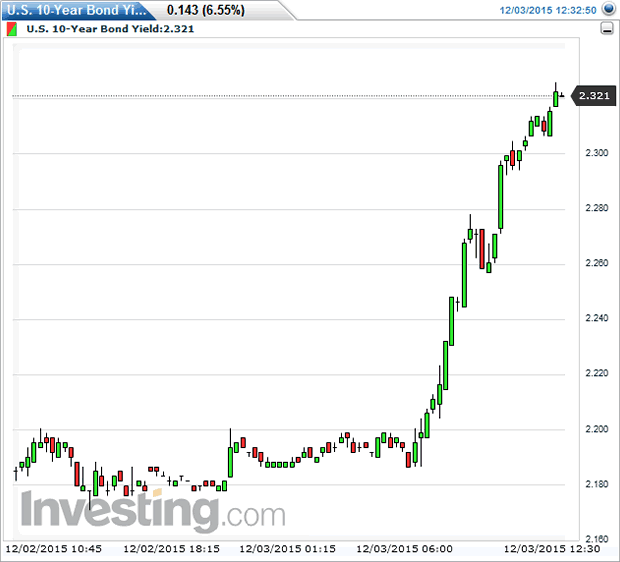

US 10-Year Treasury Yield 15-Minute Chart

More, More, More

The markets are clearly hooked on easing, always demanding more, more, and more. Japanesque announcements are simply not enough, nor are below zero interest rates to the tune of -0.3 percent.

Good luck with that.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.