Do You Have to Settle for Mediocre Returns in The Stock Market?

Stock-Markets / Stock Markets 2015 Dec 10, 2015 - 03:44 PM GMTBy: Sol_Palha

"In the republic of mediocrity, genius is dangerous." ~ Robert Green Ingersoll

"In the republic of mediocrity, genius is dangerous." ~ Robert Green Ingersoll

Morgan Stanley surprised everyone or, at least, tried to by stating that it was no longer going to be easy to make money in the equity markets. Let's stop, right there; was it ever really easy. If it were everyone that jumped into the markets would be wealthy, instead the opposite is true. Right of the bat, we can state that the best place for such advice is the dustbin.

They went on to inform portfolio managers that the days of easy money were over and that they should expect Paltry gains of roughly 5%. Well, most, investors have been used to paltry gains as they have parked their money into treasuries, risking returns in their quest for safety.

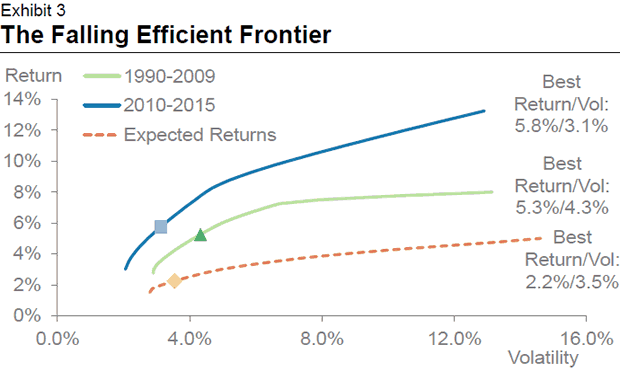

They then went to state that the so-called Efficient Frontier model is about to collapse as indicated in the image below.

Source Bloomberg.com

The only thing that caught our attention was the word collapse, and that to us means opportunity. We are not going to bother with the rest of the analysis because it's total hogwash. It has never been easy to make money in the markets, and that is why the majority of players lose. At the same time, it is not as hard as many would have you believe. Some effort on your part is needed; the saying all play and no work make Jack a dull boy comes to mind. Trends come, and trends go and the only way to make money consistently is to identify new trends at the onset; you certainly are not going to make any headway listening to these talking heads.

So what these chaps are in effect stating is that you can now only make money if you opt for risk as opposed to growth. Was there ever such a thing as a risk-free investment, and has not the Fed forced individuals to speculate by maintaining an environment of ultra-low rates for an inordinate period.

The mere act of getting up and going to work entails some risk; you could get hit by a bus on the way to work or drop dead from a heart attack. In that sense, living is a risk, as your life could and will come to a sudden end one day. Do you see what we mean when we state this line of thinking is utter rubbish?

Morgan Stanley suggests that the traditional portfolio that contains a mix of stocks and bonds won't work and only provide one with mediocre to paltry returns. However, they are basing this on a 50:50 stock bond portfolio. This strategy has two problems, over emphasis on bonds and focusing on traditional stocks; even worse it is their focus on a specific model. We believe that the Model is the problem and not the market. The solution is simple. Instead of focusing or obsessing over a single strategy, the focus should be on finding the new trends. Look for companies that are growing and leaving their competition in the dust. Even in the worst of markets, there are always companies that innovate and find new ways to improve the bottom line. If you focus on the traditional model, then Morgan Stanley has a point, but that point is only valid because the advice is based on an outdated strategy. Do not fixate on a strategy or a model; focus on selecting the right mix of assets.

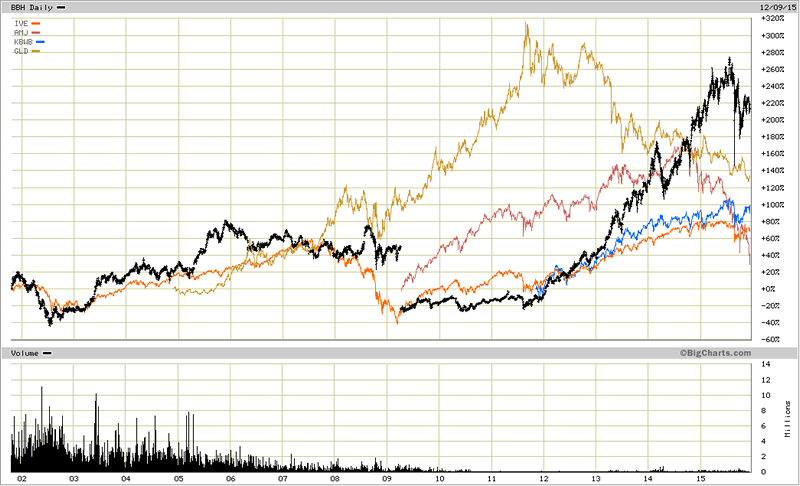

The chart below indicates that you do not have to settle for mediocre. All one needs to do is change the model and the result changes. We used ETF's only; had we used individual stocks the results would have been even more stunning. Additionally, we do not even choose the best ETF's, and we purposely threw in the Gold ETF and over the long run it, the performance is not too shabby. However, if you were following trends, you would have got out this sector long ago. Now imagine what your gains would look like if you decided to focus on the fasted growing sectors and then invested in some of the top stocks in that sector. The point we are trying to make is that stock gains will always be mediocre if the model itself is mediocre in nature. Change the model and the outcome changes.

High priced firms seem to be great at doing only one thing, and that is constantly telling you how the paradigm has changed and in most cases delivering mediocre returns. So perhaps the title should have been; high priced investments firms will only deliver mediocre returns due to their inability to adapt to changing market conditions. Which then begs the question, why do you need them, if that is all they can deliver.

Game plan

Stop listening to the so-called experts and take control of your money. If you are young, then you can take on extra risk, and dedicate some money to plays that are more speculative in nature, but that offer the potential for larger gains. In general, investors should stop stop basing your investments decisions on outdated models. The focus should be on finding the fastest growing sectors, stocks that offer high growth potential and on corporations whose profits are trending upwards, and you will fare a lot better than the average investor. There are other strategies such as writing covered calls or selling naked puts that can be used to increase your income without taking on an extra risk. Both these options strategies carry the same risk or even less than buying stocks.

We are not in the age of mediocrity; the only mediocrity we see is the advice that so-called top firms are dishing out to their clients. Lastly, the best time to get into an investment is when it's despised, and the best time to get out is when the crowd is jubilant.

"Mediocrity can talk, but it is for genius to observe." ~ Benjamin Disraeli

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2015 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.