Gold a Safe Harbor on an Ocean of Excess Reserves

Commodities / Gold and Silver 2015 Dec 30, 2015 - 02:57 PM GMT"We had initially asked to pay interest [in 2006] on reserves for technical reasons. But in 2008, we needed the authority to solve an increasingly serious problem: the risk that our emergency lending, which had the side effect of increasing bank reserves, would lead short-term interest rates to fall below our federal funds target and thereby cause us to lose control of monetary policy. When banks have lots of reserves, they have less need to borrow from each other, which pushes down the interest rate on that borrowing — the federal funds rate." Ben Bernanke, The Courage to Act

It has been an enduring mystery to many why the enormous amount of money created by the Federal Reserve in the wake of the 2008 crisis never translated to a general price inflation. After all, as Milton Friedman lectured us, "inflation is always and everywhere a monetary phenomena." So why didn't the enormous amount of money created by the Fed during its quantitative easing program – some $3.5 trillion added to the bank reserve credit – launch double-digit price inflation, or worse?

The answer, as it turns out, lies in a little discussed and understood line item on the Fed's balance sheet labelled "Reserve balances with Federal Reserve Banks," or "excess reserves" as it is called in the banking trade. The line item was the result of the Emergency Economic Stabilization Act passed by Congress in 2008, also known as the Wall Street bailout. In it, the Fed was given the authority to pay interest on excess reserve deposits made by commercial banks. Those excess reserves, in turn, were created by the Fed through its quantitative easing program when it purchased massive amounts of mortgage backed securities (MBS) and Treasury paper from the banks.

Up until recently, the excess reserve mechanism operated quietly in the background with little in the way of public notice on the part of either Wall Street analysts or the mainstream financial media. Excess reserves began to get more exposure in the wake of the recent Fed announcement on raising rates. Various mainstream media sources, including the Wall Street Journal's John Carney in a Heard on the Street column, cited it as "the main tool" the Fed would use to force interest rates higher.

How the Fed sterilized quantitative easing

I must confess that up until Art Cashin mentioned the rate on excess reserves in a CNBC interview, followed the next day by Carney's column, I had never heard of the commercial banks' excess reserves on deposit at the Fed. I would be willing to venture a guess that most of our readers hadn't heard of it either. At the same time, we are not talking about some small matter when it comes to these reserves.

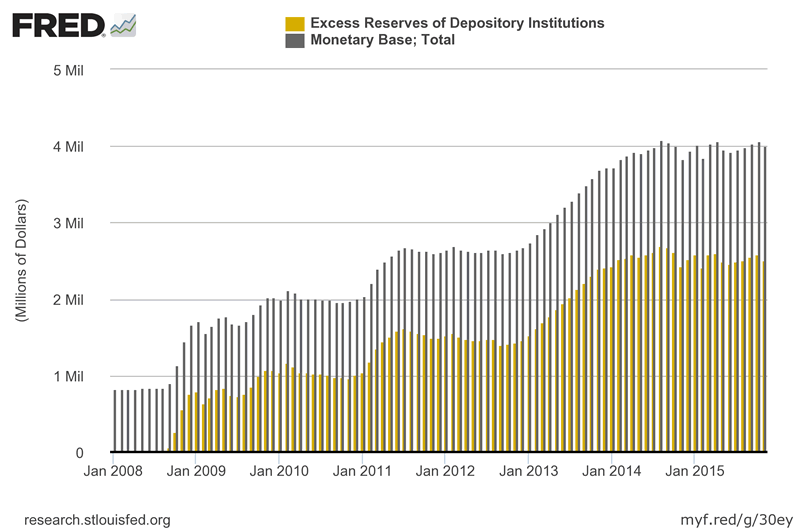

At present, the Fed balance sheet shows $2.4 trillion in excess reserves on deposit. In 2008, that figure hovered near zero. (Excess reserves are the amount commercial banks have in reserves not required to back deposits.) A quick calculation tells us that nearly 70% of the $3.5 trillion pumped into the commercial banking system by the Fed through its QE program made its way back to the Fed in the form of excess reserves! This recyling program amounts to little more than a thinly disguised sterilization of Wall Street's bailout in order to defer the inflationary dangers it might have generated. If you've been wondering why the recovery never made it to Main Street, you now have the explanation. In the end, financial institutions were saved, but the real economy was left gasping for air.

From the beginning the interest rate paid by the Fed on excess reserves was higher than the rate it received on fed-funds transactions. When interest rates were zero, the Fed paid .25%. When it raised the fed-funds rate to .25% on December 16, it also raised the rate on excess reserves to .5%. Clearly, the Fed has an interest in discouraging deposit withdrawals, but it remains an open question whether or not the commercial banks will go along with the program under the new interest rate regime. Unless there is some sort of quid pro quo that the Fed hasn't told us about, banks might find it in their best interest to leverage up their loan portfolios and put that money to work in the general economy. If so, as Ben Bernanke explains in our masthead quote, the Fed might find itself at odds with the commercial banks over its new interest rate policy.

Here's how economists Ben Craig and Matthew Koepke framed the issue in a paper for the Cleveland Fed back in February of this year:

"The simplicity of the one-to-one correspondence between the Federal Reserve's balance sheet and excess reserves hides the difficulty involved in predicting how banks are likely to behave in the presence of the expanded reserves. Unfortunately, understanding this behavior is what matters for deciding on an appropriate policy for excess reserves.

The fact that banks are holding excess reserves in response to the risks and interest rates that they face suggests that the reserves are not likely to cause large, unexpected increases in their loan portfolios. However, it is not clear what banks are likely to do in the future when the perceived conditions change or which conditions are likely to bring about a massive change in their use of excess reserves. Recent history is not much help in determining the answer to this question because no balances this big have been seen in recent times. . .

So the Federal Reserve has no easy policy choices, particularly in the absence of a large body of accepted theory on how banks can be expected to handle their oceans of cash under changing conditions."

(See Excess reserves: Oceans of Cash, Craig and Koepke, Federal Reserve Bank of Cleveland, February, 2015)

Reader note: If you appreciate the kind of gold-based analysis you are now reading, you would probably find value in subscribing to our newsletter. It comes free of charge by e-mail and you can opt out of the service at anytime. Last, we will not deluge you with e-mails. Over 20,000 subscribe to this newsletter – one of the best and most widely read in the field. Never miss another issue. . . Please register here.

Excess reserves create whole new world for Fed, the economy and investors

It is the part about how commercial banks will react when "the perceived conditions change" that may send a shudder or two through the markets as we head into 2016. The following are a few quick observations meant as a framework. We will be monitoring this situation carefully as 2016 progresses, as I am sure, will be a good many others.

First, the monetary inflation inherent to the original money creation is still alive and well and sitting on the balance sheet of the Federal Reserve. The excess deposits are still owned and remain under the control of the commercial banks. In a 2014 essay published by Heritage Foundation economists, Norbert J. Michel and Stephen Moore exposed a compelling concern largely overlooked by financial markets with respect to the excess reserves overhang:

"Arguably most immediate risk from the Fed's policies is that banks could use those newly created excess reserves too quickly. Banks now have an additional $2.6 trillion in excess reserves, which means that they can create up to approximately $26 trillion in new money. In other words, banks now have the power to create more than twice the amount of money currently in the U.S. economy, thus heightening the risk of future inflation. As the economy improves, the Fed may have to pay higher interest rates on these reserves to keep banks from dramatically increasing their lending. Paying higher rates, all else being constant, would exacerbate any 'losses' suffered by the Fed, thus increasing [its] political problems."

(See Quantitative easing, the Fed's balance sheet and central bank solvency, Michel and Moore, the Heritage Foundation, August, 2014)

In that paragraph we read not just the potential for inflation, but the potential for virulent inflation, and that is why the Fed is willing to pay more on its liabilities (the excess reserve rate) than it takes in on its assets (the fed-funds rate).

Second, the prevailing concern among market players is that the disinflationary risks that brought about the 2008 crisis remain the predominant economic challenge today. If so, the Fed may have just escalated those concerns by raising rates. Should the Fed have its way and the banks refrain from leveraging-up their excess reserves, inflationary concerns could turn quickly to disinflationary considerations, including the prospect of a repeat of the 2008 debacle (also brought on by a disinflationary economic environment.) The shut down of junk bond funds like Third Avenue Management, Stone Lion Capital and Lucidus capital, involving multi-billions, might be the canary in the coal mine in this regard.

Though the rate increases appear small at this juncture in percentage terms, the prospect of additional increases will weigh heavily on the minds of global money managers. Though the increases themselves seem small at a .25%, their aggregate effect on profit and loss statements could be significant. Rapid deleveraging in a wide range of markets appears inevitable. That prospect, though, is only one among many overlapping concerns with respect to the systemic risks unleashed by a disinflationary unwinding of positions. Rising interest rates have a way of flushing out the over-leveraged, the under-capitalized and the overly-dependent. As Warren Buffett once put it, "only when the tide goes out do you discover who's been swimming naked."

Gold still the best option for the average investor hedging uncertainties

Last, I would be remiss if I did not end with a word or two on the role gold might play as all of this sorts itself out. Of the two outcomes just highlighted, disinflation seems the most probable at this juncture. Inflation, it it occurs, will take some time to manifest in the economy itself. No matter the outcome, though, gold and silver coins and bullion remain the best hedge for the average private investor. The greater part of global gold demand today has little to do with gold's reputation as an inflation hedge. The metal is being accumulated by everyone from private individuals, to huge institutions, central banks and nation states themselves as a hedge against the next financial crisis no matter what form it takes – inflation, disinflation, deflation or hyperinflation.

Gold rose like a phoenix from the ashes of the last financial crisis because it is a store of value and portfolio insurance, not because its market price was about to bolt through the roof (though higher prices were its subsequent fate). We are in a much different situation today than we were back in 2008 and the excess reserve overhang will play heavily in the next stage of the on-going financial crisis. The financial system as a whole still suffers from the damage done by the last phase of the crisis, and it will be on a hair trigger in the new interest rate environment.

If another "event" were to occur today, it would start with a much weaker line-up on the playing field than the last time around and a Fed with fewer, less reliable tools in its toolbox. We suspect that gold and silver demand will continue to grow as the dangers and uncertainties just outlined begin to manifest themselves in the financial marketplace. It will serve as safe harbor on this ocean of excess reserves. Those who understand the virtues of gold ownership are not going to suddenly go to their national currencies, or the banking system, or the New York Stock Exchange as a defense. They will go to gold and silver.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.