Emerging Market Currencies Hit the Skids

Economics / Emerging Markets Jan 07, 2016 - 10:12 AM GMTBy: AnyOption

Investors, equities traders and global analysts were shocked when the Shenzhen Composite Index and the Shanghai Composite Index opened to a 7% decline on Monday, 4 January 2015. That alarm bells sounded and markets were shut down is testament to the precarious predicament of Chinese equities. As the world's second largest economy, China weakness has a devastating effect on the fortunes of developing countries and developed countries alike. Such was the negative sentiment around the sharp declines in Chinese equities, mutual funds and foreign funds (with an emphasis on Asian stocks), that global bourses also moved south. The situation is being compounded by sharp declines in oil prices, with oil futures for February setting fresh new lows.

Investors, equities traders and global analysts were shocked when the Shenzhen Composite Index and the Shanghai Composite Index opened to a 7% decline on Monday, 4 January 2015. That alarm bells sounded and markets were shut down is testament to the precarious predicament of Chinese equities. As the world's second largest economy, China weakness has a devastating effect on the fortunes of developing countries and developed countries alike. Such was the negative sentiment around the sharp declines in Chinese equities, mutual funds and foreign funds (with an emphasis on Asian stocks), that global bourses also moved south. The situation is being compounded by sharp declines in oil prices, with oil futures for February setting fresh new lows.

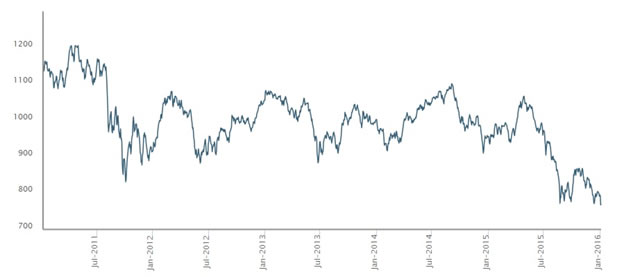

MSCI Emerging Markets Index

As cases in point, the S&P 500 index slid 1.5%, the DJIA (Dow Jones Industrial Average) declined by 1.5% to 16,895 and the NASDAQ composite index plunged 1.6%. In Europe, the Stoxx Europe 600 shed 1.7%, as the resources sector dragged the entire index lower. This was exacerbated by sharp declines in the price of copper and Brent crude oil dropping below the crucial $35 per barrel support level. Fueling the equities decline in China was a rapid deceleration of service growth activity in the month of December 2015. The PMI index dropped 1 point from 51.2 in November 2015 to 50.2 in December 2015 according to the Caixin China index. The PMI is now just 0.2 points above the critical 50 level – any readings beneath 50 represent a contraction in overall economic activity.

How China Weakness is Impacting on Emerging Market Currencies?

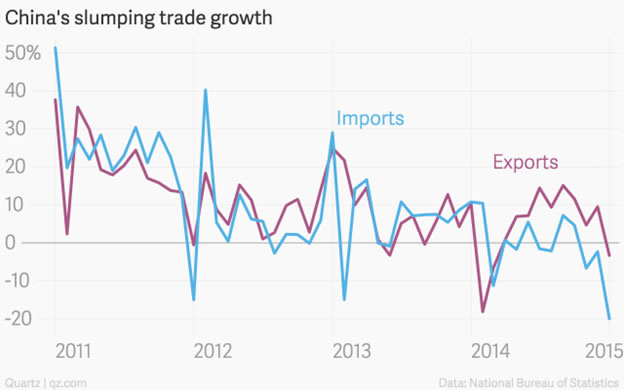

China is the world’s biggest emerging market economy, and the Chinese yuan is being propped up by the People's Bank of China. The Chinese do not allow the CNY to fluctuate according to market forces, since government intervention plays an active part in maintaining a peg to the USD. As the Chinese economy loses steam, import and export numbers decline. This naturally impacts upon the demand from emerging market countries such as Brazil, Russia, South Africa, Kenya, Venezuela, Zaire, Zambia, Nigeria and others. These countries typically produce vast quantities of natural resources that are consumed en masse by China such as metals and energy commodities. Some of the hardest hit sectors to date include copper, iron ore, coal, natural gas, oil, molybdenum, aluminium, zinc and others. Contractions have been taking place across the board and the manufacturing sector in China has declined for the 10th successive month as at December 2015.

- The Vanguard Emerging Markets Stock Index Fund (VEMSIF) plunged 2.9% recently

- Heavy investments in emerging markets coupled with sharp depreciations in exchange rates have left these countries with massive debts that their economies cannot sustain

- Currency traders are now selling emerging market currencies en masse and buying the USD, GBP and Euro

- The Turkish lira (-1.6%) and the Brazilian real ($0.2475) slumped approximately 2 percentage points against the USD

- Emerging market currencies are now on the back foot after showing some resilience of late

- Money managers are avoiding emerging market countries like the plague, given the volatility, uncertainty and high risk profile of these countries under current global economic conditions

- Further rate hikes by the Fed are going to strengthen demand for the USD and weaken demand for emerging market currencies

The problems with the emerging market economies are not limited to the supply and demand considerations taking place in China. For example countries like South Africa are plagued by a broken power-grid system which interrupts daily business activity, malfeasance in government, a complete loss of investor confidence, and massive trade union disruptions. In Turkey, problems include hyperinflation, a lack of international investor confidence in the central bank of the country, et al.

One of the leading investment corporations – Societe Generale – estimates that $540 billion of capital flight from EM countries took place during 2015. Even though the currencies for these countries are cheap, and appear to be attractive buying options there is way too much downward pressure for currency traders to go all-in right now. As it stands, the number one concern for emerging market countries (developing countries) is China weakness. The year is likely to be dominated by the slowdown in China given its 180° pivot from an export-driven economy to one which is focusing on services and consumption in the domestic economy. We will naturally see ongoing weakness vis-a-vis EM currencies while the G-10 currencies show renewed strength.

Anyoption™ is the world's leading binary options trading platform. Founded in 2008, anyoption was the first financial trading platform that made it possible for anyone to invest and profit from the global stock market through trading binary options.

Our goal here at Market Oracle is to provide readers with valued insights and opinions on market events and the stories that surround them.

Website anyoption.com

© 2016 Copyright Anyoption - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.