The Bond Bubble Has Begun Bursting

Interest-Rates / Corporate Bonds Jan 15, 2016 - 08:29 AM GMTBy: Graham_Summers

The bursting of the bond bubble has begun.

The bursting of the bond bubble has begun.

As I’ve outlined previously the primary concern for Central Banks is the bond bubble. CNBC and other financial media focus on stocks because the asset class is more volatile and so makes for better content, but the foundation of the financial system is bonds. And bonds are THE focus for Central Banks.

In the simplest of terms, the world is awash in too much debt. The bond bubble was close to $80 trillion in size going into 2008. The Central Banks had a choice to either let the defaults hit and clear out the garbage debt from the financial system or attempt to inflate the debts away.

They chose to attempt to inflate the debts away. Put differently, all of their policies were aimed at containing debt deflation… or the process through which debt becomes less and less serviceable leading to eventual insolvency and default.

To whit:

- Central Banks cut interest rates to zero to make bond payments smaller.

- Central Banks launched QE and other programs to put a floor beneath bond prices (when bond prices rise, bond yields fall and debt payments become smaller and easier to service).

- Central Banks provided verbal intervention promising to do “more” or “whatever it takes” whenever bonds came close to ending their bull market.

As a result of this, the financial system has become even more leveraged than it was in 2007 at the beginning of the last debt crisis.

Globally the bond bubble has grown by more than $20 trillion since 2008. Today it is north of $100 trillion, with an additional $555+ trillion in derivatives trading based on it.

Yes, $555 TRILLION, more than seven times global GDP, and more than 10 times the Credit Default Swap market ($50 trillion), which triggered the 2008 Crisis.

By not allowing the bad debts to clear in 2008, the Central Banks conditioned everyone from consumers to corporations to believe that business cycles could be contained and that the bond bubble/ bull market had not ended.

As a result of this, TRILLIONS of dollars of capital have been misallocated. The evidence is everywhere you look. Corporates around the globe have been issuing record amounts of debt, much of it in US Dollars.

Few of these bonds were high quality. Indeed, globally over 50% of all corporate bonds are now “junk.”

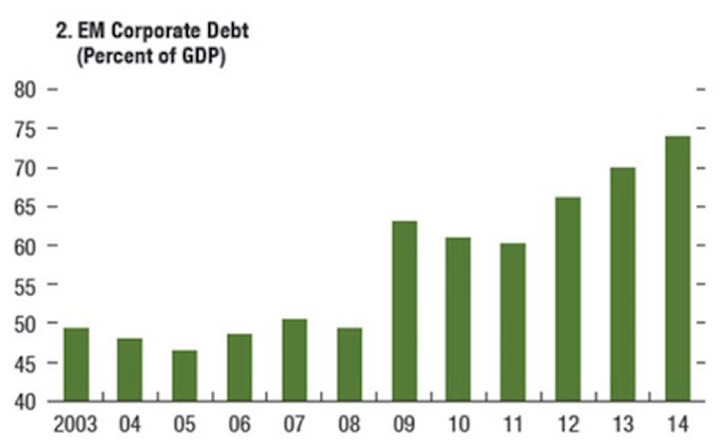

Chinese firms might be the most out of control when it comes to bond issuance, but they are hardly unique. As the below chart reveals, the pace of corporate debt issuance in Emerging Markets worldwide has been extraordinary relative to economic growth.

Today, the Emerging Market corporate bond market is equal to nearly 75% of total Emerging Market GDP. It was at just 50% in 2007 during the last peak!

H/T Jeroen Blokland

This has also been the case in the US where corporates have posted four straight years of record bond issuance.

Moreover, most of US corporate bond issuance is going towards stock buybacks and financial engineering (massaging results to look better than they are) NOT legitimate expansion.

As a result of this, the financial system today is even more leveraged with more garbage debt than it was going into 2008.

Another Crisis is coming. Smart investors are preparing now.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisoryis a WEEKLY investment newsletter with an incredible track record.

To whit, we just closed out two new double digit winners yesterday, bringing us to 40 straight winning trades over the last 12 months.

That correct, during the last year, we’ve not closed a SINGLE LOSER.

And if you go back further, 46 of our last 47 trades have made money.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS.

During that time, you’ll receive over 50 pages of content… along with investment ideas that will help make you money… ideas you won’t hear about anywhere else.

If you have not seen significant returns from Private Wealth Advisory during those 30 day, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2015 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.