The Bursting of the Bond Bubble Has Begun - Pt 2

Interest-Rates / International Bond Market Jan 17, 2016 - 06:18 PM GMTBy: Graham_Summers

As we wrote earlier this week, bursting of the bond bubble has begun.

As we wrote earlier this week, bursting of the bond bubble has begun.

The decision by Central Banks to “inflate” the system’s debts away post-2008 has resulted in the misallocation of trillions of Dollars of capital.

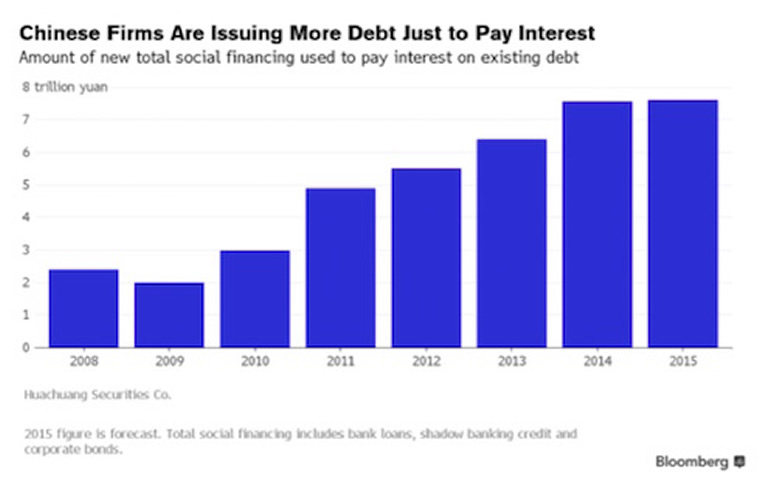

The worst offenders were Chinese corporates. China has created the single largest mountain of bad debt in the world. Indeed, things are so out of control in China that 45% of all proceeds from new bond issuance are being used just to pay off interest on old loans.

Chinese firms might be the most out of control when it comes to bond issuance, but they are hardly unique. In the US where corporates have posted four straight years of record bond issuance.

The bond market is booming again, a sign of investors’ faith in the resilience of the U.S. economy.

U.S. bond sales by companies with good credit ratings hit $103 billion in October, a record for the month, according to deal tracker Dealogic. Corporate-bond sales in the U.S. are on track for their fourth straight annual record, according to data from the Securities Industry and Financial Markets Association.

Source: Wall Street Journal.

Today corporates are more leveraged than they were in 2007. Thus, the Bond Bubble not only encapsulates sovereign nations, but even individual companies. And now that bubble is bursting.

Companies have defaulted on $95bn worth of debt so far this year, with 2015 set to finish with the highest number of worldwide defaults since 2009, according to Standard & Poor’s.

The figures are the latest sign financial stress is beginning to rise for corporate borrowers, led by US oil and gas companies. The rising tide of defaults comes as investors reassess their exposure to companies that borrowed heavily in recent years against the backdrop of central bank policy suppressing interest rates…

Based on the number of defaults in the first three quarters of the year, S&P expects 109 defaults by year-end, the largest total since 268 borrowers ran into problems in 2009. There were only 60 defaults worldwide in 2014.

Source: Financial Times

The high yield bond or junk bond market was the first to go. It’s already taken out its bull market trendline and is collapsing.

This is just the beginning. The bond bubble will take months to completely implode. And eventually it will consume even sovereign nations. Globally the bond bubble is $100 trillion in size: larger than even global GDP.

Another Crisis is coming. Smart investors are preparing now.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisoryis a WEEKLY investment newsletter with an incredible track record.

To whit, we just closed out two new double digit winners yesterday, bringing us to 40 straight winning trades over the last 12 months.

That correct, during the last year, we’ve not closed a SINGLE LOSER.

And if you go back further, 46 of our last 47 trades have made money.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS.

During that time, you’ll receive over 50 pages of content… along with investment ideas that will help make you money… ideas you won’t hear about anywhere else.

If you have not seen significant returns from Private Wealth Advisory during those 30 day, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2015 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.