S&P 500 Has Likely Entered a New Bear Phase

Stock-Markets / Stock Markets 2016 Feb 02, 2016 - 02:41 PM GMTBy: Submissions

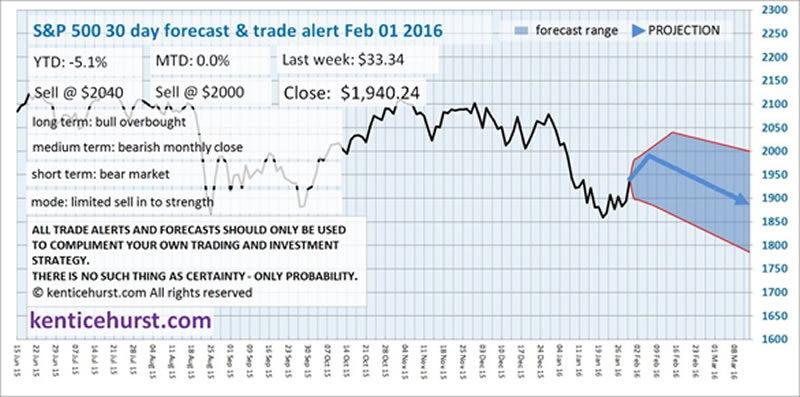

Ken Ticehurst writes: The S&P 500 has now more than likely entered a new bear phase which could well last for most of 2017 the monthly close signalled the probability that a multi month decline is underway. Since 2008 the S & P 500 has enjoyed one of its largest and longest and rises in modern times, our long term chart below shows this Bull Run in context.

Ken Ticehurst writes: The S&P 500 has now more than likely entered a new bear phase which could well last for most of 2017 the monthly close signalled the probability that a multi month decline is underway. Since 2008 the S & P 500 has enjoyed one of its largest and longest and rises in modern times, our long term chart below shows this Bull Run in context.

We had kept in mind the possibility of a final blow off top in 2016, and whilst one should never rule anything out, the probability seems to be diminishing,

Our forecast is for the current rebound to run in to trouble somewhere around the 2000 area with a possible high around 2040, from there we expect the decline to get underway in earnest. For us to become bullish we would want a monthly close in excess of 2050 but we do not anticipate this being very likely, the risks at present remain to the downside.

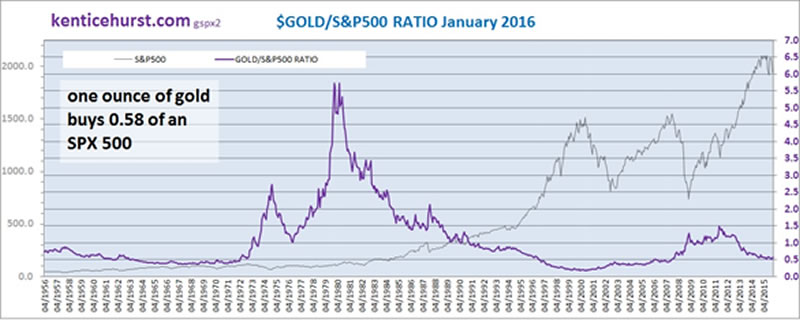

Our main long term interest is to watch for a change of the multiyear disinflationary trend we have been tracking since the post 2008 crisis inflationary trend ended in 2011 with tops in silver and gold. As you can see from the gold/SPX ratio chart below, inflationary trends tend to see gold outperforming stocks and in disinflationary trends the reverse tends to be true.

The difference today from the disinflationary phase of the eighties and nineties is the massive increase in the level of debt in the global financial system and the demographics of the developed economies.

High levels of debt with falling prices means the value of the debt rises in real terms this is a dangerous cocktail that central bankers will fight tooth and nail once this disinflationary trend has become the dominant mind-set in the general economy.

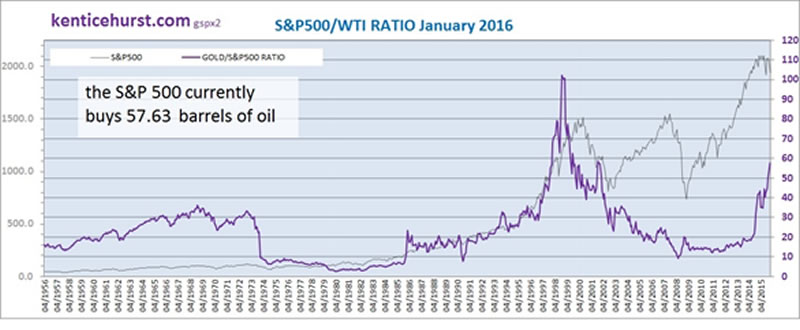

Below is the SPX/WTI ratio chart showing clearly our current disinflationary trend, the S&P 500 has outperformed oil by a factor of nearly six since 2008 and appears to heading into an unsustainable climax. This ratio never really confirmed the commodity bull up to 2011 it hinted that a disinflationary episode was possibly underway.

The current disinflationary episode also looks similar to the eighties and nineties, but again there are stark differences, not only are debt levels vastly different but so are demographics in the developed economies. The post war generation are now retiring in ever larger quantities and will be for the next twenty years this demographic bulge that created the demand that drove the huge debt bubble is now putting the brakes on their consumption.

However our scenario points to this disinflationary episode ending in the not too distant future we believe that inflation is the only acceptable way for the global debt burden to be reduced in real terms. Most high inflationary episodes invariably begin with a deflationary episode it is this panic stage leads to the inflationary stage that follows it.

It is our belief that as this disinflationary trend becomes the dominant theme amongst the general public it will probably mark its final climax, some extreme valuations will occur there will be a panic and at that point a new global inflationary trend will begin, possibly the first truly global inflation that may last for decades.

For the time being we remain in a disinflationary episode and can only judge our long term thesis by the evidence the market gives us. For now inflation remains a distant memory but economics and the markets have a habit of delivering the unintended consequences of past actions just when most least expect it.

We now create forecasts for a wide range of markets, stocks, commodities, forex, interest rates and energy along with gold using our unique forecasting logic that has kept our followers on the right side of the gold market for so long.

Ken Ticehurst

We have a free subscription service, we send our subscribers a forecast every weekend. To view some of the most accurate and unique market forecasts available sign up at: http://www.kenticehurst.com

Copyright © 2016 Ken Ticehurst - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.