UK Interest Rates, Economy GDP Forecasts 2016 and 2017

Interest-Rates / UK Interest Rates Feb 06, 2016 - 04:59 AM GMTBy: Nadeem_Walayat

Six months ago Bank of England Governor, Mark Carney in 'forward guidance' at the time gave his intentions to start to raise UK interest rates early 2016, that in the run up to the Fed December rate hike had galvanised many to expect a similar trailing response from the Bank of England to gradually follow the Fed towards normalisation of UK interest rates towards a target of 2.5% over 3 years i.e. by Mid 2018.

Six months ago Bank of England Governor, Mark Carney in 'forward guidance' at the time gave his intentions to start to raise UK interest rates early 2016, that in the run up to the Fed December rate hike had galvanised many to expect a similar trailing response from the Bank of England to gradually follow the Fed towards normalisation of UK interest rates towards a target of 2.5% over 3 years i.e. by Mid 2018.

"Short-term interest rates have averaged around 4.5% since around the Bank's inception three centuries ago, the same average as during the pre-crisis period when inflation was at target...

"It would not seem unreasonable to me to expect that, once normalisation begins, interest rate increases would proceed slowly and rise to a level in the medium term that is perhaps about half as high as historic averages.

"In my view, the decision as to when to start such a process of adjustment will likely come into sharper relief around the turn of this year." - Mark Carney

However the noises coming out of the Bank of England following the Fed December rate hike have become increasingly dovish, with BoE recently making it clear that the prospects for a UK rate hike for the whole of 2016 have more or less completely evaporated.

"the firming in inflationary pressure we had expected will take longer to materialise".

"Since last summer, progress has been insufficient" to warrant higher interest rates, Mr Carney explained, adding that "the world is weaker and UK growth has slowed".

"the year has turned, and, in my view, the decision proved straightforward: now is not yet the time to raise interest rates". Mark Carney

UK Interest Rates Panic

UK interest rates have now flat lined at 0.5% for 80 straight months, with market attention post the May 2015 general election had been turning towards the prospects for the first of a series of interest rates hikes. However, firstly understand that 0.5% is NOT NORMAL, it is a PANIC MEASURE.

Therefore Bank of England has been in a perpetual state of PANIC for over 6.5 years of which dropping interest rates to 0.5% was just one of many steps towards propping up Britain's bankrupt banking system, the second step was the £500 billion or so (£375 billion official) of total Quantitative Easing or money printing that has been stuffed into every orifice of the bankrupt banks, and the list goes on with capital injections and the Funding for Lending Scheme which succeeded in eroding the purchasing power of savings (stealth theft) since it was first implemented in Mid 2012, ALL to prop up the Bank of England's banking sector brethren.

UK Inflation

Official UK CPI Inflation continues to hug 0% at a rate of just 0.2% for December 2015. Meanwhile RPI, which is the closest official measure to real inflation continues to nudge higher to 1.2%, which are set against the demand adjusted UK Real inflation rate of 1.6%. So deflation? Not really, real UK price Inflation is actually well above 1%, and that's before I mention the big elephant in the room - HOUSE PRICE INFLATION which is galloping along at 9% per annum, but of course that does not count where the Bank of England is concerned.

One does not have to look far for why UK inflation is so low, for which at the top of the list is the oil price collapse which I covered in-depth in this recent article and video analysis that concludes in a detailed trend forecast for the whole of 2016:

17 Jan 2016 - Crude Oil Price Crash Triggering Global Instability, Trend Forecast 2016

Crude Oil Price 2016 Forecast Conclusion

My forecast conclusion is for the crude oil price to trade within three distinct trading ranges for 2016 of $20 to $40, $35 to $50 and $62 to $40. Furthermore the trend pattern imposed onto the trading ranges implies that a bottom is likely by early February 2016 at around $25, followed by a trend higher into Mid year towards $50, a correction into September, followed by a trend towards $62 before succumbing to a correction during December to target an end year price of approx $48 as illustrated by the following forecast graph.

The implications of a RISING crude oil price that could easily double from its recent lows should have the effect of pushing UK inflation far higher, probably seeing CPI near 2% by early 2017, and RPI near 3%. The implications of this would normally be for interest rate hikes by early 2017. However, it should be noted that the BoE has ignored high inflation rates in the past i.e. during 2011 CPI spiked to over 5% without a flicker out of the BoE, which implies 3% CPI let alone 2% are unlikely to result in a UK rate hike.

UK Economy

The oil price collapse has triggered a huge transfer of wealth from England to Scotland to prevent a collapse of the Scottish economy following what will probably turn out to be the slow death of the North Sea oil industry which requires an oil price of approx $60 just to break even let alone the likes of $100+ to finance new expensive operations that the fantasy land Scottish Nationalists had propagandised during the 2014 Independence Referendum and delusionally continue to cling onto to this day when the truth is that Scotland's oil party is well and truly over!

Nevertheless the support for Scotland, a weak european economy and evaporating Chinese demand are all acting to drag down UK GDP to imminently a sub 2% rate. However, whilst a recession does not appear to be on the cards the slowdown in momentum is such that the UK looks set to dip to an annualised growth rate of below 1.5% and may even touch bottom at 1% which compares against the engineered mini-election boom of 2.8% in the run upto the May 2015 general election.

Therefore, as usually tends to be the case for post election economic slowdowns, then the next 2 years are likely to be weak (2016, 2017) with GDP probably going to average at a rate of about 1.6% for each year which compares against the Bank of England's economic propaganda expectations of 2.5% for 2016 and 2.7% for 2017.

Therefore the weak prospects for the UK economy over the next 2 years are not conducive for the need to raise interest rates as actual GDP data releases will slowly prompt the academic economists to revise their GDP forecasts lower during 2016 and 2017 which thus implies the Bank of England will probably opt to do nothing and perhaps loosen monetary policy further via mechanisms such as QE. Which would translate into perhaps an extra £50 billion of QE from £375 billion to £425 billion.

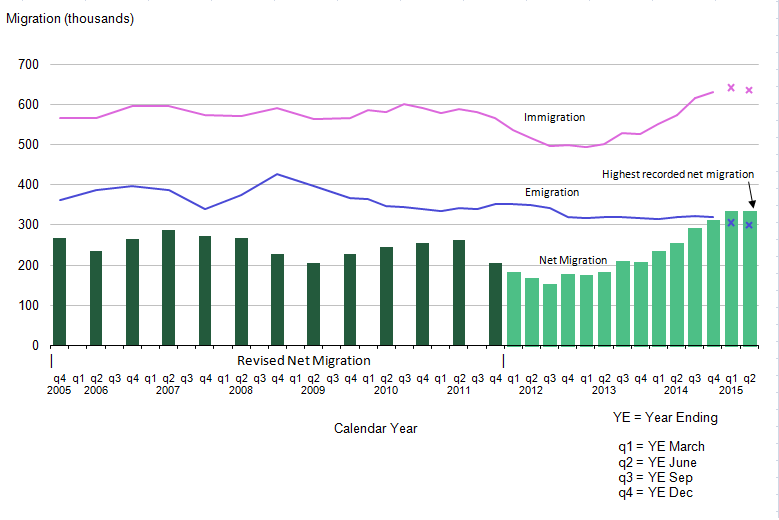

Whilst 1.6% GDP growth may not sound so bad considering what is going on elsewhere, however consider this that the UK population is increasing at the rate of about 1% per annum, so in per capital terms it means that many of not most folks are actually going to feel POORER as the headline growth rate masks the consequences of continuing out of control immigration from predominately eastern europe that is resulting in a net migration level of about 350,000 per year. In fact I am sure the mainstream press too will eventually clock onto this reality when annual GDP dips to 1% resulting in per capita stagnation.

And it is continuing out of control immigration that is triggering the Leave or Remain EU referendum this year, probably as early as Mid June 2016

EU Referendum - Britain's Last Chance for Freedom From Emerging European Super State

Britain's Prime Minister, David Cameron emerged Tuesday waving a piece of paper Chamberlain style of a 'draft' agreement that follows several months of negotiations that had the PM running around europe begging the likes of Donald Tusk (a former Polish Prime Minister) and former eastern block nations for some return of sovereignty. A piece of paper that is heavy on printed pages but light on anything that even comes close to matching the Conservative Manifesto pledges of a series of red lines ahead of Britain's EU In / Out referendum.

I explained the key points of failure in the following article and video of why this really IS Britain's very LAST chance to gain Freedom from an emerging European super state:

03 Feb 2016 - David Chamberlain Cameron, Britain's Last Chance for Freedom From Emerging European Super State

I also covered Britain's housing crisis consequences of continuing out of control immigration impact on London in the following comprehensive video analysis:

Youtube 26 Mins - https://youtu.be/yQJIB7AuqRQ

Britain's Last Chance to Gain Freedom from Emerging European Super State

What most pundits fail to recognise or lack experience of is trend and momentum both of which for the past 40 years have been moving in one direction that for the emergence of a highly centralised European super state that the financial crisis and subsequent economic depression of southern europe is accelerating the trend towards.

So whilst it is too late for the euro-zone members who for better or worse are locked into a death embrace that has all but nullified democracy for most of the euro-zone states as the elections in Greece, Spain and Italy have clearly demonstrated the lack for even radical governments such as Syriza to do anything other than obey their German paymasters who control the euro currency and can within a couple of weeks bring fellow euro-zone members to the brink of collapse as was repeatedly demonstrated by Greece last year.

Thus, for Britain the saving grace of not being in the euro-zone offers the UK a unique final opportunity to make the choice of either FREEDOM or become another satellite state revolving around a German centre that will increasingly dictate terms and conditions.

Therefore, given that there would probably not be another referendum for at least 20 years, then this really is Britain's VERY LAST CHANCE. There WON'T be another opportunity because with each passing year the price for a BREXIT increases, and we are not that far off from the point of no return when an exit would result in an economic collapse, much of the situation the euro-zone members have been since they signed up to scrap their currencies and join the Euro-zone.

Of course both the LEAVE and the REMAIN camps put out a lot of propaganda and spin on the others consequences. For LEAVE it's a case of everything smelling of roses in a Britain that has been freed from increasing European bureaucracy and interference, that would be in full control of Britain's borders. Whilst the REMAIN camp paints a picture of FEAR, of economic and financial catastrophe coupled with punitive terms for exit that would seek to punish Britain for daring to exit the euro-zone, so much for so-called european unity built on common purpose and friendship instead the European Union is increasingly a club of FEAR and PARALYSIS.

The Price for Freedom

The truth is that a BREXIT WILL BE ECONOMICALLY PAINFUL despite all of the benefits of being outside of the E.U. The cost of BrExit will be anywhere from 2% to as high as 5% of GDP if the euro-zone is determined to make an example of Britain to act as a warning to others by raising punitive tariffs on trade. However remember that attaining FREEDOM ALWAYS carry's a PRICE, in which respect even the worst case scenario for a 5% loss of GDP in the grand scheme of things does not compare against the infinitely greater price the people of Britain paid for their freedom in both past World Wars and so it is now THIS generations turn to pay a price for the freedom of future generations.

What the people of Britain need to fully understand is that this really is their VERY LAST CHANCE for Freedom!

Though given the backtracking of Schengen currently underway, and Greece, well still bankrupt then the European project could yet unravel all on its own even BEFORE a BrExit referendum is held! In fact a BrExit would likely be THE nail in the European Unions coffin that would literally start to disintegrate and it could all unravel quite quickly as I have been warning of for some time

BrExit Economic and Interest Rate Consequences

Following a BrExit vote, in terms of the economy little would change for several years as the negotiations towards the UK leaving the EU would take many years to reach a final agreement, and so could probably easily stretch to well into the NEXT Parliament i.e. over 5 years after a EXIT vote, especially when we consider that Greece is taking forever just to leave the euro-zone (6 years and counting), let alone leave the European Union. So a BrExit could take place in a series of stages.

Whilst in terms of interest rates, the increased economic and market uncertainty following a BrExit vote would make the Bank of England less inclined to raise interest rates for the whole of this Parliament and would probably consider further easing of monetary policy, more QE to counter any loss of GDP during each stage of implementation of BrExit.

So in interest rate terms a BrExit would make the Bank of England LESS inclined to raise interest rates for the whole of this Parliament, and in fact will encourage further easing so as to cope with uncertainty.

UK Debt

Whenever George Osborne or David Cameron state that they are paying down Britain's debt, they are LYING! The same went for Ed Milliband when he would state that Labour would cut Britain's debt. NO GOVERNMENT DEBT IS BEING REPAID OR WILL EVER BE REPAID! Instead the truth is that the WHOLE of the economic growth (in real terms) since the May 2010 General Election and continuing into 2016 is wholly as a consequence of some £586 billion of additional DEBT. Again this is a very important point to note that virtually ALL of the economic growth since 2010 is DEBT based, ALL of it, including the 2015 election boom, the debt accrued since 2010 will likely equate to total real terms increase in GDP - virtually pound for pound which is why there is a cost of living crisis because printing money (debt) does not increase productivity, all it does is inflate the money supply.

Conservative Government Debt Fantasy

Just as the Coalition government ended up borrowing over £200 billion more than it forecast it would so we can also take the Conservative governments pledge / promise / forecast / hopes / dreams / fantasy to a 2014-15 £90 billion annual deficit into a fantasy land £5 and £7 billion surpluses in their last 2 years of office, that is just not going to happen!

- 2014-15 : £90.2bn

- 2015-16 : £75.3bn

- 2016-17 : £39.4bn

- 2017-18 : £12.8bn

- 2018-19 : £5.2bn surplus

- 2019-20 : £7bn surplus

Therefore just as I voiced in my May 2015 analysis that the Conservative government would end up borrowing TRIPLE the £115 billion it expecting to over the next 5 years i.e. approx £350 billion.

20 May 2015 - UK Deflation Warning - Bank of England Economic Propaganda to Print and Inflate Debt

Therefore instead of borrowing £115 billion over the next 5 years, I would not be surprised if the so called economic austerity Conservative government actually ends up borrowing TRIPLE the amount i.e. the actual amount borrowed will be closer to £350 billion rather than propaganda of £115 billion.

My forecast conclusion is for the Conservative government to again borrow at least £200 billion more than the OBR is forecasting today i.e. At least +£315 billion by March 2020 as illustrated by the graph with the risk that borrowing could turn out to be as high as +£350 billion which is set against the OBR/ governments forecast of just +£115bn.

And as of writing the UK so far this financial year to December has already borrowed £74.2 billion, virtually reaching the total target for the whole of 2015-16 that has another 3 months to go! With total public debt now at £1.54 trillion or 81% of GDP. Now factor in my growth forecasts for an average of 1.6% per year which would translate into lower tax reciepts and so even greater pressure to borrow more.

So the worsening debt dynamics are such that the Bank of England is unlikely to even want to signal the start of rate hiking cycle could be near as it would lead to higher government borrowing costs which implies to expect more dovish comments out of the Bank of England throughout 2016.

UK Bonds

Unlike during 2013, today there is not much sign of the UK bond market discounting future rate hikes any time soon, in fact the we are probably well over a year away from any rate hike. And likewise there is not much sign of life in the LIBOR market (12 month 1%) signaling even 1 rate hike let alone a series. Though do remember this is a 30 YEAR long bull market, so one can easily forget just how expensive bonds are, a bubble that awaits the return of inflation to burst.

UK House Prices

The Non seasonally adjusted UK house prices momentum graph shows that the UK housing market is bouncing back strongly from a post election slowdown to +7% to currently stand at +10.5%.

The trend in momentum is in line with my long standing expectations for house prices momentum to fall in the months following the general election to be nothing other than a 'mild correction' as I expected the over-riding bull market trend to reassert itself.

UK House Prices 5 Year Forecast

It is now over 2 years since excerpted analysis and the concluding 5 year trend forecast from the then forthcoming UK Housing Market ebook was published as excerpted below-

UK House Prices Forecast 2014 to 2018 - Conclusion

This forecast is based on the non seasonally adjusted Halifax House prices index that I have been tracking for over 25 years. The current house prices index for November 2013 is 174,671, with the starting point for the house prices forecast being my interim forecast as of July 2013 and its existing trend forecast into Mid 2014 of 187,000. Therefore this house prices forecast seeks to extend the existing forecast from Mid 2014 into the end of 2018 i.e. for 5 full years forward.

My concluding UK house prices forecast is for the Halifax NSA house prices index to target a trend to an average price of £270,600 by the end of 2018 which represents a 55% price rise on the most recent Halifax house prices data £174,671, that will make the the great bear market of 2008-2009 appear as a mere blip on the charts as the following forecast trend trajectory chart illustrates:

In terms of the current state of the UK housing bull market, the Halifax average house prices (NSA) data for January 2016 of £210,108 is currently showing a 3% deviation against the forecast trend trajectory, which if it continued to persist then in terms of the long-term trend forecast for a 55% rise in average UK house prices by the end of 2018 would translate into an 8% reduction in the forecast outcome to approx a 47% rise by the end of 2018.

Another point to mention is that the widespread bearish doom merchants of the past TWO years expectations for an always imminent end to the house prices bullish trend have now to contend with the fact that UK house prices are now 4.5% HIGHER than there 2007 bull market peak!

Whilst the prospects for a UK rate rise during 2016 have been evaporating. However as my previous analysis has consistently repeated that rising interest rates, especially at the start of a cycle tend to be GOOD news for house prices.

20 Aug 2015 - Will UK Interest Rate Rises Crash House Prices?

For instance the great housing bull market of the noughties was during a RATE RISING CYCLE, whilst the crash in house prices was accompanied by deep cuts in UK interest rates. Therefore historically UK house prices usually tend to RISE when interest rates are Rising and FALL when interest rates are Falling. Which actually is a common sense market response for interest rates tend to be raised to cool and regulate an over heating booming economy. Whilst interest rate cuts tend to take place in support of a weakening economy that is fast heading towards recession or worse. Therefore interest rate hikes this time around will also be a GOOD indicator for future house price inflation which again is completely contrary to the academic noise that is liberally regurgitated by the pseudo economists (journalists) in the mainstream financial press that today in unison warn of the negative consequences of interest rate hikes on UK house prices as illustrated by the following recent headlines:

BOJ Negative Interest Rates

Despite the US Fed raising interest rates in December, all of the worlds other central banks are not only cutting interest rates towards zero but as the recent BOJ decision illustrates have actually gone negative!

Whilst most market commentators were fixated on the prospects for further Fed tightening, the so called unwinding of easy money quantitative easing in the United States. The Japanese arm of the central banking crime syndicate took the markets by storm Friday by effectively decreeing that inflation is just too low for the systematic stealth theft of bank deposits to continue so now it's time to ramp things up a notch with the next step which is for NEGATIVE INTEREST RATES. The FIRST instance of which will be that an interest rate of -0.1% will be applied to bank deposits (excess reserves) with the central bank, again this is just the FIRST instance with MORE or rather WORSE to follow which sends a discouraging message to all against holding Yen deposits, triggering an immediate drop of over 2% in the value of the Yen.

I am sure you are already aware of the 'Hallelujah' immediate response of the worlds stock markets, news of which greatly upset the growing bearish consensus in the wake of the ongoing correction to the now 7 year long stocks bull market. Which given the widespread bearish ear ache it generated, I could not resist responding to in the following tongue and cheek video -

The primary reason why the Japanese government has gone negative on interest rates is to trigger PANIC consumption, to force bank customers to withdraw and SPEND their Yen or it will be stolen by the government and the rate at which it will be stolen will only worsen from -0.1% to -1%, to -5% to -10% all the way to -50% of remaining Yen bank balances! Whatever it takes will be DONE! YOU HAVE BEEN WARNED!

Japan's move should not come as much of a shock for several European central banks have already been busy stealing bank deposits such as Switzerland's on -0.75% or ECB on -0.3%, so Japan given China's recent devaluations had no choice, and neither do the worlds other central banks for call it what you will i.e. the actions of a central banking crime syndicate or a currency war or a war on cash. For this is nothing new as I have been warning of the consequences of the WAR on CASH for several years now, as the central banks have each taken their respective steps along the path towards both PREVENTING future BANK RUNs (i.e. you can't withdraw your deposits as cash) and for triggering PANIC CONSUMPTION whenever the fiat currency system appears at risk of imploding into the deflationary death spiral that the perma bears have been blindly peddling as always being imminent forever! All whilst remaining consistently BLIND to the fact that the worlds central banks will always do what needs to be done to INFLATE!

This begs the question, how can the likes of U.S. Fed further raise interest rates when other central banks are not only cutting but going negative? As this will just force the U.S. Dollar higher still. So is likely to act to dampen future Fed rate hikes for this year.

In the following comprehensive video I covered the Bank of England's War on Cash following it's September 2015 announcement aimed towards phasing out cash with is a pre-requisite for the effectiveness of negative interest rates.

The Bank of England has taken the refugee crisis as a cue to accelerate the time table for targeting abolishing cash and therefore this video in the 'Illusion of Democracy and Freedom' series focuses upon the 'War on Cash', what it is, what it means and what it is trending towards and what all people need to do to protect themselves against the potential risks of not just theft of their hard earned life time of savings that in the future could be just a mouse click away from being legally stolen, but the risks of being financially deleted as western democracies are trending towards becoming financial totalitarian states.

Do watch the video for it highlights several strategies to avoid the consequences of the war on cash.

This IS THE MASTER plan of all governments, who via their central banks WILL seek to trigger PANIC CONSUMPTION through the mechanism of outright theft of bank deposits for which a very necessary step is the WAR on CASH so as to prevent the withdrawal of bank deposits as cash to be stuffed under mattresses both in response to negative interest rates and the next banking crisis bail ins.

Remember that such theft is nothing new, because for the past century it has been by means of INFLATION, i.e. real inflation 5%, interest rate 3%, net -2% stealth theft of deposits. Now with rates near zero the stealth theft looks set to become outright theft. Thus negative interest rates are just a continuation of the policy for theft of purchasing power of currency in a very low inflation or even deflation environment.

Consequences for Asset Markets

The consequences of negative interest rates / the war on cash have remained consistent for several years now in that for savers to protect their wealth need to convert bank deposits into hard assets such as property, precious metals (opportune moment) and of course stock holdings (high volatility). Given my own portfolio breakdown which has remained pretty consistent now for near 4 years, my most favoured wealth protection asset class by far remains property holdings. Bonds should also do well as rates go negative.

UK Interest Rates Conclusion

Therefore the overwhelming picture is one of the Bank of England continuing to kick the interest rate can down the road for the whole of 2016 and probably for the whole of 2017 too, even if inflation rises to above 2%. Where even a BrExit induced mini-sterling crisis is unlikely to prompt the BoE to shift on UK interest rates. Especially as I expect the UK economy to significantly weaken to an average GDP of 1.6% per annum that compares against BoE expectations of 2.6% per annum.

The bottom line is that a paralysed BoE remains terrified of its banking brethren that could yet go bankrupt again, especially given Britain's continually expanding debt mountain, and thus will only hike rates when it is faced with an even worse crisis. In fact odds probably favour a CUT in interest rates rather than a RISE, maybe even going negative, though negative interest rates just do not work because they act as a tax on the economy instead of a stimulus.

What the Bank of England Should Do but Won't Do

It's simple - RAISE INTEREST RATES! Why ? Because QE does NOT WORK! ZIRP DOES NOT WORK! We have 20 years of PROOF from Japan and the REST of the Western World for the past SEVEN YEARS!

Instead the clueless academics, bureaucrats and central bankster's peddle more of the SAME! At least the U.S. Fed had the balls to nudge rates higher in December which means the US economy should continue to out-perform. THAT IS THE DIFFERENCE between REALITY and ACADEMIC THEORY of the Economists and Central Bankster's. They really STILL don't have a clue! If Cutting interest rates to ZERO did not work, then instead of the next step being to go NEGATIVE, instead they should NORMALISE INTEREST RATES, and then they can years later with the benefit of hindsight right why it worked in reams and reams of academic papers, all patting themselves on the back trying to forget all the years when they got it wrong and only got it right after they had thrown everything else including the kitchen sink at the problem!

Market Implications

Low borrowing costs and savings interest rates are likely to continue to persist for the next 2 years. Therefore savers should eye fixes of at least 2 years for higher rates. Bank customers also need to be aware that there is a real risk of NEGATIVE interest rates, which means the BANKS will STEAL a percentage of your bank deposits each year. That's right, the banks take your bank deposit, loan it out at 5%, 10%, or 20% and then will CHARGE you for allowing them to do so with your money. If this is not the behaviour of crime syndicate then what is it?

Expect further ongoing weakness for sterling, a trend forecast for which will follow in a separate analysis. Lack of rate hikes and the prospects for further easing are supportive of the stock and housing markets for 2016.

I will cover the prospects for U.S. interest rates in my next analysis, so ensure you are subscribed to my always free newsletter (only requirement is an email address) for the following forthcoming analysis -

- U.S. Interest Rates 2016

- US Dollar Trend Forecast

- Stock Market Trend Forecast 2016

- US House Prices Forecast 2016 and Beyond

- Gold and Silver Price Forecast 2016

Source and Comments: http://www.marketoracle.co.uk/Article53952.html

By Nadeem Walayat

Copyright © 2005-2016 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.