Silver COT Paving Way for Sustained Upside Breakout Sharp Rally

Commodities / Gold and Silver 2016 Feb 07, 2016 - 01:03 PM GMTBy: Clive_Maund

Like gold, the bearmarket in silver should be brought to an end by the dollar breaking down, and especially the powers that be resorting to massive global QE in a last desperate effort to beat back the forces of deflation caused by gargantuan debts that are strangling the life out the world economy. Since you cannot beat the problems caused by debt by creating more debt, the end result of this will be the ruin associated with hyperinflation - and you don't to be a genius to work out what will happen to the prices of both gold and silver when that happens. The timing of the launch of the big global QE program will determine when gold and silver really take off in a big way, but it cannot be far off.

Like gold, the bearmarket in silver should be brought to an end by the dollar breaking down, and especially the powers that be resorting to massive global QE in a last desperate effort to beat back the forces of deflation caused by gargantuan debts that are strangling the life out the world economy. Since you cannot beat the problems caused by debt by creating more debt, the end result of this will be the ruin associated with hyperinflation - and you don't to be a genius to work out what will happen to the prices of both gold and silver when that happens. The timing of the launch of the big global QE program will determine when gold and silver really take off in a big way, but it cannot be far off.

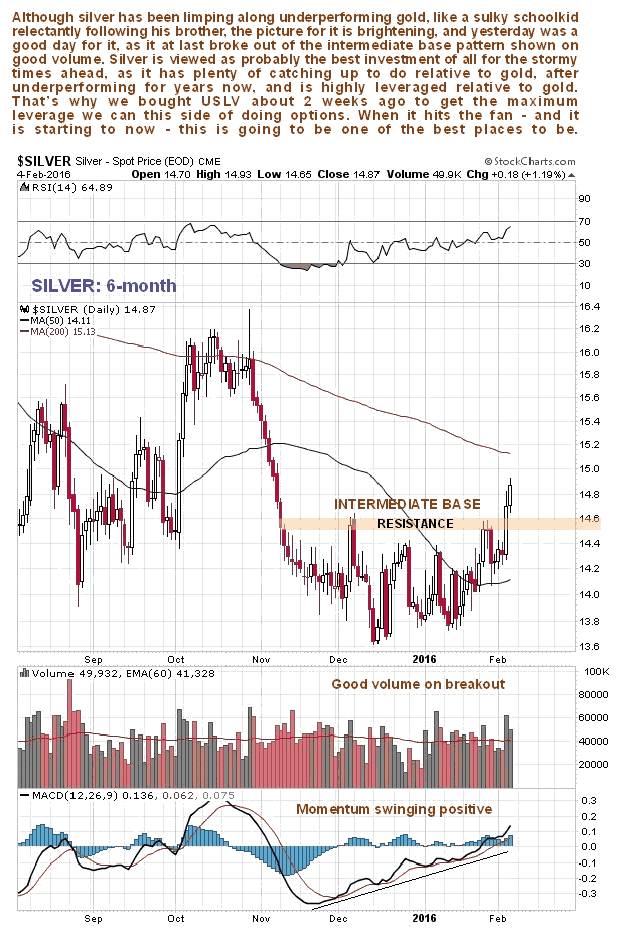

Taking things one step at a time we are now going to look at the ground in front of us, and consider the immediate prospects for silver. Silver has broken higher in recent weeks, but its progress has been muted compared to gold. This is normal in the earliest stages of a bullmarket when gold takes the lead. On its 6-month chart below we can see that it has now broken out of a quite sizeable intermediate base pattern, as expected and predicted in the update Imminent Dollar Shock and Effect on Gold, Silver & Oil, after which we went for leveraged silver bull ETFs. It should have some way to go before the current rally fizzles out in the vicinity of its still falling 200-day moving average and it then consolidates or reacts back, with an outside chance of it breaking out of its major downtrend shown on its 5-year chart presented further down the page without further ado and storming ahead, since a clear breakout from this downtrend would likely trigger a possibly dramatic spike.

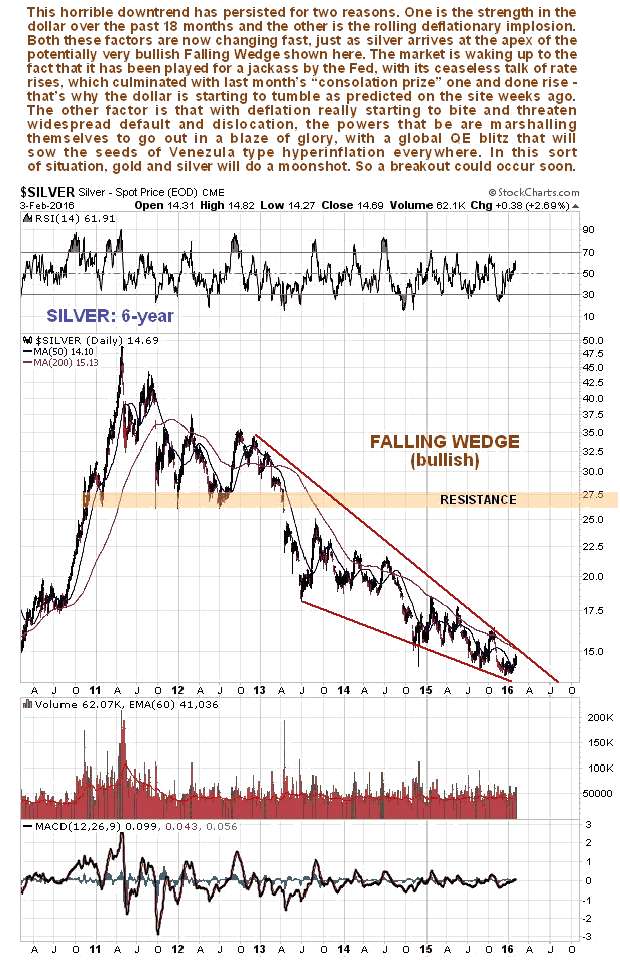

The 5-year chart for silver looks encouraging as it shows the price locked within a giant Bullish Falling Wedge downtrend which is now closing up, making a breakout likely, with the dollar's breakdown of recent days increasing the chances that it will happen soon. The only circumstance in which this pattern could break to the downside would be if the Fed obstinately presses ahead with more rate rises, triggering a widespread collapse. However, this looks unlikely, especially given the NIRP message telegraphed by Japan last week, which is believed to be a deliberate plot to prepare the ground for the Fed to back out of its projected rate rises. That is why the dollar has plunged.

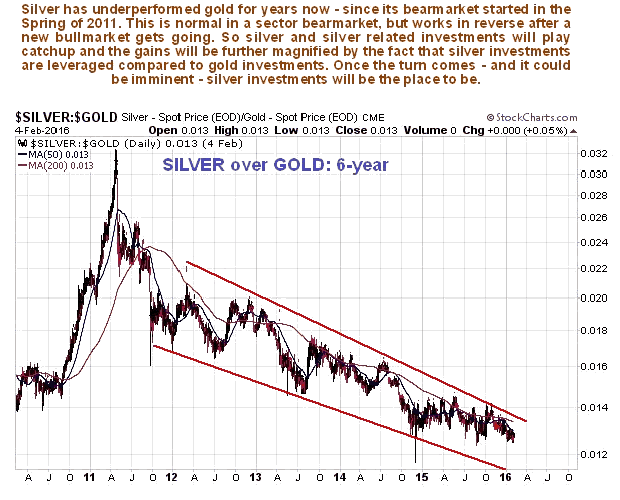

The following silver over gold chart shows how it has underperformed gold for a long time as the bearmarket has unfolded, which means that once a new bullmarket does start, silver will have quite a bit of catching up to do. Putting that together with its higher leverage as an investment, and you will readily see that silver and silver related investments are going to be the place to be once this sector turns higher.

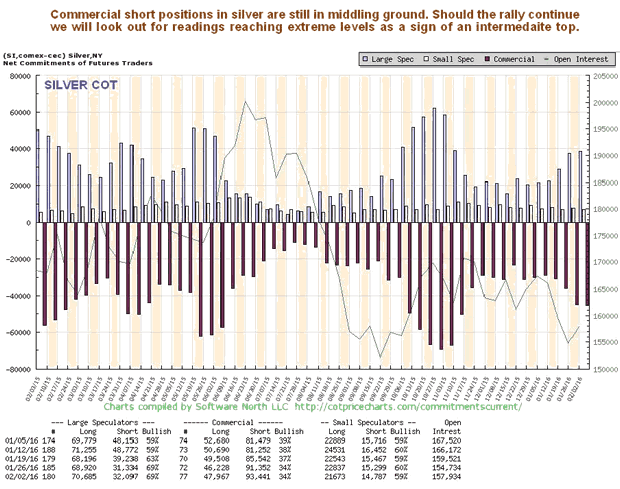

The latest silver COT shows readings in middling ground with scope for further gains by silver, and we will watch out for Commercial short positions rising to more extreme levels as a sign that we may be at or close to an intermediate top.

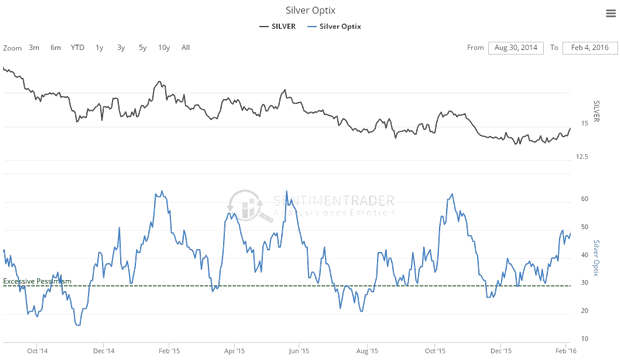

Silver's optix or optimism chart is also in middling ground, but any further gains by silver will doubtless see readings on this chart rise to levels that call for an intermediate top, to be followed by consolidation or reaction.

Chart courtesy of www.sentimentrader.com

In conclusion, the picture for silver appears to be brightening considerably, with the prospects for an upside breakout from its long and stubborn downtrend brightening considerably. Ideally, what we would like to see is a little more upside progress, and then a period of consolidation or minor reaction that allows COT readings to improve, paving the way for a sustainable upside breakout that triggers a sharp rally.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2016 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.