Preparing for Crisis - It's About Risk Mitigation and Capital Preservation

Stock-Markets / Financial Crisis 2016 Feb 09, 2016 - 10:20 AM GMTBy: Gordon_T_Long

John Charalambakis is the Managing Director of Group, a boutique style asset and wealth management firm, which focuses on risk mitigation, capital preservation and growth through strategies that are rule based. Dr. Charalambakis has been teaching economics and finance in the US for the last twenty years. Currently he teaches economics at the Patterson School of Diplomacy & International Commerce at the University of Kentucky.

John Charalambakis is the Managing Director of Group, a boutique style asset and wealth management firm, which focuses on risk mitigation, capital preservation and growth through strategies that are rule based. Dr. Charalambakis has been teaching economics and finance in the US for the last twenty years. Currently he teaches economics at the Patterson School of Diplomacy & International Commerce at the University of Kentucky.

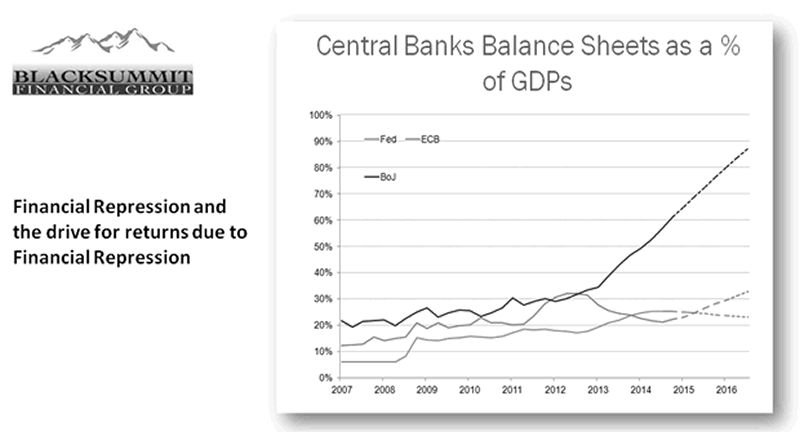

Financial Repression

"The outcome of financial repression is when the role of the markets is diminished because of the actions of central authorities, such as central banks."

Fed: Central banks of the United States, ECB: European central bank, and BoJ Bank of Japan

Assets under management have skyrocketed from about 7% in 2007 for the U.S Fed, to over 20% as of the end of 2015, increasing 3 times. Over this time, the GDP did not equally increase 3 times. This increase eventually leads to a greater role of central authorities. Looking at Japan in 2007, they had about 20% of their GDP in their balance sheet, currently they have over 90%, meaning the role of the markets is diminishing and the role of central authorities is increasing, creating financial repression.

Gord asks John what assets people should invest in, in this era of financial repression that would create a store of value, which may not bring in a yield, but would preserve their money.

Gold - Intrinsic Value Assets

"I think the goal of any pension fund, institutional or private investor should be capital preservation. Assets should have intrinsic value. Assets that have intrinsic value such as gold or silver, historically have retained their value especially in times of crisis." John mentions how the price of gold in 2009 rose from about $500-$500 to $1900 because investors were seeking a safe haven of intrinsic value assets. "There is not enough gold for everyone. Only 1/3 of 1%, a miniscule number, is invested in precious metals." Hypothetically if every manager by the end 2016 would invest just 3% of their wealth into precious metals, the price of gold would rise to an estimated $2700. Growing demand and financial stress can, and likely eventually will, create a financial crisis.

Key Principles of the Austrian School of Thought

- Uncertainty is endogenous in the markets, and therefore investments should be based on rules. "Regardless of where the market temporarily may be moving, the investor, whether individual or institutional, should be guided by rules."

- Investors, whether fortunately or unfortunately, are emotional beings, therefore there are psychological deficiencies caused through emotions, effecting investments. Due to these emotional deficiencies, investors must be disciplined, and once again be guided by rules

- The conventional methodology of 60/40, stock and bond rule is not adequate. It ignores the risk parity considerations. Investors should shift their portfolio based on the macro environment of risk, in order to take advantage of the more promising and safe investment at the time being. John mentions that in 2009-2011 bonds gave a much better return, because money had left stock and shifted to bonds. It also ignores the potential black swan phenomenon. A black swan phenomenon is likely to happen again and in greater frequency than we've seen before, we need to be prepared and eventually hedge our portfolios in such a way, that we are able to sacrifice some return for the sake of stability and preservation.

- Portfolios need to structure in such a way to survive in a macro and business cycle, as well as the credit cycle.

- Markets cannot escape realities of wealth creation. Nations do not become wealthy by printing money. Rather, wealth is created through free markets, when the entrepreneur is allowed to take risks, because risk liberates. "When there is excess regulation suffocating the entrepreneur, wealth cannot be created." Investing in entrepreneurs and innovators, with proper risk analysis, can result in great returns.

"Unfortunately risks and stresses are being built up and portfolios are suffering the consequences. People think because they have wealth on a financial statement, that wealth can be preserve. When the markets collide, that wealth is destroyed because it is paper wealth, not real wealth."

Infastructure Investment

"Infrastructure investment needs to be financed, usually countries finance infrastructure through deficit spending, and that cannot happen due to big holes in their budgets." John questions whether or not the internal rate of return justifies infrastructure. He doesn't believe the environment is mature enough currently, due to the possibility of a looming crisis in the next couple years. This would push back infrastructure spending.

Preparing for a Possible Crisis

- Analyzing risk, and understand where the risk is coming from.

- Anchor the portfolios. (Most usually used in hard assets)

- If applicable; hedge the portfolio either by selling covered calls, and collect premium by doing so, as well as mitigating risks. Individuals may also consider buying puts.

"Since we are in an era of financial repression you cannot expect the income from treasuries or CDs, explore all sources of income"

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.