With A Gloomy Start To 2016, A Bust Seems Just Around The Corner

Stock-Markets / Financial Crisis 2016 Feb 11, 2016 - 10:50 AM GMTBy: Submissions

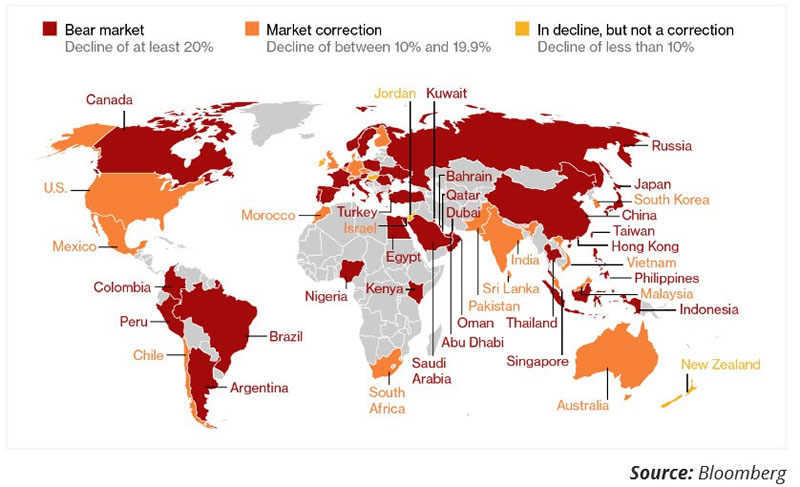

Taki Tsaklanos submits: Markets have corrected substantially since the beginning of the year as most of the gains of the past two years have been erased. According to Bloomberg, 40 out of the largest 63 markets have dropped over 20%! The image below shows the performance of markets word-wide since their last peaks. Most markets are in a bear market phase or at best are experiencing a market correction. The world is red!

Taki Tsaklanos submits: Markets have corrected substantially since the beginning of the year as most of the gains of the past two years have been erased. According to Bloomberg, 40 out of the largest 63 markets have dropped over 20%! The image below shows the performance of markets word-wide since their last peaks. Most markets are in a bear market phase or at best are experiencing a market correction. The world is red!

Where do global markets stand?

China’s economy is slowing down and oil prices have slumped to a new multi-year low. Is this THE bust of the cycle that started in 2008? In our ‘Clean Slate’ report about the Austrian Business Cycle Theory, we explained how we have short-term cycles, which last for approximately 7 years, but also long-term cycles, which are around 50 years. Those who read the bible are familiar with the term “jubilee”, which signifies the end of a 50-year long-term debt cycle, when all outstanding debts are annulled and slaves are freed. But before the “jubilee” of our times happens, things will likely get worse. We will see governments taking measures that constrain our liberties further. Their objective is to maintain an artificially centralized system by force, however eventually this system will fall apart.

Past recessions, such as the oil shock in 1973, the recession of 1980, the stock market crash in 1987, the bond market crash in 1994, the dot-com bubble in 2001 or the 2008 financial crisis were all busts operating within short-term cycles. We believe that we are approaching the end of the current 7-year cycle. In the report we published at the end of 2014, we expected a sharp correction in equities (and other inflated assets) within two-to-three years, and it appears we might have been right. Though we have reason to believe that we will not witness a hard-landing of international markets in 2016, we are convinced that the bust of our current money-printing induced cycle could be coming very soon! So what leads us to this conclusion?

China’s slowdown is no surprise!

Many believe the fall of China’s economy will be the start of a chain reaction that will take the world into the next global recession. Global investor, Felix Zulauf, believes that the slowdown in China will present a similar threat as the subprime mortgage crisis did in the past financial crisis. So, you can imagine the potential global impact!

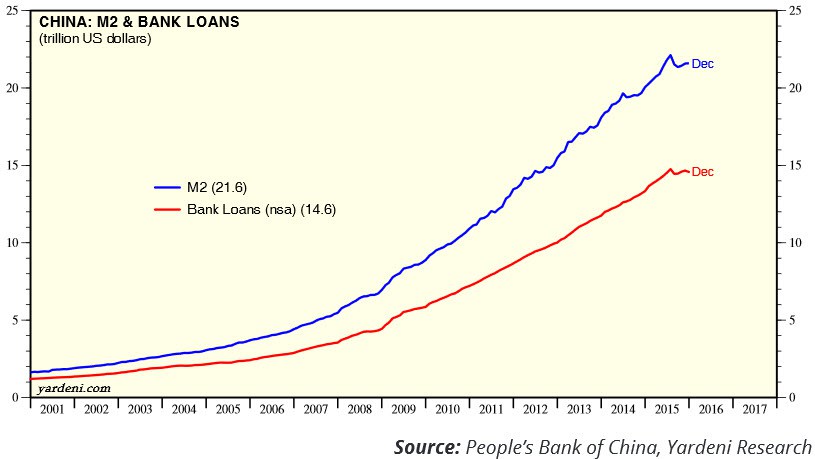

The truth is that the current crisis in China is a logical consequence of the long boom of over 20 years! In 2010, China registered a GDP growth of 10.4%, however, only a couple of years later this growth has deteriorated to an estimated 6.9%. We don’t necessarily believe in government statistics – especially from China – and we assume that, in reality, the growth rate is much lower. The problem is not the deceleration itself, but the reason it is decelerating: the boom was not driven by demand growth, but rather investment growth. And these investments wouldn’t have been achievable without the accumulation of debt and an expansionary monetary policy. The chart below shows the exponential growth of both the money supply and the bank loans in China.

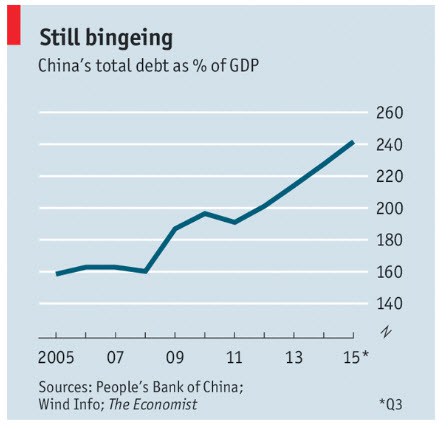

In other words, it was Chinese investment (50% of GDP) and not consumption (40% of GDP), which geared this long and high boom. As a result, the Chinese invested in excess: excess real estate, excess construction and excess manufacturing. Real estate, including related industries such as steel, cement, etc. represents 25-30% of GDP! All of this overcapacity was connected with the accumulation of debt. China self-created its own credit bubble where overall debt to GDP is estimated to have climbed to more than 240% in 2015 compared to 160% in 2007.

This slowdown will have its consequences on the Chinese domestic market and internationally. In China, you will have a recession or massively lower growth rates and a halt in industrial development. On the backdrop of a lower Renminbi, imports to China will decline while Chinese exports will become cheaper. Conversely, international markets will be challenged by cheap Chinese exports. But what is more problematic are the capital outflows: China’s total capital outflows in 2015 have climbed to USD 1 trillion with that number growing along with negative investor sentiment on the Chinese economy. Meanwhile, the Chinese government is trying to support its currency with its foreign reserves, which have dropped to USD 3.23 trillion, the first annual drop since 1992, according to Bloomberg.

The greatest threat is China exporting its deflation. This would have a particularly strong impact on the already heavily indebted economies such as the U.S., Europe and Japan. We believe that central banks will fight deflation with any means possible. Central banks, including the Fed, are therefore likely to keep interest rates low or may even start implementing negative interest rates. Yes, we all should be concerned – but we definitely should not be surprised. As Steen Jakobsen put it, “China is the easy scape goat, but seriously if anyone is surprised about China’s growth slow-down and its needs to buy time for changing its economic mix-up, they need their school money back.” The Chinese slowdown is just stating the obvious: bubbles driven by debt are bound to burst.

Drop in oil price means more than we think

Additionally, the world is also concerned about a major commodity: oil. The oil price broke the USD30 benchmark, the lowest level since over a decade. While everyone is wondering what this means, and if it will go any lower, I am more interested in the views of former Congressman and freedom activist, Dr. Ron Paul. The slump in the oil price has major implications for the international economy. It signifies the end of an era – a paradigm shift in the international monetary system that we’ve known since Nixon closed the Gold Window.

According to Ron Paul:

“The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the better.”

I will take this opportunity to talk more about Ron Paul’s perspective: The U.S. dollar became the world’s premier reserve currency with the implementation of the Bretton Woods system. In 1971, Nixon closed the Gold Window to stop pressure on the Treasury’s gold reserves, as an increasing number of foreign countries, most notably France, were converting their dollars into gold. The closing of the Gold Window, meant that governments could no longer convert dollars into gold, which would imply lower demand for dollars and accordingly a weaker dollar on the world markets. This of course, was unacceptable to the U.S., government. So they needed to create demand for the dollar and motivate countries to hold and use dollars.

Here is where oil comes into play. Oil became the commodity that would guarantee international demand for the dollar. And this guarantee was achieved by a classic politico-strategic alliance with mutual benefits between the U.S. and Saudi Arabia, the holder of the largest oil reserves and leading OPEC member. This was a milestone for the U.S.; in essence the era of petrodollars has allowed the U.S. government and its citizens “to live beyond their means”, according to Paul. Americans managed to live beyond their means, as their government felt comfortable to pursue an expansionary monetary policy (after all, who would not need to buy oil?), which encouraged Americans to accumulate debt and consume aggressively.

What we have now is an entire monetary system built on a political alliance, an alliance that is now on shaky grounds for a number of reasons, including the growing instability in the Middle East amongst others. But now we are looking at a system that is on the verge of collapse, and if it does, there will no longer be a reason for countries to demand the dollar. As a result, the dollar will lose its status as an international reserve currency. Domestically, it will mean that peoples’ wealth will be eliminated! How so? The government will be desperate to cash-in; it can resort to capital controls, wealth confiscation, price and wage controls, pension nationalizations, etc. What this means is that the demise of the dollar is linked to oil and the petrodollar system, and with that, the wealth of the American citizen who will not be able to protect his wealth from a state that is no longer able to finance itself.

The Eurozone crisis is growing

The Euro’s crisis is growing not only because of the refugee crisis, which will most likely accelerate because of the ongoing wars in the Middle East, but also due to weak oil prices. More people will be forced out of their country. The open-border policy of the “Schengen Area” is collapsing and certain countries in Europe have already started to implement national border controls, which are opposed by Brussels. Economic growth is nowhere to be seen and investments into the Eurozone have fallen tremendously, in real terms, since 2008. The ECB has announced that it will inject as much liquidity as needed and started to purchase additional corporate bonds (ABS). A constant redistribution from the northern to the southern nations is necessary to keep the whole Eurozone together. This, in combination with a possible exit of the U.K., could be the trigger that will tear the Eurozone apart. Therefore, we see a flight out of the Euro, which is a logical consequence of all of these uncertainties. The idea of a centralized plan for Europe has failed and until it actually does fall apart, a constant redistribution from the North to the South will go on and destroy the middle class.

We are approaching a great shift!

With a global slowdown triggered by China, and a potential crisis of the petrodollar system, we believe that the game is changing, and with it, the rules. We expect the bust to come in the foreseeable future but not necessarily in 2016. However, we are certainly getting closer to a great shift: a correction of the monetary system to pave the way for a free market economy and transformation in the global currency system. The correction is inevitable. Ludwig von Mises said:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

Many investors and individuals fear the words “bust” and “recession”, its implications and what it means. What will happen when we hit rock-bottom? The answer is simple: massive defaults and deflation! This will be the point when all assets, which have been propped up with freshly created liquidity are going to correct massively. Economies will be at a standstill. We have one of two options: 1) another temporary fix, which will not solve the source of the problem but only postpone the inevitable bust that will hit even harder than it would now; and, 2) accept and endure the “correction”. The correction needs to be seen as something positive, as it corrects the mismanagement that had been experienced in the economy and rectifies the imbalances. This correction is inevitable, and has been a long time coming. The Bank of International Settlement even supports this view in its 2013/14 report:

“To return to sustainable and balanced growth, policies need to go beyond their traditional focus on the business cycle and take a longer-term perspective – one in which the financial cycle takes centre stage. They need to address head-on the structural deficiencies and resource misallocations masked by strong financial booms and revealed only in the subsequent busts. The only source of lasting prosperity is a stronger supply side. It is essential to move away from debt as the main engine of growth.”

Our past and existing monetary policies have clearly shown that inflation has little to do with supply and demand, but rather is driven by the expansion of the money supply. As we have seen since 2008, total credit increased from USD 140 trillion to USD 200 trillion. This means USD 60 trillion have been artificially created by central banks worldwide to bail out the banking system! It is clear that nothing has helped rectify the situation – all these dollars were only temporary fixes to avoid what should have happened in the first place: the endurance of painful but needed “correction”. I am happy to see that more and more people are coming to understand the malfunctions in our system!

Timing is always the big uncertainty. As we have mentioned before, we believe interest rates will stay low. The Fed has only increased the interest rate by 0.25% because they had to fool the masses to believe that interest rates will go up in the future, with the aim to keep them invested in pension funds and bonds. If the people realize that we will not see higher interest rates in the future, they would most likely start shifting their assets into hard assets. These, by nature, have a stronger potential upside in such an environment because they are scarce compared to paper and computer digits created out of nothing.

Regarding the equity markets, we believe that we will see increasing volatility in the financial markets, however based on the actual Price-Earnings Ratio of the S&P 500, stocks do not seem to be extremely overvalued yet. At the moment, the ratio is about 20 and in 2001 we stood at 45 and in 2008 at 28 – so there is still some room for equity markets to move higher. We can’t exclude a possible recovery of the stock market in the near future. However, we believe people should use the time to prepare themselves for the worst.

Are you prepared for the bust?

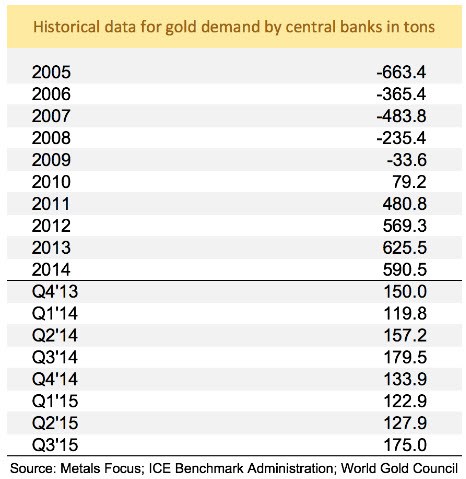

Some countries have realized long ago that the dollar is just an artificial currency that is not backed by any value. And even though practically everyone was stuck in this artificial monetary system, they sought to support their countries with the highest quality assets out there: GOLD! Central banks are well aware of the need to prepare for a downturn and have been rather active buyers of the metal and building up their gold reserves, particularly since 2010. China and Russia have been the top buyers up to early 2015.

We are convinced that 2016 will be a good year for gold again. It is possible that the price of gold might come down in the next couple of months, however several trustworthy gold analysts that we follow see an upside of around 20% for gold in the second half of the year. We also find the acceleration of physical demand for gold and silver coins, especially in the retail market, such as in the U.S., Germany, but also in Switzerland, very interesting. It just shows that more and more people understand that gold and silver act as a protector of property rights and that current prices are very attractive.

Gold is not only an inflation hedge. Even in the deflationary environment we are likely to endure, people will want to shift their investments to high quality assets with low or no counter-party risk. In short, it is a flight to quality and the hardest currency for the past few thousand years has been and still is gold. Conversely, in a boom, or inflationary environment, people move their money towards high-risk assets such as derivatives and paper markets.

Today’s uncertain situation requires capital preservation, which is certainly found in gold. Whether the gold price moves upward or downward, the value is real. Gold is a hedge in an uncertain economic environment with negative interest rates. In fact, gold is a better option than bond investments. In comparison to bonds, gold is much more volatile, nevertheless it is the only asset without any form of counter-party risk and it has been considered valuable for millennia. Gold is an investment that you make, away from financial institutions and government intervention. In essence, you protect yourself from governments and markets. Maybe we cannot predict the future, but we can certainly prepare for it!

I would suggest starting to accumulate precious metals, because we are standing at the beginning of the next phase of the bull market. If you believe the system will crash, you need gold; or, if you believe that saving money makes sense because you don’t trust the government’s promises that it will take care of you in the coming years, then gold makes sense as well. Gold is your insurance and you need to own it physically. We advise you to store some of your gold outside the jurisdiction you live in as your personal “Plan B” and this is where Global Gold comes in. We look into all the little details, which will make a big difference in a harsh crisis scenario. But one thing is certain: The time to increase holdings is now!

Source: Global Gold Outlook Report N° 13, subscribe to receive future updates for free

Author: Claudio Grass

Source: http://goldandliberty.com/money-markets/gloomy-start-2016-bust-around-corner/

© 2016 Copyright Gary Savage - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.