Stock Market Sells Yellen's 'Deer in Headlights' Congressional Testimony

Stock-Markets / Stock Markets 2016 Feb 11, 2016 - 12:01 PM GMTBy: Mike_Shedlock

Saxo Bank CIO and chief economist Steen Jakobsen phrased Fed Chair Janet Yellen's testimony before Congress this way: "The politicians were rude and pretty much clueless ... and Yellen often looked like a deer in headlights. Her performance today is probably the worst I have ever seen from seasoned central banker!"

Saxo Bank CIO and chief economist Steen Jakobsen phrased Fed Chair Janet Yellen's testimony before Congress this way: "The politicians were rude and pretty much clueless ... and Yellen often looked like a deer in headlights. Her performance today is probably the worst I have ever seen from seasoned central banker!"

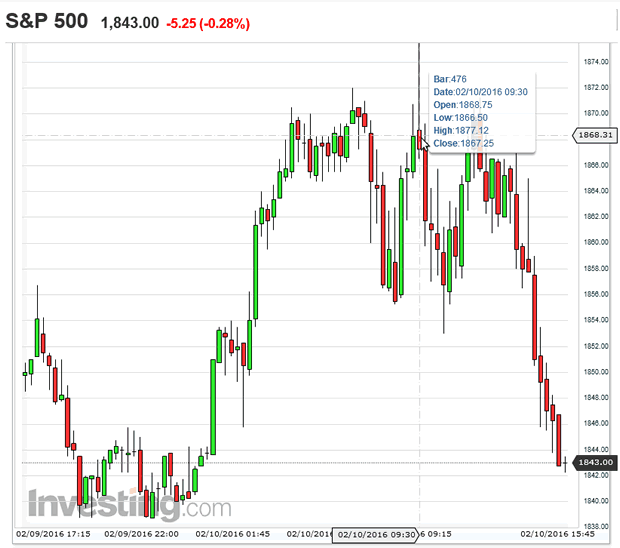

After an initial rally attempt this morning, the market had serious second thoughts.

S&P 500 15-Minute Chart

Email from Steen

Steen's email lead-in this afternoon was rather humorous. Here's a slightly edited version.

Today's testimony showed US politics and central banking from its worst side: The politicians were rude and pretty much clueless.

The Chair of the Federal Reserve was of little help and often looked like a deer in the headlight. Incredible! I am sure Ms. Yellen is an excellent "model economist" but her performance today is probably the worst I have ever seen from seasoned central banker!

The Fed came into this meeting with very little credibility and this event did not add to the tally. Instead, we are left wondering how they expect to help the market. One Senator asked: "Ms. Yellen, what tools are those you keep talking about, interest is pretty much zero anyhow?"

Yellen responded: Well, we can do "lower for longer"!

So let's forget about central banks. Yes, Draghi will try to command some media time and the BOJ likewise, but it's probably to no use.

Could the European Central Bank expand its asset-buying programme next month to include corporate debt in an effort to help the eurozone's banks?

From Evercore ISI: ECB Likely to Buy Corporate Debt .

"We think the ECB is increasingly likely to expand its (quantitative easing) programme into investment-grade corporate debt in March. This would be a means of pushing back against the surge in credit risk premia that is in turn contributing to pressure on equities in general and bank stocks in particular," the investment bank writes.

"Buying investment-grade corporate debt would directly lower spreads on this debt, while putting downward pressure indirectly on bank bond yields and on spreads on non-financial high-yield bonds through portfolio re-balancing effects," it adds.

Evercore ISI reckons the ECB is increasingly likely to introduce additional measures to support bank funding in a complementary effort to help stabilise eurozone banks.

"We do not think the ECB will buy bank debt outright. However, one obvious step would be to increase QE in covered bonds, allowing banks to wrap more assets and sell them to the ECB," it writes. "Another would be to put in place an additional series of cheap TLTRO term funding "

Conclusion

Yellen did not deliver anything to help the market at all. She left Capitol Hill bruised but is back tomorrow.

My risk model is still calling for a lower market.

1st support is 1813/15, 1560/80 if broken. I still see an end of March low, Oil in 20/22$ range, Gold at 1,300.

Safe travels,

Steen

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.