Is the Gold Price Manipulated?

Commodities / Gold and Silver 2016 Feb 19, 2016 - 03:57 PM GMTBy: Arkadiusz_Sieron

The belief in manipulation in the gold market is associated with the notion of discrepancies between the paper and physical price of gold. The latter is artificially set lower by futures markets creating tons of synthetic gold. Hence the price of gold does not reflect its fundamentals. But the divergence between paper gold and ‘real’ gold cannot last forever; therefore the day of reckoning will finally come, and the paper gold market will collapse and the price of gold will skyrocket.

The belief in manipulation in the gold market is associated with the notion of discrepancies between the paper and physical price of gold. The latter is artificially set lower by futures markets creating tons of synthetic gold. Hence the price of gold does not reflect its fundamentals. But the divergence between paper gold and ‘real’ gold cannot last forever; therefore the day of reckoning will finally come, and the paper gold market will collapse and the price of gold will skyrocket.

Why is this reasoning flawed? First, no significant and mysterious discrepancy exists between the paper and physical price of gold. Gold prices are set in worldwide trading, mainly in London and New York, which are the base for determining prices in the physical market. The price quoted by different bullion dealers is the international gold price, but with added distinct premiums, depending on the local conditions, the competitiveness and the character of products. The margin between ‘paper’ and ‘physical’ prices is hardly surprising – this is how the retail trade operates. The retail sellers, like bullion dealers, buy gold in the wholesale market (the gold OTC market) and sell them to the retail investors. They add a margin to compensate their costs and earn profits. Do not forget that physical gold is less liquid and requires incurring minting, insurance, delivery and storage costs.

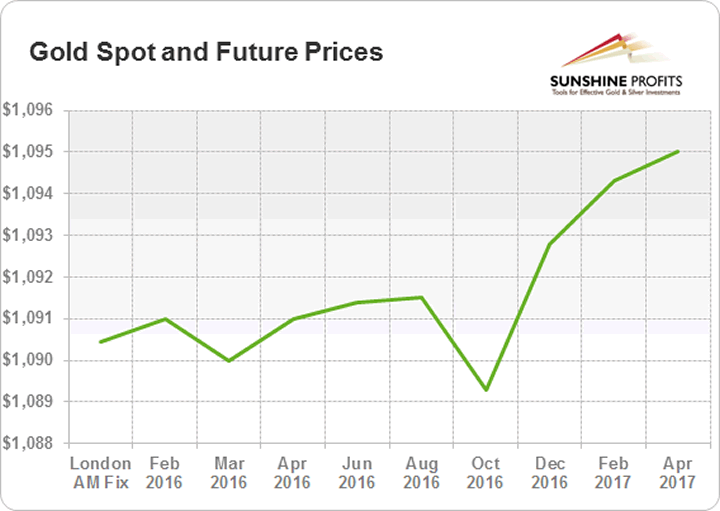

Moreover, the significant and permanent divergence between paper and physical gold cannot last long due to the arbitrage process. The arbitrage traders will always operate in the markets, and seek large divergences between the prices to take advantage of them. If such a discrepancy between ‘paper’ and ‘physical’ gold prices really existed, people noticing it should be buying the paper and sell the physical gold to profit from the divergence instead of writing about manipulation. If nefarious banks sell futures to suppress the ‘paper’ price of gold, they will create a large spread between the future prices of gold and the price of the physical metal (manipulators do not sell the physical bullion which is getting scarcer and scarcer). However, the backwardation – i.e. the situation when futures are traded at a discount in comparison with spot – is very rare in the gold market. And when it exists, it is very small and short-lived. Usually, the futures prices are higher than spot prices (see contango) in the gold market, which clearly indicates that they are not relatively suppressed compared to spot prices (see the chart below).

Chart 1: Gold spot (London AM Fix) and future prices (as of 18 January 2015, 14:55)

Second, futures markets drive the spot market prices (to a large extent). The academic literature points out that stock and currency futures markets lead spot markets in terms of information and price discovery. Why would it not also be the case for the gold market? Investors should realize that the gold futures market is simply much larger and liquid than the spot market. It also enables investors to use leverage and not take delivery. In other words, thanks to the special features of the gold futures market, traders on these markets react first to the latest developments.

Future exchanges exist in many countries to facilitate trade of asset classes, like stocks, commodities, currencies, bonds, stock indices, etc., but nowhere do they arouse such emotions as within the gold investor community. Many people accuse bullion banks of selling uncovered shorts on the Comex (the most important gold futures market) to drive down the price of gold. They believe that this manipulation works, because most players have no intent to deliver or take delivery of gold.

However, this is how the future markets work. The majority of transactions in the futures markets (not only gold) are without physical delivery and are cancelled out by purchasing a covering position, because it is a much more convenient way of settling the contract and gaining exposure on the price movements. The impact of ‘naked’ shorts is more controversial, but this academic paper about ‘naked’ shorts in the stock market shows that uncovered shorts were reacting to fundamental signs of financial weakness. If short sellers on the Comex were really as uncovered as it is claimed, there would be a huge ‘short squeeze’ and the price of gold would rise. Therefore, any manipulation using ‘naked’ shorts would be short-lived. If banks had massive short positions in the gold market, they would have to buy large numbers of futures contracts to cover their position and buy the physical metal to deliver it or roll their positions, by buying expiring contracts and selling the next one out. In all cases the short-term impact of selling the futures contract would be reversed as banks would have to unwind their positions (investors should also not forget that for each seller of a futures contract there must be a buyer). Thus, this practice, existing or not, cannot explain the long-term bear markets in gold.

Although many people talk about a disconnection between ‘paper gold’ prices and physical demand, these claims are unfounded. The futures markets often lead the spot gold market because they are faster and more information-sensitive. Then, the international gold price becomes the basis (adjusted for premium) for the bullion prices quoted by bullion dealers. The short positions in the gold market form a part of the futures markets (for example, as a part of hedging). Some of participants may also engage in ‘naked’ shorts, but their suppressing effect on gold prices (assuming that these shorts do not reflect fundamentals) would be only short-lived. There is usually contango in the gold market – i.e. the gold futures (allegedly manipulated) are traded at a premium over spot – which refutes the theory about big banks constantly selling uncovered shorts to suppress the price of ‘paper’ gold.

Consequently, it might be a better idea to focus on other reasons for buying gold instead of doing so only based on the possible collapse of Comex. There are many reasons to hold gold as insurance, to invest in it (given favorable circumstances) and to trade it for short-term profits. We’ll continue to provide our fundamental and trading analyses to increase the profits that can be achieved thanks to participating in the precious metals market.

Thank you for reading the above free issue of the Gold News Monitor. If you'd like to receive these issues on a daily basis, please subscribe. In addition to these short daily fundamental reports, we focus on the global economy and the fundamental side of the gold market in our monthly gold Market Overview reports. We also provide Gold & Silver Trading Alerts for traders interested more in the short-term prospects. If you're not ready to subscribe yet, or are unsure which product suits you, we encourage you to sign up for our mailing list and receive other free alerts from us. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.