US Dollar and The Global 'Peg Pain Trade'

Currencies / US Dollar Feb 22, 2016 - 06:20 AM GMTBy: Gordon_T_Long

Charles Hugh Smith and Gordon T Long analyze, with 25 slides, the strength in the US Dollar and what we can likely expect going forward.

Charles Hugh Smith and Gordon T Long analyze, with 25 slides, the strength in the US Dollar and what we can likely expect going forward.

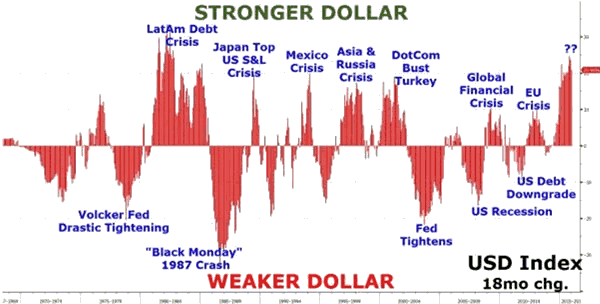

Both see a strong dollar in the future as it becomes, more and more a flight to safety associated with failed monetary / fiscal policies, weakening current accounts and slowing trade around the world. It isn't that the US$ is a paragon of virtue and value, but rather the "least ugly".

What We Might Expect

1. A Strong dollar is killing global US corporate profits. This will continue to impact stock valuations,

2. Currency wars favor the US at this point. Global investors with billions to manage can still earn a yield in 30-year Treasury bonds, and yet they also get exposure to future appreciation vis a vis other currencies.

3. The stronger dollar (despite recent weakness) acts as a magnet for global capital, leaching capital out of emerging markets, China, Asia and Europe.

4. What happens in a full-blown currency crisis? If history is any guide, gold and the US dollar both soar as panicked investors seek safe havens.

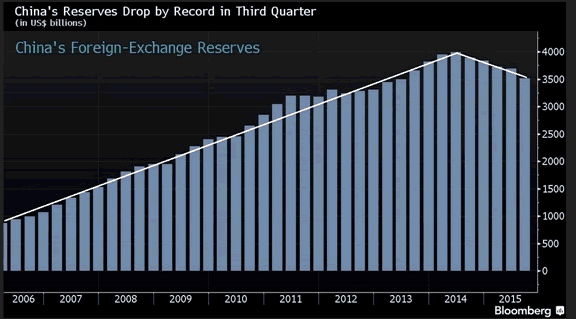

Fallig Currency Reserves

The collapse in commodity and energy prices, which can only be described as historic, is presently ravaging the current accounts of many countries dependent on the prices paid for these products. Many sovereign nations have been forced to sell currency reserves to protect their currencies.

Chinese Reserves

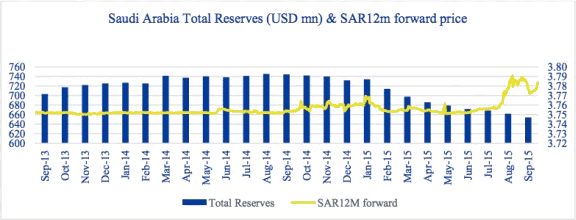

Saudi Reserves

The selling of Currency Reserves can clearly be seen in foreign holdings of US Treasuries which has been steadily eroding. Though selling of foreign reserves is temporarily contributing to a weakening US dollar it is likely only short term. In the longer term there is a shortage of reserves in many nations to sustain the current selling before they experience full blown currency dislocations. As global currency instabilities worsen, both video participants see the US dollar as best positioned currency to head higher as the recipient of a flight to "perceived" safety.

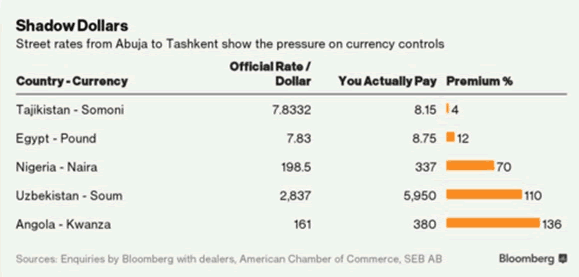

Falling Currency Pegs

Gordon T Long and Charles Hugh Smith both believe ailing Currency PEGs will increasingly take center stage with investors. The Hong Kong Dollar, the Chinese Yuan and the Saudi Arabia Riyal currencies are all focuses of traders and speculators, as are most of the energy exporter nations with a US$ PEG.

Individuals and businesses in five nations across central Asia, the Middle East and Africa are paying anywhere from 4 percent to 136 percent more than official exchange rates to get their hands on dollars. This is a growing tell tail sign as black market trading in the US$ is surging. These are signs of turmoil and a desire for "safety".

Japan's NIRP Has TriggeredSerious Disruptions to Capital Flows

According to Graham Summers at Phoenix Capital, Japan just lit the fuse on a $9 Trillion debt implosion. Hundreds of billions of Dollars in capital will begin fleeing Japan to come to the US.

-

Bank of Japan implemented Negative Interest Rate Policy, or NIRP.

-

It is the second Central Bank to do so.

-

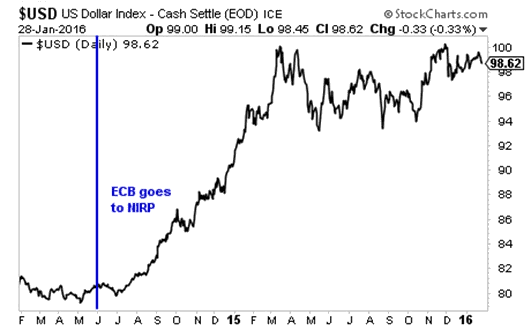

The European Central Bank or ECB first went to NIRP in June 2014.

-

Thus, between Japan and Europe, over 20% of the world's GDP is being managed by a Central Bank with NIRP.

-

More importantly, TWO major currencies in the world are now at NIRP while the US Dollar is at 0.5%.

When the ECB went to NIRP it precipitated the lift in the US$. The US Dollar has been in a bull market since mid-2014. It is not coincidence that it started when the Euro first went to NIRP, the minute the ECB implemented NIRP money began fleeing the Euro and moving into the US Dollar.

There is much, much more in this 29 Minute video illustrated with 25 slides.

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.