US Trade:Deficit Realities and Fallout

Economics / US Economy Jul 11, 2008 - 02:32 PM GMTBy: Andy_Sutton

I want everyone to forget the first sentence of last week's column. Things are not scary; they're bordering on out of control on several fronts. In particular, there are two items which are getting nearly no press that urgently need to be discussed. While the media world continues to focus on whether or not Fannie Mae and Freddie Mac have another 12 hours of solvency left, our trade deficit continues to persist despite continued weakness in the Dollar and out of control import prices. I like to use these two macro measures as a barometer of not only what is going on now, but what is likely to happen down the road.

I want everyone to forget the first sentence of last week's column. Things are not scary; they're bordering on out of control on several fronts. In particular, there are two items which are getting nearly no press that urgently need to be discussed. While the media world continues to focus on whether or not Fannie Mae and Freddie Mac have another 12 hours of solvency left, our trade deficit continues to persist despite continued weakness in the Dollar and out of control import prices. I like to use these two macro measures as a barometer of not only what is going on now, but what is likely to happen down the road.

Import Prices

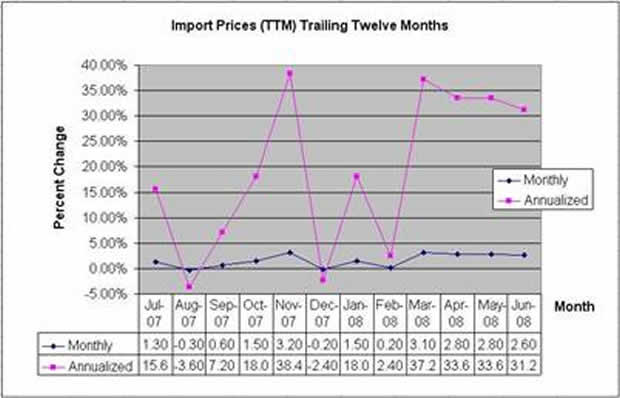

Since our last analysis of import prices in May, we have seen matters continue to get worse. In the few mainstream news pieces which actually refer to import prices, the blame has been laid solely at the feet of crude oil. So, in the spirit of fairness, I am including a chart of ‘headline' import prices as well as ‘core' import prices (ex petroleum).

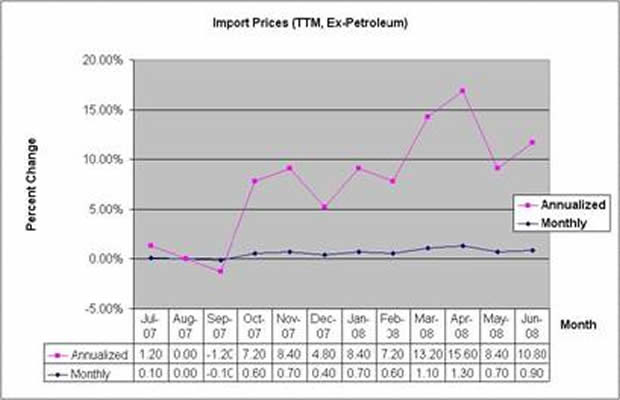

Granted, petroleum prices have been volatile even as they trend higher. Now look at the same series with petroleum imports taken out. See a trend here?

Even with petroleum products removed, we are moving higher, and quickly. With annual increases of 5-15%, it is easy to see how Main Street 's 3.6% average wage growth just doesn't keep up. Throw in petroleum and the picture gets a whole lot worse.

Trade Deficit

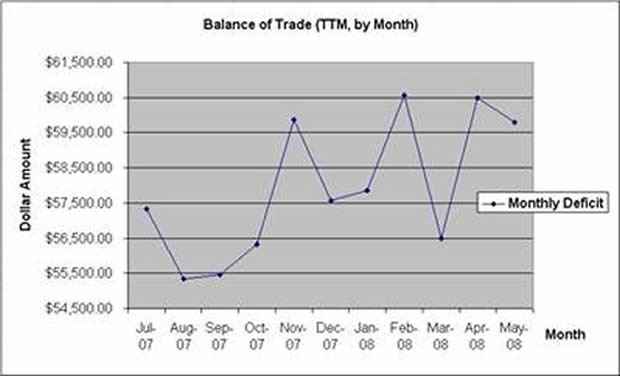

Despite the fall in the Dollar over the past 12 months, our trade deficit continues to get worse. Pundits have pointed out that April 2008 exports set an all-time record. However, they failed to note that imports also set an all-time record. It also must be noted that imports and exports are calculated in Dollars spent; not the quantity of goods. With import prices rising rapidly, what this is saying to us is that we're getting fewer goods for the same money. This is directly attributable to the falling Dollar:

In July 2007, the US Dollar Index was at 81. Today, the index is at 72.50, a loss of 10.5%. During the same period, the accumulated trade deficit has been a staggering $637 BILLION dollars. So as our Dollar has lost its purchasing power, our debts to foreigners have increased by nearly two thirds of a trillion dollars. This is exactly what I expected would happen as outlined in the 9/28/2007 missive Economic Myth Busters Vol. 2 Clearly we are no better for the fall in the US Dollar; we are far worse.

Analysis of these two measures tells us a few things. First and foremost it tells us that the US consumer is under extreme pressure from prices and will remain so for the foreseeable future. This isn't going away; it is getting worse. This reality will translate into reduced sales of discretionary goods, particularly since credit is being withdrawn from a good portion of these consumers. As the snowball gains momentum, reduced sales will translate into reduced earnings for discretionary companies and subsequent lower stock prices. To frame this for Main Street , they will see prices of goods and services continue to rise as the money supply is inflated to bail out Wall Street. However, by the mechanism described above, many of their paper investments will continue to lose value. This at the same time their homes continue to depreciate in value, causing what have become necessary credit lines to be either reduced or cut off completely.

The persistent trade deficit tells us that there is a continued outflow of funds from the US as we are required to borrow more and more money from overseas to pay for imports. When the Dollar's decline first got the attention of the mainstream press last year, we were assured that a falling Dollar was good for exports, which to a certain extent it has been. However, they forgot to consider the other side of the equation. A falling Dollar means we have to pay more for our imports and since we have done almost nothing to change our reliance on such imports, the concomitant rise in import costs has wiped out any benefit of increased exports.

So in the end, Main Street gets a weaker Dollar, unchanged trade deficits, skyrocketing import prices, falling asset markets and consumer price increases that not only show no signs of abating, but continue to get worse. Talk about getting the short end of the stick. So what can we do about it? Again, I refer to a prior article, penned on 9/14/2007 entitled Beat the Bust . The simple strategies outlined in that article are still in play. Comparing then and now validates those strategies. Comparing then and the future makes them absolutely invaluable

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.