Overseas Stock Markets are Down. SPX Targeted by HFTs

Stock-Markets / Stock Markets 2016 Feb 29, 2016 - 12:17 PM GMT The SPX Premarket is marginally lower this morning. However, it has not crossed beneath the 50-day Moving Average at 142.90, so anything may happen at the open.

The SPX Premarket is marginally lower this morning. However, it has not crossed beneath the 50-day Moving Average at 142.90, so anything may happen at the open.

The largest influence on the markets appears to be China. ZeroHedge reports, “After the G-20 ended in a wave of global disappointment, leading to the biggest Yuan devaluation in 8 weeks, and sending Chinese stocks into a tailspin on concerns the PBOC has forsaken its stock market as well as speculation the housing bubble is now sucking up excess liquidity which in turn pushed global market deep in the red to start the week, it was the PBOC's turn to scramble in a panicked reaction to sliding risk exactly one month after Japan unveiled its own desperation NIRP, and as reported before unexpectedly cut its Reserve Requirement Ratio by 0.5% to 17.0%, the first such cut in 2016 and the 5th since the start of 2015.”

The Shanghai Index is down 2.86% in overnight trading.

ZeroHedge comments, “It appears the market got a hint from our tweet at 8:33 am...

... promptly going vertical literally seconds later on a spike in - you guessed it - USDJPY:”

It now appears that SPX may open green.

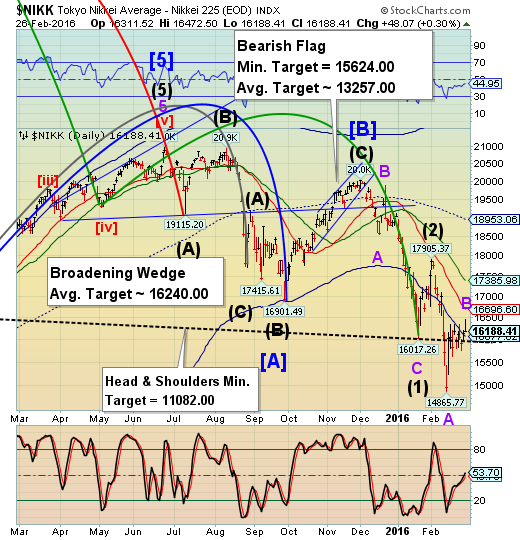

The Nikkei closed down 1% in its first session of the week. It stands right at the Head & Shoulders neckline. A further decline spells trouble for the Nikkei.

After gyrating around in its session, EuroStoxx Index appears to be flat as the US markets open. The action in today’s market has the earmarks of a reversal in motion, provided it does not exceed Friday’s high of 2893.12.

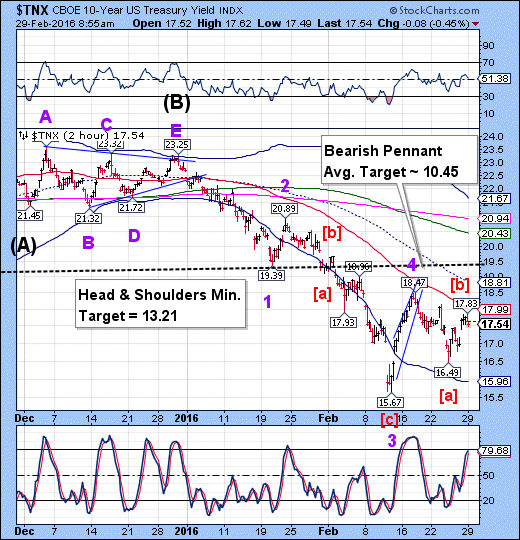

TNX appears to have completed its Wave [b] retracement at 17.83, but doesn’t seem inclined to resume its downdraft yet. This may be the strongest decline yet, targeting between 13.21 and 10.45.

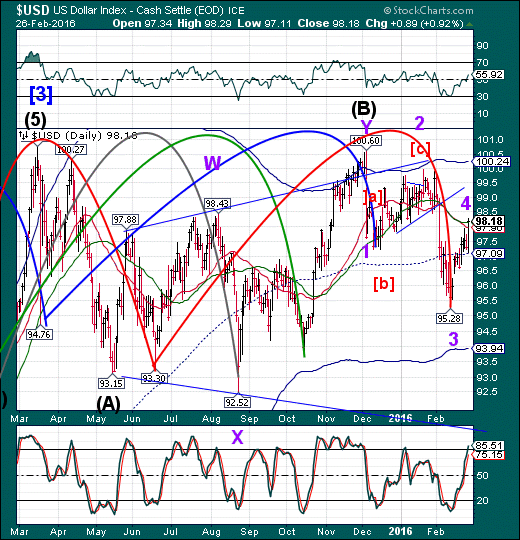

USSD appears to have made a final probe to 98.37, a marginally higher high this morning. The Cycles Model suggests that today may be an important Pivot day. If not today, the USD may hover at or above its 50-day Moving Average at 98.14 for the balance of the week, since Friday is the next significant Pivot day. We’ll keep an eye on the machinations of the USD, since that will be one of the indicators for a sell-off in stocks.

ZeroHedge comments, “Two years ago, when looking at the first available public data out of HFT frontrunning powerhouse Virtu, we observed the surge in net income from FX at the expense of all other traditional product categories, and reported what we thought was "The One Financial Product Now Targeted By The HFT Swarm" - currencies and FX in particular.”

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.