Behold the New Gold Bandwagon. . .

Commodities / Gold and Silver Stocks 2016 Mar 04, 2016 - 10:26 AM GMTBy: The_Gold_Report

Precious metals expert Michael Ballanger says we are actually back in a bona fide, brand-spanking-new, bull market in gold and the gold miners.

Precious metals expert Michael Ballanger says we are actually back in a bona fide, brand-spanking-new, bull market in gold and the gold miners.

As I was busy last evening returning a myriad of emails regarding the near-term outlook for gold and silver, I was suddenly hit with the realization that we really are actually BACK in a bona fide, brand-spanking-new, bull market in gold and the gold miners.

After doing this for nearly four decades—riding these massive cyclical swings in the resource sector and nearly/totally losing my mind—I have developed an indicator that can best be described as an "ad hoc" indicator that is totally based upon my interpretation of human emotion and one that cannot be quantified. The reason is so difficult to quantify is that it is so totally subjective and completely devoid of any form of objective analysis and, sadly, 100% reliant upon my ability to correctly assess the levels of "fear" and "greed" that dominate the precious metals arena.

Back in the summer of 1987, I was at a local meeting of the "Small Business Luncheon Group" in a mid-sized Ontario city and in the pre-lunch cocktail session, I would stand by the bar and offer to answer questions from the attendees about stocks and bonds and gold. Over the past years, I had noticed that my popularity at these events carried an inverse relationship to the real estate market and was directly correlated to stock market tops and bottoms. I affectionately called this my "Cocktail Party Theory" and I have made notes every year since 1985 although I rarely attend these functions anymore, largely because everyone is 20 years younger than I am and doesn't know the difference between a porphyry and a porpoise. (A porphyry is a type of mineral deposit.)

At this particular meeting around June of 1987, you could SMELL the GREED in the room and cut the financial hysteria with a knife. Every discussion by various pods of people was stock-centric and the decibel level was like the floor of the old Chicago Mercantile Exchange pork belly pit. As for me, I was up there at the bar (no surprise here, move along) holding court with what must have been 25 people in a crowd at least five-deep all shouting questions like "Whadd'ya think of Magna?" or "We gonna see 3,000 Dow by Labor Day?" or "What about calls on Royal Trustco?" (RT went BK about five years later) and when it was all over and I realized that my beer had actually gone warm at half-empty, I was struck with an epiphany: The stock market was going to crash.

Well, you all know what happened on October 19, 1987, so I won't bore you with how much money I actually LOST (I was long gold miners instead of gold—TSE Gold Stock index got cut in half while bullion prices went up 20% in 10 days) but the point of the exercise is that this uncanny ability to sense "crowded" trades and "exaggerated sentiment" has kept me out of the glue more than a few times in my career and while not exactly perfect, it is a pretty reliable tool, despite the fact that I can't explain it.

Where we are today, I believe, in the context of the "New Golden Bull," is very, very difficult to assess and especially for a long-standing gold "bull," like me, to assess. On the one hand, the majority of the people I liaise with are , like me, inherently hopeful/convinced/rabidly sure that we are now in a new bull market that is going to a) make them rich, b) make them smart, c) make them incredibly attractive, and d) make them invisible. (Yes, "invisible," kind of like "The Four Stages of Tequila").

The problem I have today with being fully exposed and "all-in" gold and gold stocks is, in addition the reason I alluded to in my short-term outlook from the weekend, is that there are thousands of hedge fund managers out there that not only had horrible years in 2015, they have started the 2016 year off even worse; nothing worked for them. It didn't matter what they touched, every asset class was down last year. This year, up until Jan. 19, it looked like stocks were going to tank and take the gold miners with them, but here we are in March and the only thing "working" is gold and its equity-based brethren.

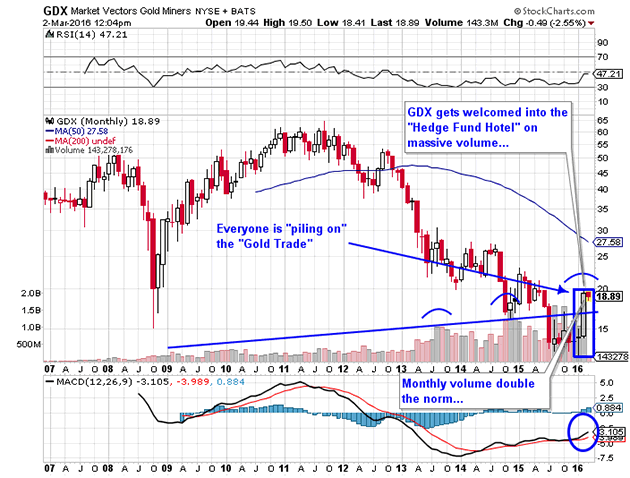

So, in order to avoid the hedge fund version of venereal disease, REDEMPTIONS, they have all begun to pile into their new best friend, the "GOLD TRADE" and now every fund manager and TV commentator are hiding in the safety and comfort of this trade because their competition is there and as we all know, these guys hate being first (or last). They just want to hide in the safety of the crowd where that extra 0.6% that being long the "GOLD TRADE" gives them is 0.6% that their competition won't beat them by in performance. They are "hugging the benchmark" and don't particularly care whether gold goes up or down, as long as every other fund owns it too. Conclusion: They are now chasing gold out of fear and that is not good.

To wrap this up, I sense that there is an ever-increasing number of hedgies out there that are become ever-so-fearful that they have missed or are missing that oh-so-important alpha-generating "Trade of the Year" that allows them to avoid putting up their redemption "gates" because they are still long Amazon and Valeant and Netflix while being agonizingly mired in YESTERDAY'S TRADE. With that sense of desperation has come the amazing spike in volume in the Market Vectors Gold Miners ETF (GDX) in January and particularly February, which has driven the RSI and MACD to multiyear overbought extremes. Now, in the past five weeks I have seen all of the CNBC Fast Money gang turn suddenly gold-bullish; Cramer is now claiming the trade as "his own" and Dennis Gartman is now "long of gold in U.S. terms"; the only thing missing is Simon Hobbs sporting a "Gold $5,000" baseball cap.

I have chosen to refrain from adding to longs and in fact I have taken out a few hedges by way of the SPDR Gold Trust (GLD) and Direxion Daily Gold Miners Index (NUGT) puts which are still only partial positions; I am now heeding the astrological signs and look to March 11 as a potential "turn day" for the metals and the gold and silver miners. We'll see what the Commercials have done this Friday, but the with open interest rising every single day, you have to assume that it can't be friendly.

So tip a glass of bull market cheer as we welcome the late-comers to our world of wonderment in sound money and hard assets; the MSM will now be transformed from agnostics and antagonists to bandwagon jumpers as they take ownership of the magical world of gold. As they move to the podium to take their bows spotlights beaming, you and I will be waiting in the wings with two suitcases full of cash, an airline ticket, a fake nose and moustache and a silver limo waiting outside the convention hall doors. . .

You know, just like it should be…

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment.

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All images/charts courtesy of Michael Ballanger

Streetwise - The Gold Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 981-8998

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.