Blockbuster Uranium Call and Best Metal and Oil Plays

Commodities / Resources Investing Mar 11, 2016 - 12:11 PM GMTBy: The_Gold_Report

The event-driven hedge fund Rosseau LP has beat its benchmark by over 50% since inception in 1998, and its founder and CIO Warren Irwin says it does so by going deep, looking at very specific events or situations that are special within industry sectors. Irwin made his name by shorting Bre-X some 20 years ago and hasn't looked back. In this interview with The Gold Report, Irwin gives us a peek into Rosseau's portfolio, discussing opportunities that he is excited about in metals, uranium and oil.

The event-driven hedge fund Rosseau LP has beat its benchmark by over 50% since inception in 1998, and its founder and CIO Warren Irwin says it does so by going deep, looking at very specific events or situations that are special within industry sectors. Irwin made his name by shorting Bre-X some 20 years ago and hasn't looked back. In this interview with The Gold Report, Irwin gives us a peek into Rosseau's portfolio, discussing opportunities that he is excited about in metals, uranium and oil.

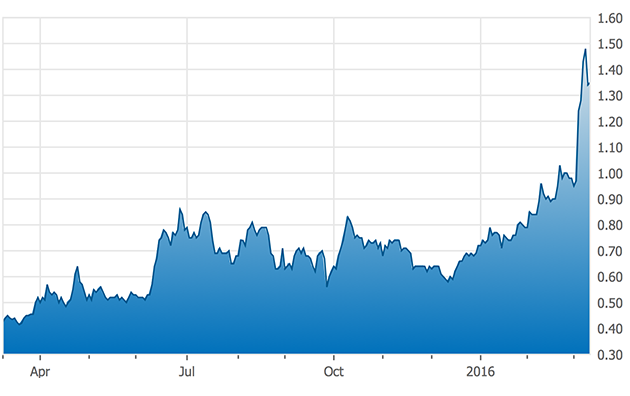

NexGen Energy One-Year Chart

The Gold Report: Warren, I just got your latest partnership numbers. It looks like you're off to a great start for the new year, up 20.38% through February. I think we first met around 2006 when you were up 121%. That was quite the year.

Warren Irwin: Yes. We have a shot at a 100% year this year, too.

TGR: Would you describe for our readers your investment approach and what makes you different from a lot of other people?

WI: What makes us different is Rosseau Asset Management does heavy, in-depth research for very specific events or situations that are special within industry sectors. Because we spend so much time on the names, we run a reasonably concentrated book. For example, we are able to go into the gold sector and pick the top two or three situations where companies are either drilling out properties and creating resources or making big discoveries, something unique to the company itself rather than making a raw bet on the price of gold.

TGR: When you say a relatively small book, during a given year, how many positions might you have?

WI: We try to keep the number at or below 20 names. One thing that helps us a lot, too, is our hold periods are quite long, usually three to five years and sometimes longer.

TGR: Let's get to some of those names. What are some companies that you are excited about?

WI: I'll start with NexGen Energy Ltd. (NXE:TSX.V; NXGEF:OTCQX), which just put out its maiden resource estimate. NexGen is a perfect example of an event-driven situation in that, although the fundamentals for uranium look very good over the next few years on a supply-demand basis, the commodity hasn't started to run yet. What is fascinating is NexGen has managed to find a massive new uranium discovery in the Athabasca Basin. It's very exciting and could be worth, at the end of the day, multiple billions of dollars.

TGR: The day of the news release, NexGen had a pretty big pop on volume, going up $0.27/share.

WI: Yes. It's a unique discovery. My original estimate from our proprietary resource model was 200 million pounds (200 Mlb) U3O8. The NI 43-101 did indeed come in around those levels at 202 Mlb. The market was actually expecting a lot less than that. We have long since touted 200 Mlb, and we were right on the money with that. We plotted every single drill hole and went very in-depth with our model to determine the size of the discovery. Having our own model is extremely time-consuming but allows us to really understand what the company is doing.

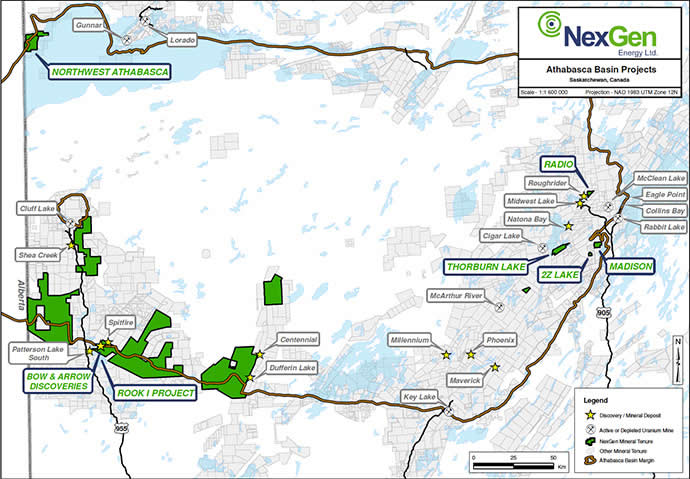

NexGen Energy's Athabasca Projects

The current winter drill program is underway. We believe NexGen has the potential to add between 100 and 200 Mlb to that resource. So there is a potential for a doubling of the resource over the winter drill program. Long term this has the potential of being the largest uranium mine in the world.

TGR: How long have you been in this stock? When did you start building a position?

WI: I first visited the property in 2014, and I've been watching it ever since. We started building a position mid-year last year. Right now the stock is extremely undervalued. It's probably trading at about a third of the value it should, even with the run-up with the news release. Putting out more results is not going to improve the situation. What it basically needs now is to have more people be aware of what an extraordinary discovery this is, and realize that it's very undervalued.

Canada is viewed by many utilities as the premier supplier of uranium to the world, and all of Canada's three uranium mines are in the Athabasca Basin, as is NexGen's discovery. But what's unique about NexGen is it's not in the sandstone or at the unconformity, which is the border between the sandstone and the basement rocks. When you're dealing with sandstone, it's water saturated, so there are a lot of water ingress issues. But for NexGen's deposit, it will be just regular underground mining in the basement rocks. It's very easy to mine and very attractive. And the scale of the deposit is clearly attracting the interest of all the global miners.

TGR: What about another opportunity?

WI: There is Canadian Overseas Petroleum Ltd. (XOP:TSX.V). I've been in the business 30 years, and I have never seen a higher-octane, more awesome risk/reward situation than this one, which involves the former CEO of Oilexco Inc., Arthur Millholland. Oilexco grew to a multibillion-dollar company but collapsed in 2008 as a result of a liquidity crunch when its bank ran into financial difficulties. When Millholland started up a new company, Canadian Overseas Petroleum, I was one of the first people to back him.

The company managed to obtain Block 13 in offshore Liberia, a very lucrative oil block. Millholland put his technical team on this project, and they found that the targets on the block are quite extraordinary. It is exciting enough that Exxon Mobil Corp. (XOM:NYSE) paid $130 million ($130M) to get involved in the project and, in addition, agreed to spend $120M to drill the first few wells. It's a very strong stamp of approval, Exxon moving forward with this project and deciding to partner with a very small junior. Generally, juniors don't operate in the offshore realm, so Canadian Overseas Petroleum is rare in that respect. Exxon was prepared to drill the initial wells about two-and-a-half years ago when the outbreak of Ebola in Liberia took place, and Exxon shut down its offices in Monrovia. We've basically been delayed two-and-a-half to three years. Exxon mentioned in a press release late last year it looked as if it was prepared to drill the well in late 2016/early 2017.

Canadian Overseas Petroleum Block 13 Offshore Liberia and Nearby Holdings

The market cap for Canadian Overseas Petroleum is sub-CA$20M, yet it would participate in a well of which it would own 17%, and Exxon is prepared to spend $120M drilling it. What's exciting is the reserve engineers are indicating that if there is oil found in the target areas, the expected recoverable number of barrels net to Canadian Overseas Petroleum is half a billion barrels, worth in today's market about US$2.5 billion. So a company trading at less than CA$20M, if successful, could be trading at multiple billions of dollars in market cap, or several dollars per share. The important thing to note here is that even in this terrible time with respect to oil exploration, Exxon is still keen to move forward.

TGR: This is offshore drilling. How long does it take to do that drilling and to get the results?

WI: It would take several months to drill the first hole. If a discovery is made, there will also be certain production tests that Exxon will need to do. Then once that is completed, there's also a follow-up No. 2 target. So the news will not stop. There are lots of exciting and interesting things happening.

TGR: What sort of a depth are we talking about?

WI: Deepwater offshore in about 6,300 feet of water.

TGR: Did you have metal companies that you wanted to talk about?

WI: We're involved with GPM Metals Inc. (GPM:TSX.V). It's a very interesting story. The company started five years ago to acquire the rights to the Walker Gossan in northern Australia. That was a project Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) has held since the early 1970s. Rio Tinto held on to this property because it believes it's a world-class prospect, but it hasn't had any luck moving the project forward with the traditional landowners in Australia. GPM Metals was able to strike a deal with Rio Tinto over two years of negotiations, and then in another two years of negotiations with the traditional landowners, it was able to strike up an access agreement. With certain payments, GPM Metals could earn into 75% of the project.

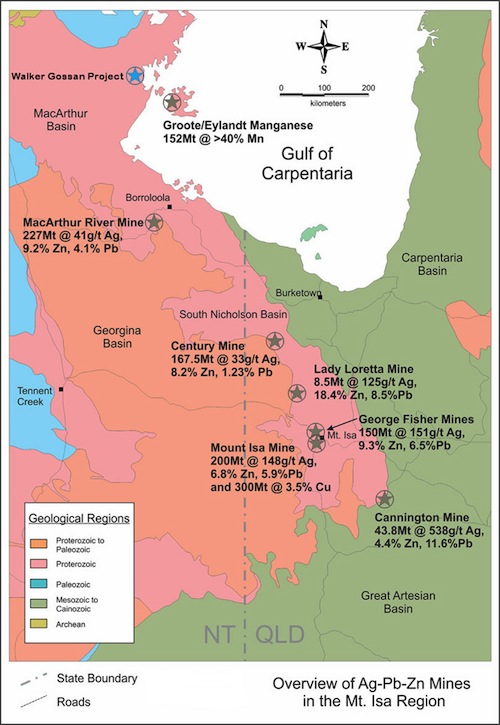

The majority of the large gossans in this region have turned out being large zinc mines. Along trend with the Walker Gossan are zinc mines like McArthur River, Mt. Isa and Century; it's the only undrilled major gossan in that trend. It's a very good risk/reward situation. GPM Metals' CEO is Pat Sheridan Jr., a proven mine finder. He was involved with both the discovery and building of the Aurora mine for Guyana Goldfields Inc. (GUY:TSX) in Guyana.

Walker Gossan Project Area

What I like about this situation is, again, we're dealing with one of the world's largest mining companies as a partner. Rio Tinto would only have held this project if it believed it was prospective to be a world-class discovery. There's the possibility of a very exciting world-class discovery of zinc.

Right now zinc's fundamentals look very good. I'm told by my mining contacts that the supply of zinc concentrate is getting very tight. I would not be surprised to see a very strong rally in zinc before too long.

TGR: Have there been zinc mine closures?

WI: The massive Century mine has closed recently. Also, Glencore International Plc (GLEN:LSE) has announced capacity shutdowns. The fundamentals on the supply/demand side for zinc look very good.

TGR: What sort of timeline are we looking at for GPM?

WI: GPM has done soil sampling that indicates there's an abundance of lead on the property. The gossans are a weathered outcrop of mineralization. The original outcrop would probably have contained lead and zinc, but the zinc has been weathered away over time. Finding lead at surface on the gossan is a very good indication that there is possibly zinc associated with the metal system. The initial geochem work has been done, and now, over the next 12 months, there will be follow-up drilling taking place where GPM will be testing to see if there is an economic zinc deposit there. If there is a discovery, it will take a few years to drill off the deposit and then years more to put the mine into production.

TGR: Could there be a revaluation of the stock based on it figuring out if it is economic and the zinc price going up?

WI: Yes. If so, there will be a massive bump in the price of this project. If we end up with a world-class discovery in a very strong zinc market, this project will be worth a lot of money.

I also want to mention that these three companies are more rock 'n' roll than blue chips, but for people who have a tolerance for high risk, they're very good risk-reward trades.

TGR: You mentioned Guyana Goldfields. Any comment on this company?

WI: I've followed Guyana Goldfields for about 20 years and have always been impressed with CEO Pat Sheridan Jr. I watched him from the original discovery right through to putting the mine in operation. I've been very impressed with Pat, and that's part of the reason I'm backing him again with GPM Metals.

Aurora Mill, Guyana. Photo courtesy of Guyana Goldfields.

TGR: Any last closing words to our readers on what we should look forward to for the balance of this year, and why you think it could be a 100% gain for your portfolio this year?

WI: I believe the bottom is in for the majority of the metals and there is tremendous value in the mining sector. Before too long, we'll probably start seeing a recovery in oil. Being in the resource sector is a really exciting and interesting place to be. It's been beaten up over the last number of years and I think the sector represents tremendous value.

TGR: Warren, I appreciate you taking the time.

Warren Irwin is president and chief investment officer of Rosseau Asset Management Ltd. He founded the firm in 1998 after several successful years as vice president and director of special investments at Deutsche Bank Canada. The firm's flagship event driven hedge fund, Rosseau LP, was established on December 31, 1998, and has since earned a reputation for solid long-term performance earning over 50% the return of its benchmark index. Irwin started his career as a bond analyst for Scotia Capital Markets where he developed the Universe Bond Index, the Canadian bond market benchmark, and shortly thereafter developed and managed Canada's first bond index fund. He is a Chartered Financial Analyst and holds a Bachelor of Mathematics from University of Waterloo and a Master of Business Administration from the University of Western Ontario.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Gordon Holmes conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report and is the founder of Streetwise Reports. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: NexGen Energy Ltd. and Guyana Goldfields Inc. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Warren Irwin: I own, or my family owns, shares of the following companies mentioned in this interview: Shares of Rosseau funds. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. Funds controlled by Rosseau Asset Management hold shares of the following companies mentioned in this interview: All companies mentioned. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Streetwise - The Gold Report is Copyright Š 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 981-8998

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.