Crumbling U.S Empire Drives Russia and China to Move into Gold

Commodities / Gold and Silver 2016 Mar 11, 2016 - 02:14 PM GMTBy: Sol_Palha

Central bankers have been on a massive Gold Buying Spree led by Russia and China. One must remember that not only is Putin ex-KGB, but he is also an economist and holds a black belt in judo. Judo teaches you to use your opponent's momentum to defeat him or her, and that appears to what Putin is doing. He has this administration running circles, by the time they figure out what he is up to, it is too late to do anything. Putin and China can see that the writing is on the wall that the days of U.S holding the top spot are numbered. Our economy is in shambles and only appears to look strong because of the hot money that is holding it up. Regarding illusions, it is a perfect illusion and for now, the masses have bought it, but Russia and China have not.

Putin is also aware that the average life span of a super power is 250 years, and the U.S has been in this position for 240 years, so it is running out of time. Hence, he is using the strong dollar to buy up cheap, valuable Gold. Russians are advanced chess players they plan several moves ahead; that is why the West has had such a hard time figuring out what Putin's next move will be. When the western media states that Russia's reserves are falling, they forget to mention that the reserves are in dollars and what Russia and China are doing are getting rid of their worthless dollars and replacing them with Gold.

IMF data (International Monetary Fund) shows that the Russia and China have been among the biggest net buyers of Gold for eight years in a row. Last year countries purchases close to 590 tons of Gold accounting for 14% of annual global gold bullion demand. Smart nations like Russia and China are using these low prices to load up on Gold and divest from the dollar. They understand that this economic illusion can last for only so long before reality strikes.

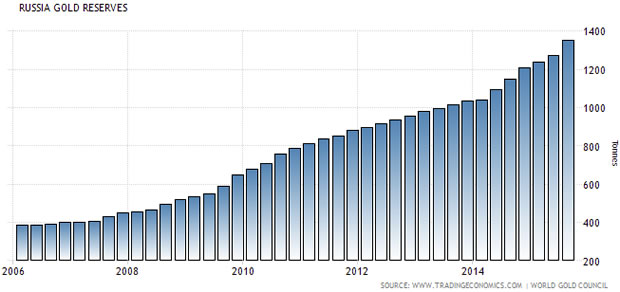

The chart below illustrates how Russia's reserves of Gold have soared over the years. Putin is planning for a day when the U.S is not the dominant power anymore. When the dollar is finally dethroned, the end will not be pretty.

Source: http://www.tradingeconomics.com

The number of bilateral deals bypassing the dollar continues to soar. The opening of the AIB (Asian infrastructure bank) and with the Yuan being accepted into the world reserve currency club, the path for the dollar is definitely downhill.

Game Plan

Both China and Russia make for great long-term investments. In Russia YNDX and VIP are examples of two good companies investors can open positions in; in China, we have BABA, CHL, HNP, etc. Most importantly, it would be prudent to hold a position in Gold bullion. You can use declines to open new positions. We would not aggressively jump into Gold bullion unless you have a lot of extra cash lying around that is not being used. Gold is still not fully out of the woods yet as the trend has not turned positive yet. It has a solid wall of resistance to overcome at $1350. The monthly close above $1200 is a move in the right direction.

A multi-polar world order is emerging. The U.S can either embrace this new trend or be crushed by it. Once a trend is in motion, there is nothing that can stop it; the best you can hope to do is to slow it down. Sadly that is the current path the U.S has opted for; perhaps the next administration will be wiser.

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.