US Dollar Strength is a Manifestation of US Dollar Shortage

Currencies / US Dollar Mar 12, 2016 - 07:41 PM GMTBy: Gordon_T_Long

FRA Co-Founder Gordon T.Long and Jeffrey Snider, Head of Global Investment Research at Alhambra Investment Partners discuss a broad array of Global Macro subjects in this 48 minute video discussion with supporting slides.

FRA Co-Founder Gordon T.Long and Jeffrey Snider, Head of Global Investment Research at Alhambra Investment Partners discuss a broad array of Global Macro subjects in this 48 minute video discussion with supporting slides.

As Head of Global Investment Research for Alhambra Investment Partners, Jeff spearheads the investment research efforts while providing close contact to Alhambra’s client base. Jeff joined Atlantic Capital Management, Inc., in Buffalo, NY, as an intern while completing studies at Canisius College. After graduating in 1996 with a Bachelor’s degree in Finance, Jeff took over the operations of that firm while adding to the portfolio management and stock research process.

In 2000, Jeff moved to West Palm Beach to join Tom Nolan with Atlantic Capital Management of Florida, Inc. During the early part of the 2000′s he began to develop the research capability that ACM is known for. As part of the portfolio management team, Jeff was an integral part in growing ACM and building the comprehensive research/management services, and then turning that investment research into outstanding investment performance. As part of that research effort, Jeff authored and published numerous in-depth investment reports that ran contrary to established opinion. In the nearly year and a half run-up to the panic in 2008, Jeff analyzed and reported on the deteriorating state of the economy and markets. In early 2009, while conventional wisdom focused on near-perpetual gloom, his next series of reports provided insight into the formative ending process of the economic contraction and a comprehensive review of factors that were leading to the market’s resurrection. In 2012, after the merger between ACM and Alhambra Investment Partners, Jeff came on board Alhambra as Head of Global Investment Research.

Jeff holds a FINRA Series 65 Investment Advisor License.

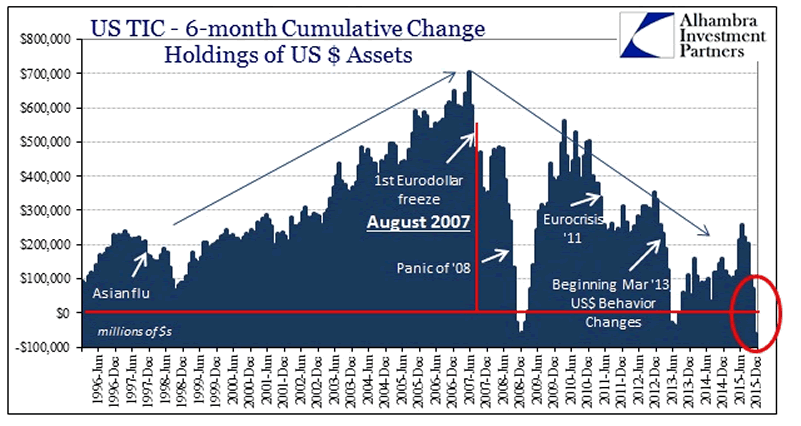

US TIC REPORT, TREASURY SALES

TIC is a compilation done by the US Treasury based on their access to data on foreign accounts and holdings of Dollar accounts and securities, and estimates the foreign Dollar market. Over the last decade or so, it is clear that the Eurodollar market grew steadily at a rapid rate until about August 2007, at which point it pivots and comes back down. The TIC data shows the tendency of dollar markets to essentially be stable, usually addressed through selling Treasury. However, the private dollar markets offshore are in disarray to the extent that central banks around the world are forced to fill the dollar deficiency with their own holdings. Of especial note is China’s reduction of their US Treasuries and foreign currency reserves, and OPEC countries incurring serious Current Account deficits in an attempt to maintain their pegs with the US dollar. In addition are the emerging markets who borrowed about $7-9T in USD, who now have difficulty paying back debts due to slowing trade and falling currencies.

This all leads to the US dollar strengthening, which is the manifestation of the dollar shortage. In recent days, Japan using NIRP will further disrupt the dollar system.

“US Dollar Strength is a manifestation of a US Dollar Shortage!”

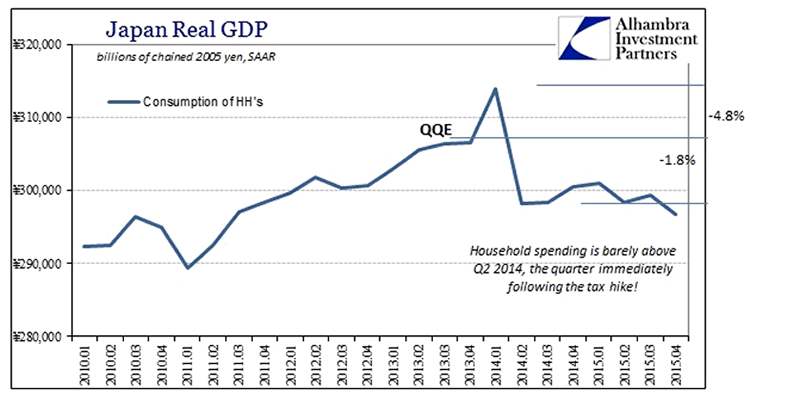

JAPAN: QE FAILURE AND WHAT NIRP MEANS

Under QE, Japan obtained a burst of inflation around 2014. Instead of leading to sustained economic activity, household income and spending dropped about 7%, which was also not offset by growth in GDP and demand. The surge in expansion, due to cheaper money, increases supply which then demolishes pricing power. In addition to the reduced value of savings, large companies have also shifted production offshore, thus increasing the effect and emphasizing the failure of QE/QQE to stimulate the economy.

NIRP also carries with it the threat of failing like QE, along with numerous other particle effects that cannot be currently measured or predicted, mostly as this type of system has not existed for over a hundred years. This is an indicator of the lack of power central banks have over the economy, but can be put down to overemphasizing the value of monetary policy over fiscal policy in the developed world. The dollar system has been artificially expanded past any control by banks and monetary policy, globally, over the last decade. The only way to stop it is to focus on other fiscal factors that would allow economic potential to be realized again and to refrain from following Keynesian economics once it has been proven to be ineffective.

“Japan is a test case in almost clinical conditions for QE and QQE, and it failed on every count.”

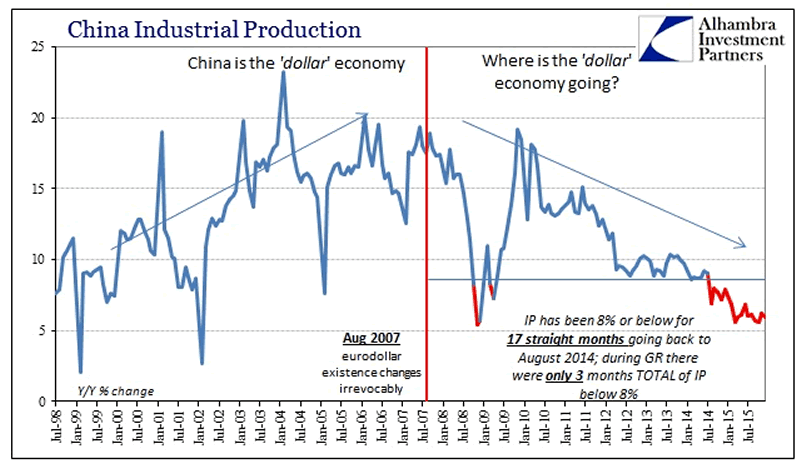

CHINA: COLLAPSING TRADE AND CREDIT

China is both an impediment to growth and a casualty of the rest of the world, but recently more of a reflection of the global dollar economy as they are most sensitive to changes there. The lack of growth over several years forces a fundamental shift toward a Keynesian response of fiscal and monetary stimulation that creates asset buffers at odds with overcapacity. Meanwhile, China still lacks any real method for economic growth and is forced to react to outside influences while juggling the problem of overcapacity with the falling export industry. This then leads to capital flight, which furthers the struggle to grow GDP.

China is clearly attempting to manage the Yuan by selling dollars to strengthen it, but will eventually falter like any pegged currency. Many currencies pegged to the US dollar, Eurodollar, and Petro dollar will likely collapse. Keynesian economists believed that 2007 was the beginning of a temporary deviation from sustainable global growth, but was in fact the structural revaluation of higher economics of the financial system. We are likely headed for a systemic reset and reorientation, which will be disruptive with significant risk but can be adapted to.

“I think we are headed for a systemic reset.”

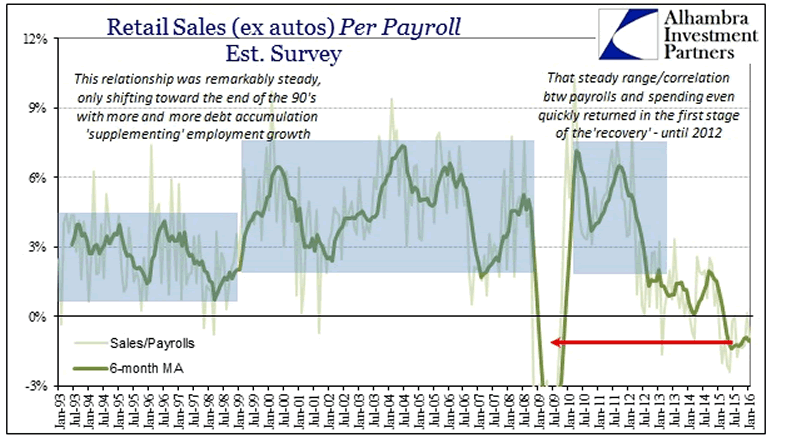

RETAIL: JANUARY SALES AND CONTINUING TREND

Retail sales have been near recession levels of low, indicating that consumers are under pressure, but inventories are still rising despite manufacturers cutting back. Retail slowing is a fixed trend starting from 2012, amplified in 2014-2015 with the disappearance of the manufacturing industry and loss of export goods. This is likely due to lack of real recovery that slowly eroded US consumers’ ability to continuously expand their activity. The middle class has no savings, so thus the capitalist system that relies on savings to reinvest into productivity.

Over the last several years, companies have been spending on buybacks instead of investing in productive capacity. 1900 of the S&P companies spent more on buybacks and dividends than they were earning, thus creating more debt.

“Recession is a necessary process, like anything else. It’s creative destruction.”

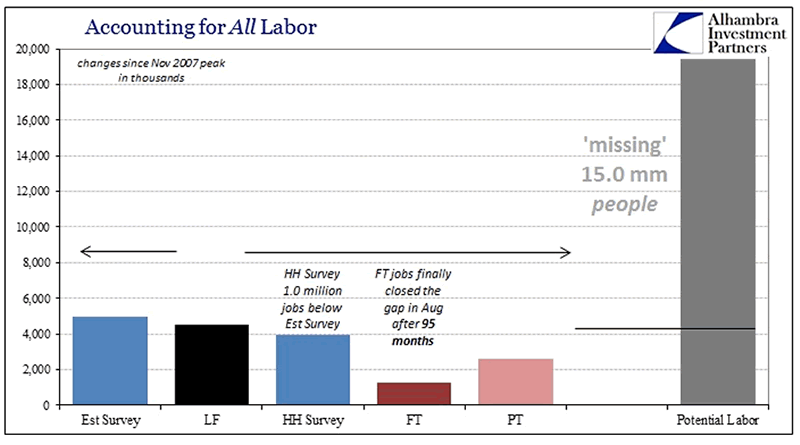

LABOR: FULL EMPLOYMENT – NOT REALLY!

There is a major disconnect between major unemployment statistics and the rest of the economy, where even having a job is not necessarily enough to support the expected standard of living. There are low prospects for growth in the job market, and people sense that there is a need for a restructuring of the system. Job growth is mostly in low income occupations, which results in potential workers entering college with a loan but failing to actually enter the labour force.

The current economic state is similar to the suppressed state of the 1930’s and 1940’s, and once the systemic reset is allowed to occur, the economic potential released will be tremendous. Recessions are necessary to allow risk to be properly priced, which in turn creates confidence in investment. The resulting reset should shift away from one centered around banks and the value of credit toward a capitalist system that prioritizes “money is money” over “money is credit”.

“Monetary policy is designed for companies to borrow more; it’s just that economists expected they’d borrow more for productive capacity rather than financial capacity.”

Abstract by: Annie Zhoua: zhou108@gmail.com

Video Editing by: Minjung Kim: minjung.kim@ryerson.ca

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.