Stock Buyback Blackout Begins

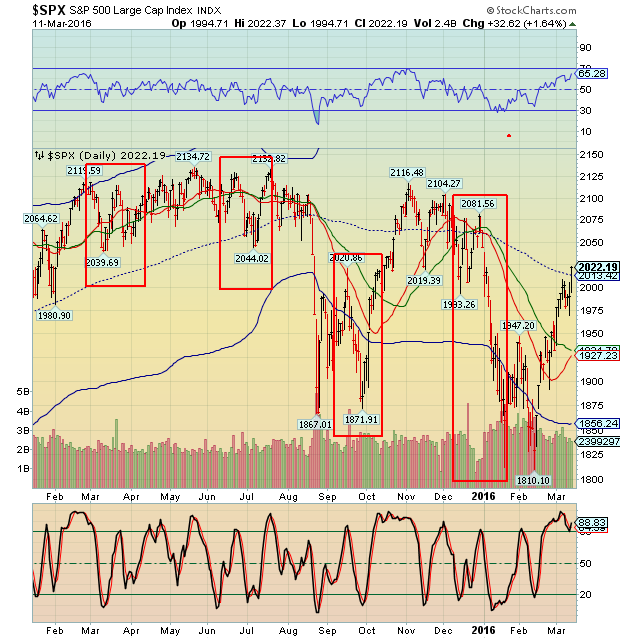

Stock-Markets / Stock Markets 2016 Mar 14, 2016 - 02:06 PM GMT We are now entering the blackout period for corporate stock buybacks, the largest purchaser of stocks for the past year. On the left is a chart showing the blackout periods for the past year.

We are now entering the blackout period for corporate stock buybacks, the largest purchaser of stocks for the past year. On the left is a chart showing the blackout periods for the past year.

Bloomberg reports, “Demand for U.S. shares among companies and individuals is diverging at a rate that may be without precedent, another sign of how crucial buybacks are in propping up the bull market as it enters its eighth year.

Standard & Poor’s 500 Index constituents are poised to repurchase as much as $165 billion of stock this quarter, approaching a record reached in 2007. The buying contrasts with rampant selling by clients of mutual and exchange-traded funds, who after pulling $40 billion since January are on pace for one of the biggest quarterly withdrawals ever.”

But the article misstates a crucial point. In the first paragraph beneath the buyback chart it says, “Kostin said companies tend to enact a blackout period and restrict share repurchases in the month following the end of a calendar quarter, and come back once they’ve reported results.” I am not sure whether this statement was made intentionally or simply a misquote.

Here is an article from a year ago which correctly explains when the blackout period begins. The blackout period actually begins five weeks before any earnings announcement is made. That means the rolling blackout period may actually begin today. ZeroHedge chimes in with its own commentary.

The fourth quarter earnings’ blackout period ended the week of January 18. The initial bounce from the January 20 low may have been sparked by corporate pension and profit sharing contributions usually due by January 15, but stock buybacks quickly took over. That is why the February 11 low (Wave 5) only went two points deeper than the January low and did not show up as a Master Cycle low, but rather a strong Pivot low.

This morning the SPX Premarket is down. We may not see a confirmation of the reversal until the SPX declines beneath 1980.00.

VIX appears to be in a pullback from an impulse that may have begun its reversal. If so, then VIX is taking the lead in announcing the turn in the market. Confirmation may appear as the VIX rises above 1893.00 again.

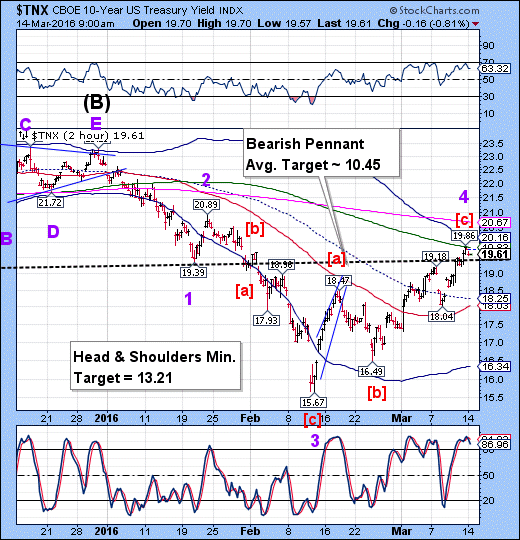

TNX also appears to be coming back down from its retracement high. Confirmation of the reversal comes beneath the neckline at 19.39.

WTIC came down to a low of 37.33 this morning. We may wish to keep an eye on its progression as a reversal pattern is not yet evident. It appears that crude may go down with equities during the balance of March.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.