Bitcoin Price Not Far from $400

Currencies / Bitcoin Mar 15, 2016 - 04:17 PM GMTBy: Mike_McAra

In short: short speculative positions, target at $153, stop-loss at $515.

In short: short speculative positions, target at $153, stop-loss at $515.

Microsoft has dropped Bitcoin from its Microsoft Store, we read on the Fortune website:

Back at the end of 2014, Microsoft started allowing many people to pay money into their accounts using bitcoins. However, it has now quietly removed the option.

The change applies to both Windows 10 and Windows 10 Mobile, meaning people won’t be able to top up their balances with bitcoins in order to buy games, music and so on.

It’s not clear why Microsoft has suddenly gone cool on Bitcoin, but it is worth noting that it never went all in — the feature never saw a wide geographical rollout, and Microsoft never accepted bitcoin for its own products and services.

While there still is no confirmation, it seems as though Bitcoin hasn’t really taken off in the Microsoft Store. A discontinuation of the service is probably a sign that Microsoft’s users are not willing to use digital currencies.

Does this mean that Bitcoin hit the end of the road? We don’t think so. The number of transactions is still on the rise and while Bitcoin adoption hasn’t really happened, we’re still seeing a lot of development in digital currencies. Most importantly, various startups are exploring ideas such as sidechains (possibility to add features to Bitcoin and test them within smaller networks), micropayments (pay $0.01 for no ads on a website), ownership confirmation (systems to enhance the work of exchanges) or even the issuance of fiat money.

All this means that Bitcoin is not yet part of the financial system, at least not in a significant way, but at the same time work is being done which might either make Bitcoin more relevant (sidechains) or help the Bitcoin-based technology transpire into the system and change the way transactions are done.

For now, let’s focus on the charts.

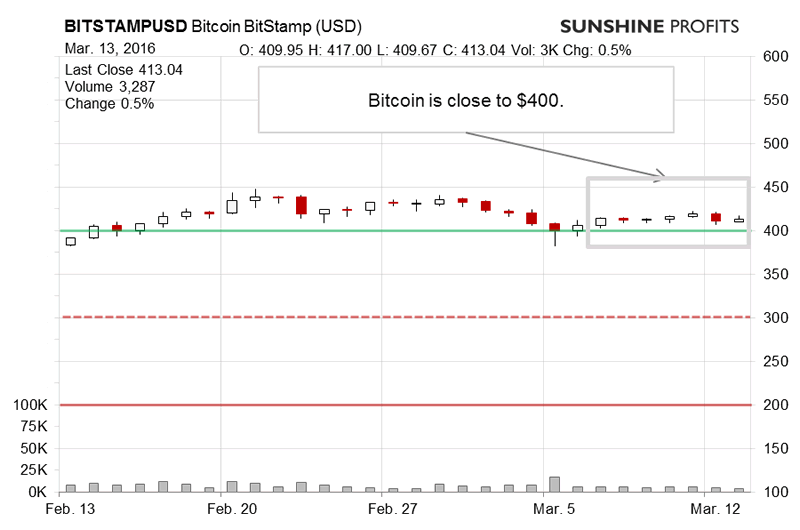

On BitStamp, we saw not much action over the weekend and in the preceding days. Bitcoin might seem boring now, but this is actually quite far from our take on the currency.

Bitcoin hasn’t moved much, the volume hasn’t been strong… So what’s interesting in the market? The lack of action itself might be an indication. This means that our previous comments are still up to date:

(…) Yes, we saw a failed breakdown below $400 but it doesn’t necessarily have any meaningful implications for the next significant move in the market. Bitcoin might go up some based on the bounce back above $400 but the implications are weak and of very short-term nature. The most important part still is the fact that we’re below a possible long-term declining resistance line.

(…)

Additionally, we now see that the late-February local top in Bitcoin is lower than the January and December tops, not to mention the November spike. A series of potentially lower highs might be a bearish indication.

The recent lack of action and the fact that Bitcoin remains below the possible long-term declining resistance line are indications that the previous trend remains unchanged – down.

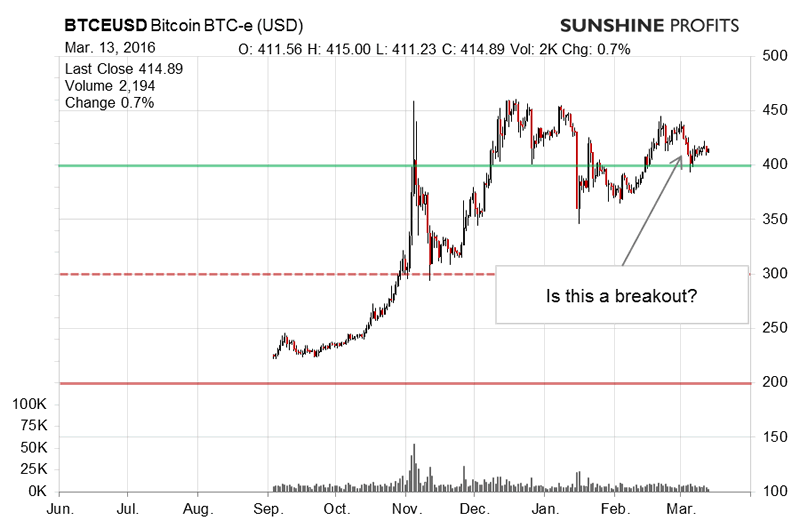

On the long-term BTC-e chart, we still see Bitcoin above $400. This might actually be less bullish than it could seem at first sight. In our previous alert, we wrote:

For the time being, it seems that we still have important resistance lines $450-470, so the situation doesn’t really seem bullish. (…) Combining this with the bearish indications still results in a bearish indication, particularly given the recent rally. It seems that Bitcoin might be ready for more declines (in our opinion).

Even if we were to see the recent months as a head-and-shoulders formation (which itself might be debatable), it would seem that we are now after the second shoulder. This would itself be a bearish indication for the next couple of weeks.

Right now it seems that Bitcoin has a lot of downside potential ($350 being the first possible pause for a potential decline) while at the same time not displaying much upside potential. If we see a slip below $400, the decline might accelerate.

(…) What is more, if you take a look at the RSI, it’s around 50, implying that there still might be room for Bitcoin to decline. As mentioned in our previous comments, there seems to be a lot of downside potential for Bitcoin with not much upside potential. Combine that with a series of lower highs, a lack of breakout above a possible long-term declining resistance line and the recent low volume of the moves up, and the situation still looks very much bearish.

This is still very much up to date. We haven’t seen a break above a possible declining long-term resistance line, the RSI still is far from oversold, we have resistance levels to the upside and not that far away, and the support levels are relatively weak. All this points to the possibility of a volatile move to the downside.

Actually, we have recently received a question about the possibility of a move to $150, and our target level. The level presented in the Bitcoin Trading Alert is not one we think Bitcoin is sure to reach, but one we think it is possible for the currency to reach given what we've seen in the past.

The level is based on the January 2015 and we think it is actually a valid target for the next couple of months. There are several reasons for that but the most important are:

- Bitcoin hasn't been able to rally farther following the November and December upswings. We're now possibly seeing a series of lower highs and the currency has resisted any serious attempts by buyers to push it above a declining long-term resistance line. Also, if the price of Bitcoin is driven by its users lack of faith in the monetary system, the lack of positive action following yesterday's ECB statement might be seen as a bearish confirmation.

- The magnitude of the next move might be significant as Bitcoin has refused to move for some time now and it has pretty weak resistance levels on the way down. If Bitcoin crosses $400, the next level to watch is $350. This is based on the mid-January move down which is a relatively recent observation and not a very strong resistance. Going lower, we might see resistance at $300 but the psychological level coincides with a November move down which was only a local low (lower prices were seen in late October). The first major resistance seems to be in the $150-200 (January and August 2015 lows) and we concentrate on the latter level because it is stronger and if Bitcoin moves to $200, inverstors might "overshoot" in their selling.

Also, it's relatively easy to be lulled by the favorable performance in 2015. Does this mean that Bitcoin can't go down 60%? We think it can. Not very long ago (December 2015 - January 2016) Bitcoin went from around $470 to $350, a 25% drop. From July to August 2015 the currency went from $318 to $200, a 35% drop. From November 2014 to January 2015 Bitcoin went from $450 to $150, a depreciation of 67%. We don't claim that the same kind of moves will be seen in the future, but our opinion is that Bitcoin is very volatile and we see more downside potential than upside potential right now.

If we do see a major move to the downside, we will reassess our target to take into account any changes in the market. For instance, if we see signs of strength, we might close the hypothetical position or even consider going long. So, our approach is not fixed and we constantly monitor the markets for signs of change. We haven't seen such signs so far but we're definitely open to them if they occur.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $515.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.