Gold and Silver March Madness

Commodities / Gold and Silver 2016 Mar 17, 2016 - 04:59 PM GMTBy: Jesse

"The main thing is that the debt is in dollars. So we can't run out of cash--we print the stuff. Suppose that foreigners decide we're not reliable. How does that drive up interest rates? The Fed controls short-term interest rates, and long-term interest rates reflect expected short rates. How's that supposed to happen?" Paul Krugman, Interview on CNNMoney

"The main thing is that the debt is in dollars. So we can't run out of cash--we print the stuff. Suppose that foreigners decide we're not reliable. How does that drive up interest rates? The Fed controls short-term interest rates, and long-term interest rates reflect expected short rates. How's that supposed to happen?" Paul Krugman, Interview on CNNMoney

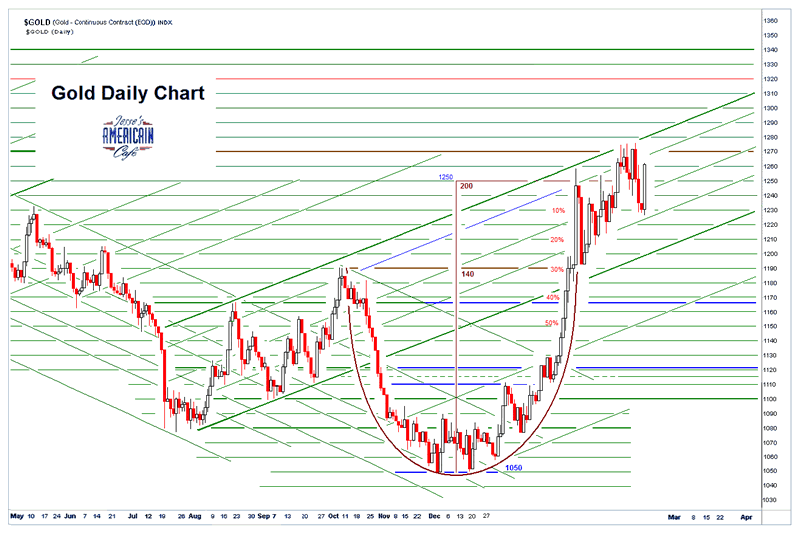

Well, at least now we know why gold was knocked down lower in the paper trading earlier this week.

It was to prepare us for The Big Retraction from the Fed, who begged a mulligan on their most recent rosy forecasts from three months ago about The Recovery™. And as suspected, it's those foreigners who are at fault. And that's why we can't have nice things.

There was intraday commentary about that here.

And so after 'fessing up and saying that things are not quite as good as they had thought, the dollar tanked and gold took off higher with some serious vigor.

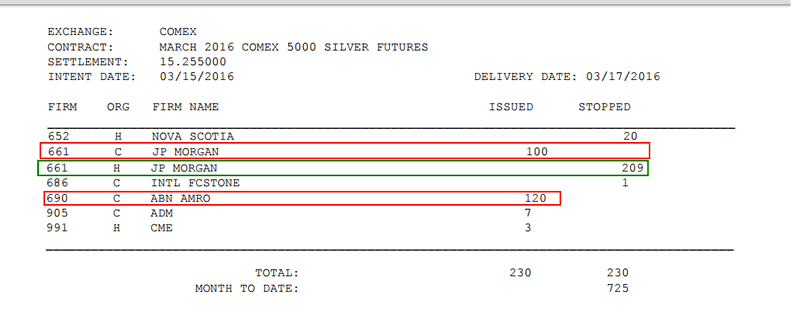

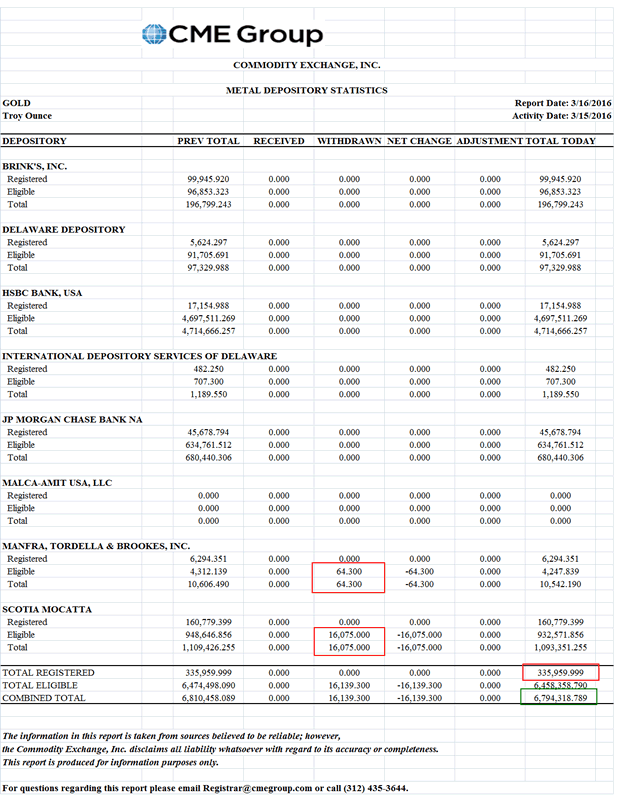

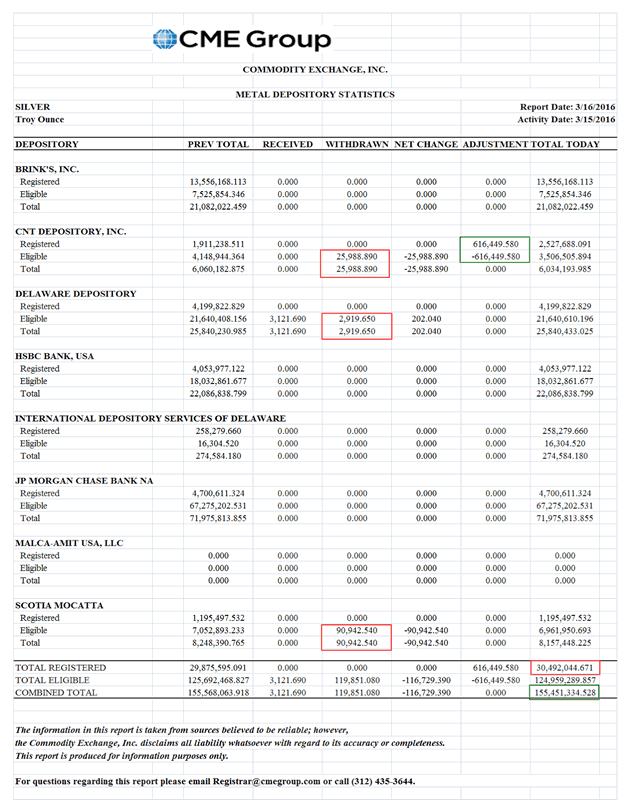

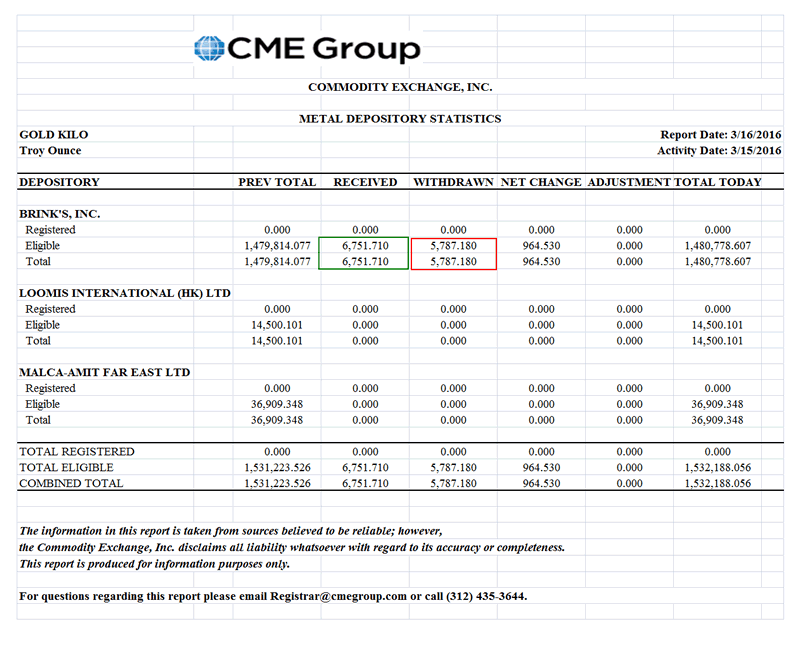

There was little delivery activity yesterday in gold at The Bucket Shop.

But some customers coughed up over a million ounces of silver, most of which were taken on the cheap by the house account at JPM. What prescient trading.

You may see that in the delivery report box scores below. Quod erat demonstrandum.

Let's see how the rest of the week goes.

Get right, and sit tight.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2016 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.