Silver – A Long-Term Perspective

Commodities / Gold and Silver 2016 Mar 21, 2016 - 04:06 PM GMTBy: DeviantInvestor

We all know silver is volatile. When gold rallies, silver usually rallies faster and farther, particularly after the rally has been well established.

We all know silver is volatile. When gold rallies, silver usually rallies faster and farther, particularly after the rally has been well established.

Volatility is not a reason to avoid silver. Instead, now is a time to continue stacking. Yes, silver almost certainly will correct many times, but examine the big picture.

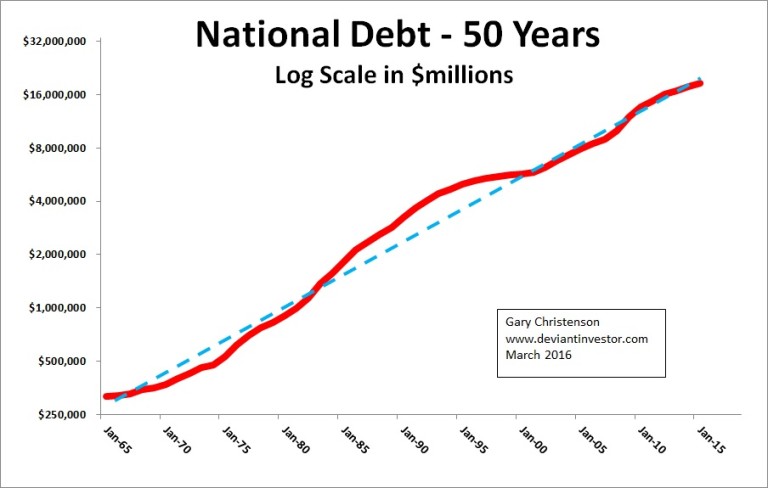

Over the past 50 years prices for stocks, silver, gold, crude oil, health care, and presidential elections have increased exponentially, mainly due to massive increases in debt (see graph below) and devaluations of currencies. Expect exponential price increases to continue.

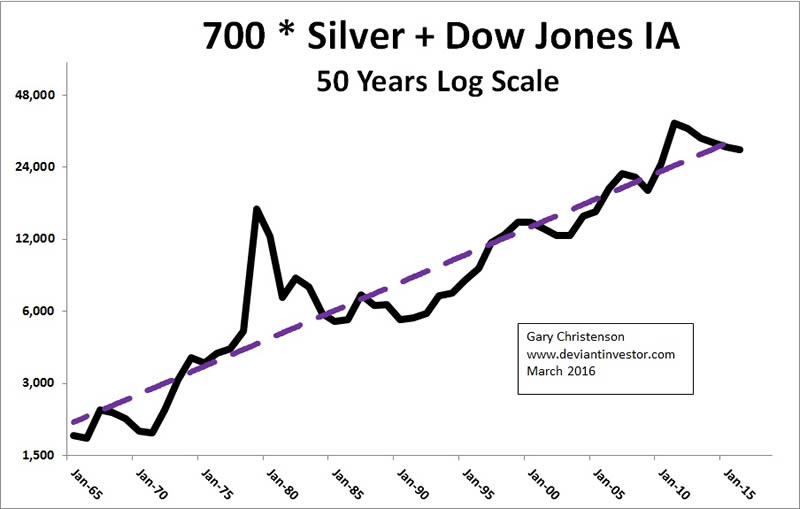

Over 50 years the Dow Jones Industrial Average has averaged about 700 times larger than the price of silver. Examine the log-scale graph (below) of 700 times the price of silver plus the DJIA.

- Prices have moved higher exponentially.

- You can see the silver bubble in 1980.

- You can see the small deviation from trend in 2011 caused by the silver rally to nearly $50. It was not a bubble.

- Another silver bubble will probably occur, but we have not seen a bubble in silver since 1980.

What about the DJIA? Examine the 28 year chart of the DJIA – log scale.

- The DJIA has moved exponentially higher for three decades.

- The red ovals indicate “danger zones” where the DJIA rallied too far and too fast, corrected below its exponential trend-line, and then fell by 40% or more.

- The DJIA peaked in May 2015 and has only fallen slightly since then. Expect a larger correction.

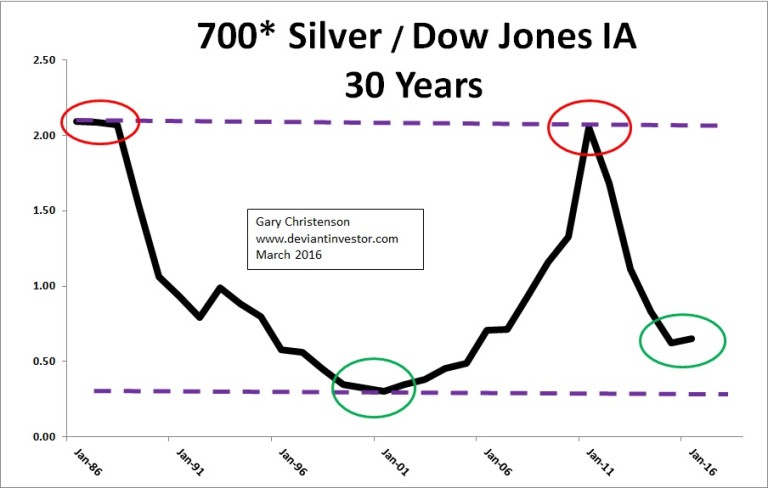

Examine the silver (times 700) to DJIA ratio over the past 30 years. This excludes the 1980 bubble in which the ratio peaked many times higher than the 2011 ratio.

- The 30 year ratio shows long term trends of investor preference for paper assets, such as the DJIA, versus hard assets such as silver.

- Silver prices and the ratio hit a multi-decade low in November 2001, as indicated by a green oval.

- The ratio is only slightly higher in 2016, as indicated by the other green oval.

- There is considerable room for the ratio to increase, which would probably involve a somewhat lower DJIA and a much higher price of silver.

CONCLUSIONS:

- The DJIA reached a high in May 2015. The next major move is likely much lower, similar to the 2001 and 2008 corrections.

- The price of silver, as indicated by the ratio to the DJIA, is near a multi-decade low. Expect the price of silver to rally substantially in 2016 – 2020. $50 silver is coming, probably fairly soon. $100 silver will take longer.

- Silver prices and the DJIA rise exponentially, thanks largely to dollar devaluations and massive increases in debt.

There are many financial and political reasons to expect a preference for hard assets over paper assets in the next several years. A few are:

- Negative interest rates indicate central bank desperation and financial craziness and should encourage sane investing in hard assets.

- Increased investor demand for silver. Read Steve St. Angelo.

- Silver prices tend to bottom, more or less, about the time the DJIA peaks. The DJIA hit an all-time high in May of 2015. Silver hit a multi-year low in December 2015. The next big moves should be up in silver and down in the DJIA.

- Global debt is estimated at $230 Trillion. When it finally dawns on people that this debt will not be repaid in current dollars, euros, yen, pounds etc. then people and institutions will want to protect their purchasing power and preserve the value of their money. Negative interest rate bonds are not the answer. Silver coins and bars are a far better answer.

- War! Desperate times call for desperate measures to inflate economies, inflate more bubbles and create distractions. It could happen.

Silver thrives, paper dies. This should be true for several more years.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.