SPX has Ceased its Rally

Stock-Markets / Stock Markets 2016 Apr 04, 2016 - 05:51 PM GMT SPX appears to have left a high of 2075.07 near the close on Friday and has ceased rising. It still needs to break the trendlines with the 4.3-year trendline near 2050.00. A short entry may come at the bounce off the trendline, especially if confirmed by the VIX.

SPX appears to have left a high of 2075.07 near the close on Friday and has ceased rising. It still needs to break the trendlines with the 4.3-year trendline near 2050.00. A short entry may come at the bounce off the trendline, especially if confirmed by the VIX.

Bloomberg comments, “U.S. stocks slipped from their highest levels this year, with declines in consumer and industrial shares overshadowing gains in health-care companies, as investors looked for fresh reasons to continue a rally.

Equities extended a retreat along with crude oil in afternoon trading. Ford Motor Co. and General Motors Co. fell more than 1.9 percent, after sliding Friday on disappointing sales. Miner Freeport-McMoRan Inc. lost 3.7 percent as copper capped its longest losing streak in two years. Virgin America Inc. jumped 42 percent after Alaska Air Group Inc. agreed to buy the carrier for $2.6 billion.

The Standard & Poor’s 500 Index slipped 0.5 percent to 2,063.48 at 2:26 p.m. in New York, after capping its sixth weekly gain in seven. The Dow Jones Industrial Average lost 74.82 points, or 0.4 percent, to 17,717.93. The Nasdaq Composite Index declined 0.5 percent. Trading volume in S&P 500 shares was 15 percent below the 30-day average for this time of day, continuing a stretch of the lightest activity this year.”

WTIC continues to decline, making fresh lows. Last week I had mentioned waiting for a retracement before going short, but it does not appear that it has had a decent rebound to make a short entry.

As the decline keeps chewing up thelongs, it may have fewer opportunities for a decent bounce, so those who would make this trade should probably make at least a partial entry.

Wave 3s are very dynamic and the Cycles Model suggests another week of decline before the next bounce into Options Expiration.

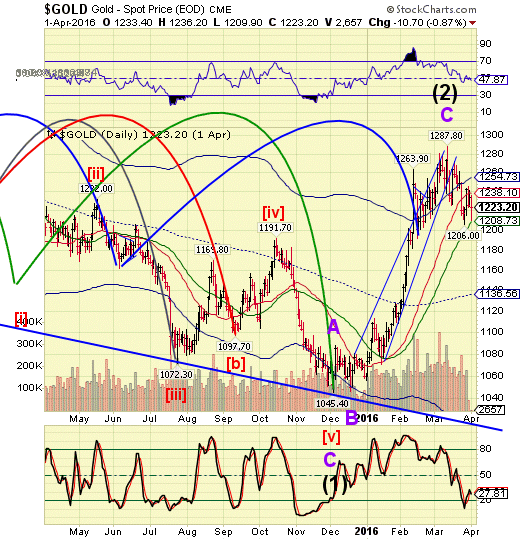

Gold appears to be completing the final decline of Wave 1. In addition, The Cycles Model calls for a Master Cycle low later this week. This is not a time to add short positions, but rather wait for the bounce . I’ll be doing an analysis in the mid-week report, if not sooner.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.