The Interesting Relationship Between Silver Rallies and Interest Rates

Commodities / Gold and Silver 2016 Apr 07, 2016 - 03:18 PM GMTBy: Hubert_Moolman

It is not well known, that historically silver and interest rates have actually moved together (in the long-term). When interest rates are going up, then silver is going up. When interest rates are going down, silver is going down. In the short-term, interest rates and silver can diverge (like since about 2002 to now); however, this is temporary.

It is not well known, that historically silver and interest rates have actually moved together (in the long-term). When interest rates are going up, then silver is going up. When interest rates are going down, silver is going down. In the short-term, interest rates and silver can diverge (like since about 2002 to now); however, this is temporary.

Interest rates have been going down for the last 34 years. Due to this long downward trend, many believe that interest rates will not rise. Unknowingly (due to the correlation between silver and interest rates), they indirectly believe that silver will not rise.

Interest rates are an indication of the value that the market places on debt (or bonds). If interest rates are low, then the market places a high value on debt, and if the interest rates are high, then a low value is placed on debt.

Silver and debt are virtually complete opposites; therefore, when interest rates are low, the market is putting a low value on silver, and when interest rates are high, then the market is putting a high value on silver.

Please note that there is a difference between the more market-related interest rates (like interest on the 10 -year Treasury) and the more manipulated interest rates (like the federal funds target rate). Here, I am mainly referring to market interest rates.

With interest rates being at all-time lows, for the last 146 years (at least), the market is putting an all-time low value on silver. Economic decline is the trigger that will bring a change in the prevailing interest rate trend. When there is economic decline, there is reduced expectation that debts will be paid (This is why the stock market collapse is such an important signal for the coming silver rally). Debt is then considered very risky, so higher interest rates are required (putting a lower value on debt).

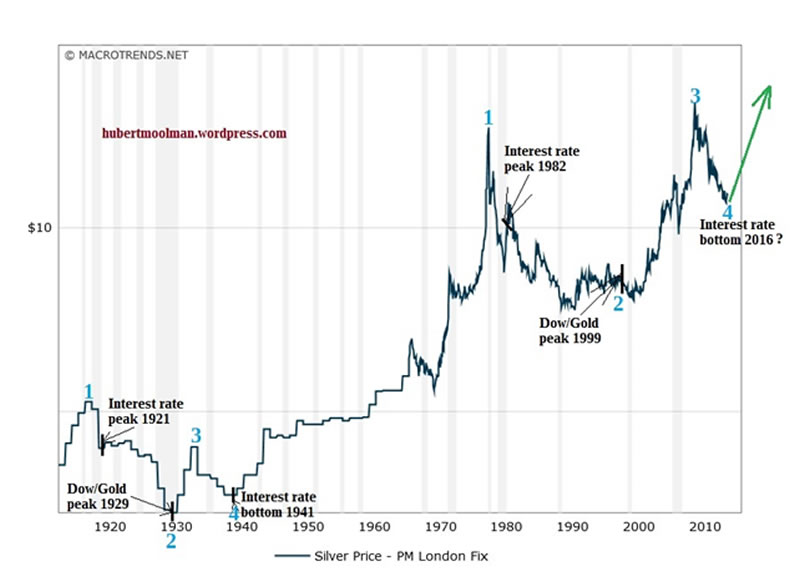

The economic decline has already started and will soon accelerate, causing a massive spike in the silver price. Below is a long-term chart of silver (from macrotrends.net):

On the chart, I have marked two fractals (1 to 4), to show how the period from 1921 to 1941 is similar to 1980 to 2016, for the silver market. The two fractals exist in similar conditions relative to interest rate peaks and bottoms, as well the Dow/Gold ratio peaks.

We appear to be around point 4, the point where silver and interest rates are likely to rise significantly.

For more of this kind of analysis on silver and gold, you are welcome to subscribe to my premium service. I have also recently completed a Long-term Silver Fractal Analysis Report .

Warm regards

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2016 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.