Gold And Silver - Fallacy Of East v West And Price Of Precious Metals

Commodities / Gold and Silver 2016 Apr 09, 2016 - 01:01 PM GMTBy: Michael_Noonan

The ongoing draining of gold from West to East is not a sign of deteriorating viability of the globalists and their takeover/total control of the world. The Game remains the same, the controlling elites remain the same, it is only the players that are changing: China, Russia, replacing US, UK/EU.

The ongoing draining of gold from West to East is not a sign of deteriorating viability of the globalists and their takeover/total control of the world. The Game remains the same, the controlling elites remain the same, it is only the players that are changing: China, Russia, replacing US, UK/EU.

Take Putin, aka Russia, for example. He has had a long-term association with Heinz [Henry] Kissinger, a higher-tiered "gofer" for the global elites. They met again in early February, when Putin welcomed globalist-NWO-agenda-pusher Kissinger as an "old friend," referring to him as a "world class politician." Putin embracing a globalist is no accident.

This, in and of itself, reveals how very much Russia now plays an integral role with the elites; not directly, and not as a part of the inside clique, but more as a renegade force that cannot, by the globalists, and will not, by Putin, be denied a place in the forward moving New World Order [NWO].

Says Kissinger, Russia is viewed as "an indispensable component of the international order." Further, "Russia should be perceived as an essential element of any new global equilibrium."

Kissinger was a leading part of a group that met regularly from 2007-2009 that included high-level officials and military leaders from both sides "to overcome crises and explore principles of world order. The US "visualized the expansion of an international system governed essentially by legal rules."

One must be keenly aware of the careful choice of words at this high level of diplomatic interaction.

The references to globalism are obvious. What few people will ever realize is Kissinger's use of the word "legal," for it is used instead of the word "lawful." We often comment on the US being a corporate federal government, and it is located in the District of Columbia. What this last sentence says, and this is critically important to know, the UNITED STATES is a term that does not describe the geographical land and its inhabitants, as almost all believe is the case when any reference is made to the US.

The US was formed as a corporation, and it is located in the District of Columbia. All corporations are artificial entities, legal fictions. Few people can grasp the fact that the US is an artificial entity that is separate and distinct from the physical country formed under the organic Constitution. The lawful physical country has been replaced by the globalist moneychangers into a legal fiction over the last few hundred years. The de jurenation has been usurped by a de factocorporation, all by design, all by deceit.

De facto- This phrase is used to characterize an officer, a government, a past action, or a state of affairs which must be accepted for all practical purposes, but is illegal or illegitimate.

De jure- of right, legitimate, lawful.

From Blacks Law Legal Dictionary, 4th Edition.

We have digressed with this important distinction because the term "legal" is used to describe procedures that must be followed in a de facto system, as opposed to lawful, which deals with substance and rights in a de jure environment. "Legal" was the word chosen by Kissinger.

Prior to Putin coming into power, it had been the decades long objective by the US to turn Russia into a vassal colony in order to exploit all of that country's natural resources for the sole benefit of the globalist's corporate agenda.

The purpose of the Putin-Kissinger meeting was to have Kissinger take a pulse for moving toward "an increasingly multipolar and globalized" world now that it is apparent that Putin has refused to allow the globalists to takeover Russia. Putin has, in effect, announced to the elites that for Russia, there is a new sheriff in town, as it were, and it is Putin in charge, not them.

For Kissinger, "Ukraine needs to be embedded in the structure of a European and international security architecture," and for Syria "it is clear that the local and regional factions cannot find a solution on their own."

Really, Dr K? You mean a solution that the US wants cannot be found. After 18 months and a trillion dollars later, the US has done nothing but destroy much of the Middle East while purportedly fighting ISIS, that terrorist group created, funded, and armed by the US [CIA], Mossad, and Saudi Arabia. After only 5 months of intervention, and only costing maybe $550 billion, Russia has kicked ISIS ass into almost total defeat, with the US refusing to cooperate.

The US wants a natural gas pipeline from Qatar to Europe, through Syria. Assad, president of Syria, said, "No thank you. We have other plans." Russia [Putin], also supplies natural gas to Europe, which the US wants to negate, but Putin said, "Back off!" The US turned tail and did.

As to Ukraine needing to be a part of "European and international security," Ukraine has a centuries old relationship with Russia, not with Europe or any other country. Obama spearheaded a Soros demand for a coup of Ukraine, replacing a Russia friendly and people elected president with a stooge installed loyal to the US, a violation of international law on the part of the US. No mention is made of this by US media.

Putin has stood up to the globalists, even going so far as to kick out the Rothschild's central bank. No other country has done that to the Rothschilds. Iceland may be considered another exception for jailing their bankers and nationalizing the banks and forgiving all mortgages held by Iceland homeowners. There was initial financial pain, but Iceland's economy has fully recovered to be one of the strongest in the world after shedding the international banks. Greece, on the other hand, remains in the grips of the IMF bankers and has been destroyed economically.

Despite giving a strong stiff-arm to the globalists, Putin has no desire to be totally independent of them. Instead, he wants recognition from them and his fair share of and position within the NWO, just as does China. Both Russia and China are the new catalysts reshaping the globalist's multipolar, stateless NWO.

Previously, the elites figured it was there [mistaken] right to takeover control of both countries, which were viewed as mere pawns. Not so, says China. Not so, says Russia [Putin]. Make no mistake, however, the globalist's total world dominance is still in play and inexorably moving forward.

China and Russia did not compliantly roll over. They will play their own determined roles, but folks like us are not included. We are all indispensable numbers, always to be fleeced and controlled by the globalist apparatus.

The de factoglobalists, the illegitimates who control by rule over money and military might, remain in charge. Your best bet to survive the swelling momentum of the elites is to continue to acquire gold and silver, the only "bargaining chips" you will have to preserve your financial existence in a world increasingly digitalized in order to be totally controlling.

What's in your wallet? [safe, or underground stash]

[Source of quotes: http://nationalinterest.org/feature/kissingers-vision-us-russia-relations-15111 ]

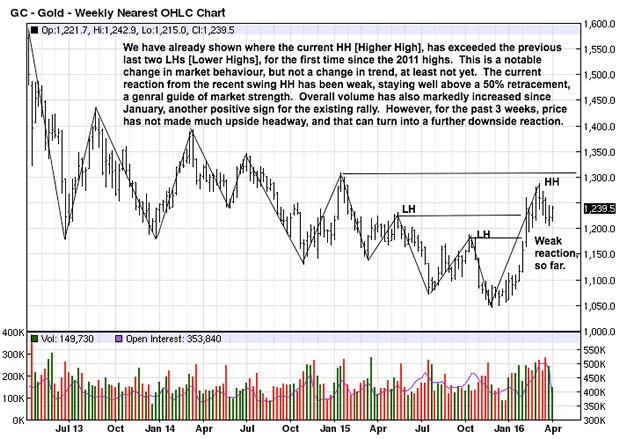

Gold appears to have stalled in its present rally. We have identified the reaction, so far, as being weak, but at the same time, it has been unable to make further headway to the upside. Two weeks ago, the volume effort was relatively strong, but the net close relative to the prior week was negligible. There was no upside payoff for the effort.

Last week the range was smaller, unable to extend higher. Based on these non-event results, odds favor more reaction lower. The chart is otherwise inconclusive.

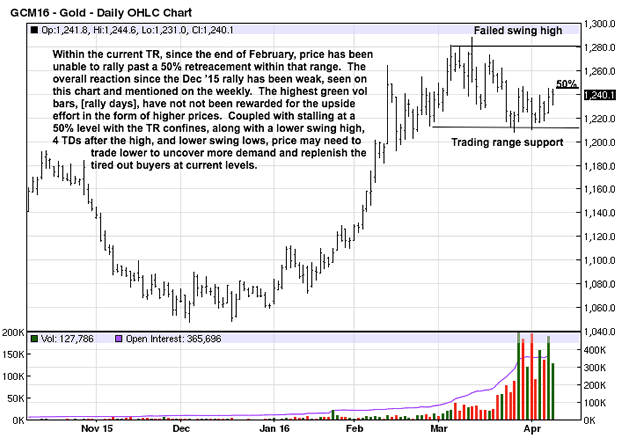

The same situation appears on the daily, and the inability to rally above a 50% retracement from the last swing high and swing low adds to the likelihood of more corrective activity.

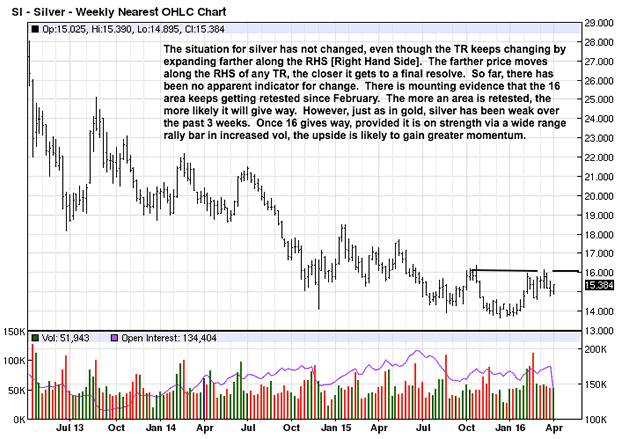

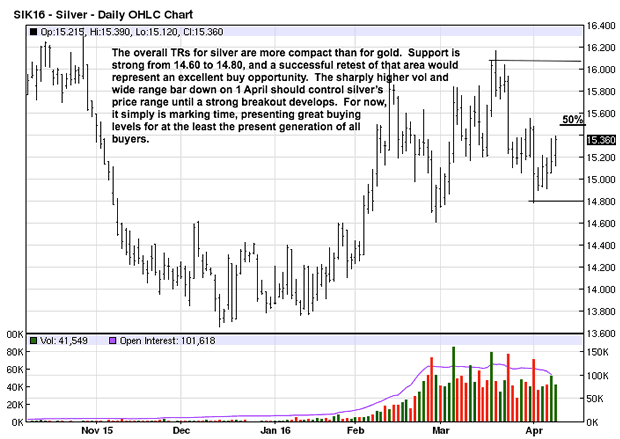

Silver may be the sleeper, here. The chart continues to move sideways with no fanfare or evidence of an imminent breakout to the upside. RHS activity that is showing in silver very often leads to a directional move. One simply must wait for the breakout.

It is obvious from the chart that the recent activity is in the lower half of the TR and not in the upper half that would lead to a breakout. An inability to rally up and away from the 14.80 support area is the reason why silver may trade in a more sideways movement. There needs to be developing bars just at or under 16.10 resistance before silver can be primed to move higher.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.