Investigating Deutsche Bank's Euro21 Trillion Derivative Casino

Companies / Banking Stocks Apr 16, 2016 - 05:58 PM GMTBy: Mike_Shedlock

Deutsche Bank Admits Rigging, Will Expose Other Riggers

Deutsche Bank Admits Rigging, Will Expose Other Riggers

Deutsche Bank has admitted it rigged both the Gold market and the Silver market. ZeroHedge has the details in his report Deutsche Bank Agrees To Expose Other Manipulators .

Many asked me to comment. I am shocked?

No. In the wake of admissions of rigged LIBOR and rigged Euribor (bank to bank interest rates in dollars and euros respectively), one would really have to wonder "What isn't rigged?"

To the Moon, Alice?

While some think gold would have "gone to the moon" without this rigging, I wonder if it got as high as $1900 an ounce because of rigging.

The same applies to silver when it topped over $40.

It's logical to believe riggers don't much care about the direction as long as they make money. Hopefully we get more details from Deutsche Bank soon.

This could get interesting.

What Isn't Rigged?

While pondering the above question, let's dive into Deutsche Bank's 2015 Annual Report to investigate other bid-rigging opportunities.

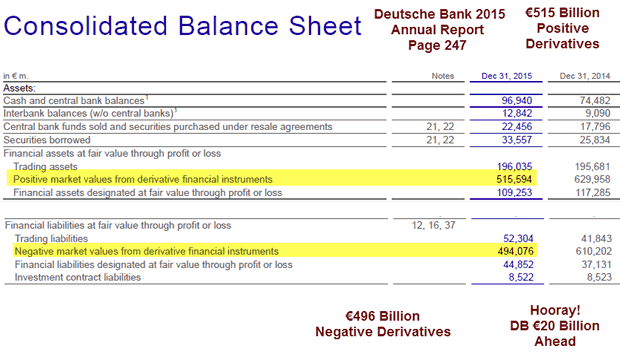

Consolidated Balance Sheet

Detusche Bank has over €515 billion in "positive derivative values" in comparison to €496 billion in "negative derivative values".

Hooray! Deutsche Bank is about €20 billion to the good. But how much was bet?

Deutsche Bank's Derivatives Casino

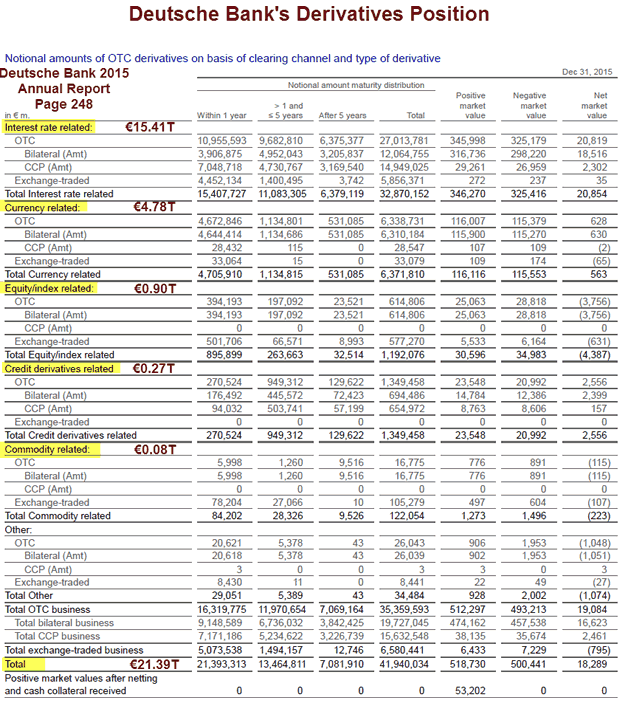

The total size of Deutsche Bank's derivatives casino is €21.39 trillion, notional.

Casino Breakdown

- Interest Rate: €15.41 trillion

- Currency Related: €4.78 trillion

- Equity Index: €0.90 trillion

- Credit Related: €0.27 trillion

- Commodity Related: €0.08 trillion

How Much Risk on €21.39 Trillion?

Inquiring minds may be asking: How much risk is there on €21.39 trillion?

Perhaps surprising little. After all, interest rate risk could easily be controlled with a few timely phone calls from the Fed and ECB.

What risk isn't controlled that way can always be controlled other ways (as we have seen).

I am pleased to note Deutsche Bank uses "central counterparty clearing services for OTC clearing" and the bank "benefits from the credit risk mitigation achieved through the central counterparty's settlement system."

"Margin requirements for uncleared OTC derivative transactions are expected to be phased in from September 2016."

Whew!

And we can all count on the obvious fact that Dodd-Frank reform has fixed everything.

So, nothing can possibly go wrong with €21.39 trillion in casino bets, just as €20 billion in profits (.0935%) shows.

Addendum

Reader "LongShort" accurately points out:

Mish, with regards to DB's Annual report page 248, you've taken numbers from "Within 1 year" column, while there is "Total" column, summing up different maturities.

The total number of bets is actually €41.90 trillion as shown in the above chart.

Thanks also to reader "Lars" for spotlighting those pages.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.