All Hail the Mighty Silver Bugs…

Commodities / Gold and Silver 2016 Apr 21, 2016 - 09:05 AM GMTBy: The_Gold_Report

Precious metals expert Michael Ballanger examines silver's recent moves upward.

Precious metals expert Michael Ballanger examines silver's recent moves upward.

In my business, there is a great deal of travel, be it to properties in the Peruvian Andes or the Canadian Yukon or to the investment conferences in New Orleans or San Francisco or London, so I get a full psychographic cross section of every type of investor imaginable. First of all, the audiences I have encountered at the "Sound Money" conferences in Nassau or Bermuda are usually quite conservative and usually well-dressed and well-groomed. When the topic is gold and it is a controversial speaker looking for "the end of Western civilization," the audiences tend to be a tad different with hair length and dress code noticeably more avant-garde.

However, when the topic is confined to silver, while the speakers tend to be "evangelical," the audiences appear to be (operative word being "appear") simply stark-raving madmen of the first order. They usually dress in military fatigues, the males are all in ponytails, the women weigh more than the men, and the T-shirts and baseball caps on both males and females carry logos from either the WWF or the Monster Truck conventions. However, they are usually quite erudite when discussing "survival techniques"; they are usually extremely well educated and they are all able to rhyme off the silver production numbers for the past 20 years BY COUNTRY; and most importantly, they carry high distain for anyone who fails to know these facts.

These are simply goldbugs amped up on argentine steroids, and I happen to have an extremely high regard for them, as they represent the fringe of the movement. The silver bugs would charge the Federal Reserve Building in a New York minute; they would canonize WikiLeaks founder Julian Assange if allowed; they would vote for Ron Paul 40 years after his passing; and they wear Edward Snowdon T-shirts around the local shopping mart. They can usually recite the Declaration of Independence in its entirety and consider themselves true patriots. They view silver as the only "real money" on the planet and normally hold over half of their net worth outside of the banking system in the form of silver, while residing in remote parts of Idaho or Wyoming, usually in the mountains. When I have given speeches or lectures over the years, I can usually pick them out in a crowd; they rarely smile and NEVER laugh at anything I have said (which may or may not be seen as abnormal). Now, you will of course forgive the stereotyping, but that is simply and purely my blanket view of silver bugs.

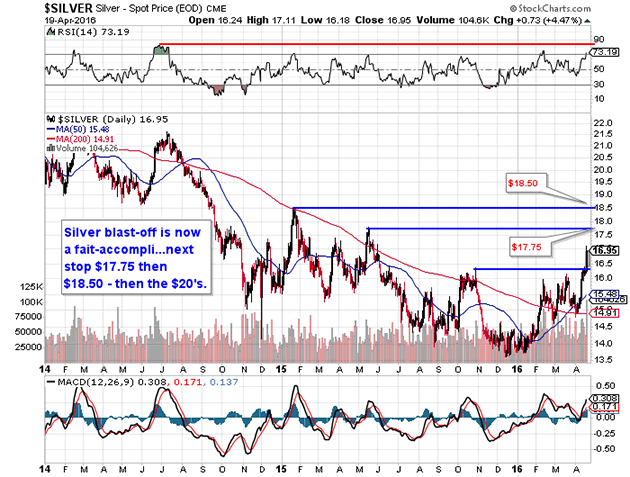

Irrespective of whether the silver aficionados laugh or not (and they don't), they are certainly SMILING lately, as am I, as there is something immensely gratifying about a prediction that turns out to be both correct and timely (usually it is difficult to pick the right direction, let alone the right timing). Thankfully, my decision to buy silver immediately rather than wait for the inevitable correction in the HUI (NYSE Arca Gold BUGS Index) has worked well as it has moved from $15.20 on March 31 to today's high of $17.11, a gain of 12.5% in just under three weeks. It surely did not hurt that Deutsche Bank was forced to settle a massive price-rigging conspiracy and implicate Scotiabank and HSBC in the process, but silver looked like it was going to "pop" long before the massive silver fraud was revealed. (See chart above.)

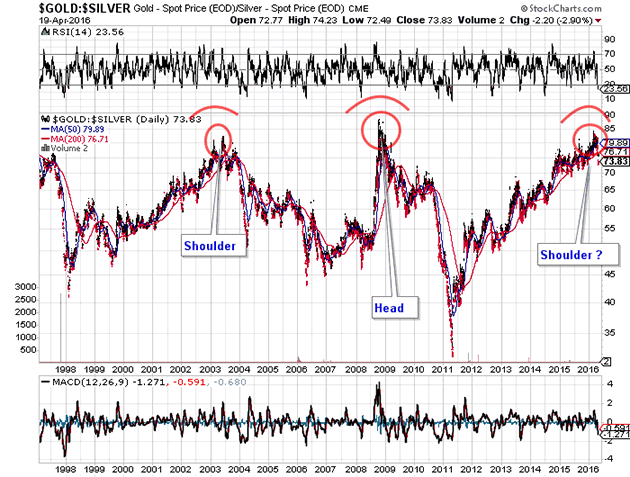

As we discussed back in late March, shorting the GTSR (Gold-to-Silver Ratio) at 80 looked like it could turn out to be the 2016 Trade-of-the-Year, but little did I expect that the move would occur without a breakout (or breakdown) move in gold. As it stands, gold is still locked in that $1,210-$1,287 range that has shackled it since the 1st of April, but silver by contrast has been a standout performer since that day. The new recovery high seen today in silver is a big positive over the near term and bodes well for the ultimate test of $18.50, with a strong likelihood that silver is leading gold to what will be an upside resolution to this sideways correction.

The GTSR was originally recommended north of 80

To coin a phrase, "There's no fever like GOLD fever," but even better is "There's no mania like silver mania," and now that silver appears to have finally shed the bullion bank shackles, it could easily see the low $20s within a few months. I was thinking of buying a fistful of long-dated calls on Pan American Silver Corp. (PAA:TSX; PAAS:NASDAQ), but I decided to buy only a few while instead putting more of the cash into a private junior silver company called Santa Rosa Silver Mining Corp. (at $.05 per share). In that time frame, Pan American Silver had advanced from $10.82 to $14.00 with the July $10 calls advancing from $1.65 to $4.00, so as much as I fashion myself as a metals expert, I should have opened up the wallet and bought the Pan American calls as well. Leaving better than a double on the table hurts despite the fact that the GDXJ (Market Vectors Junior Gold Miners) position has better than doubled since Jan. 19.

The GDXJ has been on one wicked tear since mid-January and, while we all know how ridiculously undervalued the miners became in the latter half of 2015 and early 2016, RSI (Relative Strength Index) readings above 70 have always been associated with tops in any and all markets that I have followed. Accordingly, I should be taking profits in the GDXJ, but I have decided to refrain and ride the trend instead. It may be madness and it may be greed, but I simply MUST hang on for dear life and pray that the golden bull doesn't throw me into the ditch and my net worth with it.

With silver up another 1.17% this morning, I feel like Robert Duval in "Apocalypse Now" because "I just LOVE the smell of incinerated silver shorts in the morning. . ." As I wrote about back in December with gold starting to rally, it feels different these days and silver feels as though it will be in the $20s sooner than one might imagine.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael Ballanger: I or my family own shares of the following companies mentioned in this interview: Pan American Silver Corp. and Santa Rosa Silver Mining Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Statement and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation or editing so the author could speak independently about the sector. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. The companies mentioned in this interview were not involved in any aspect of the article preparation or editing so the expert could comment independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts courtesy of Michael Ballanger

Streetwise - The Gold Report is Copyright © 2016 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 773-5020

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.