US To Paint New Pictures On Its Dying, Barbarous Relic of a Currency

Currencies / US Dollar Apr 21, 2016 - 05:35 PM GMTBy: Jeff_Berwick

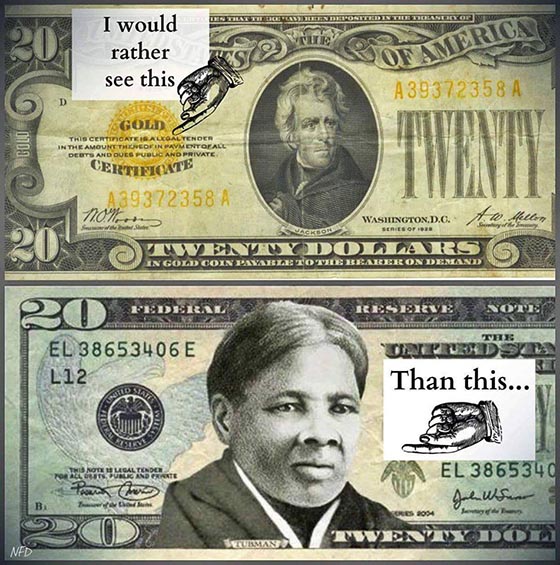

In a letter to the American tax slaves, US Treasury Secretary Jacob Lew “the Loon” has presented his plan to replace some of the images on the dwindling $20, $10 and $5 Federal Reserve Notes. Slave emancipator, Harriet Tubman, will replace Andrew Jackson on the $20, leaders of the suffrage movement will go on the $10 and images of the Lincoln Memorial will go on the $5.

In a letter to the American tax slaves, US Treasury Secretary Jacob Lew “the Loon” has presented his plan to replace some of the images on the dwindling $20, $10 and $5 Federal Reserve Notes. Slave emancipator, Harriet Tubman, will replace Andrew Jackson on the $20, leaders of the suffrage movement will go on the $10 and images of the Lincoln Memorial will go on the $5.

You’d think with the US government being $19 trillion in debt they’d have bigger priorities than artwork.

The US can’t pay what it owes any more than its indebted citizens can. Something like 50 million are on food stamps and most of the rest don’t have a dollar in the bank to tide them over once things get worse. And they will. Just wait until the dollar crashes for good.

Loon wants to inspire Americans and make them feel better about their currency. And sadly, it is working. In the dumbed down populace they care more about who is on the money than understanding what money is.

But his PR campaign is just more window-dressing and propaganda written on a dying, archaic, barbaric piece of paper. Considering that the dollar is the most widely used currency in terrorist financing, illegal arm sales and drug trafficking, Loon should probably be working on ways to outlaw the dollar rather than dress it up.

China and other major countries are running away from the dollar as fast as they can. China just created its own yuan-gold price fix. It’s not going to be convertible into dollars either. And Hungary just made its first debt offering in yuan.

But Lew the Loon has the solution! New pictures! Surely the Chinese might consider holding on to them if they’ve got some great new graphics!

In a letter that accompanies the press release, he goes on and on about the millions of responses he received. People feel great about changing the look of the scrip they are forced to use on the tax farm. Too bad they’re not improving its solvency.

It actually makes sense to move Andrew Jackson to the back of the $20. In fact, Jackson was the Ron Paul of the 19th century and was responsible for shutting down the US’s second central bank. He’d likely be disgusted his face adorns the scrip of the third, and worst, central bank of the US, the Federal Reserve.

Meanwhile Alexander Hamilton who was a driving force behind creating a strong (tyrannical) federal government including a central bank remains on the $10. It’s fitting that Hamilton remains on the dollar since he is largely responsible for the disaster it has and will become.

But, being huge Harriet Tubman fans, here at The Dollar Vigilante, we have mixed feelings about her being the new face of the $20. We’d certainly much rather look at her face than any of the other dead criminals printed on the other bills. In fact, she is the only won who wasn’t a criminal.

Harriet was something we don’t have anymore… male or female. An incredibly brave person who helped free slaves against a tyrannical system. She absolutely was a hero. We hope this is the image they use… but we doubt it.

She is best known for her wise statement, “I freed a thousand slaves. I could have freed a thousand more if only they knew they were slaves.”

That statement has never been more true than today. In fact, slavery never ended in the US. Instead of ending black slavery they just ended up making everyone a slave. After all, if slavery is having 100% of your productivity stolen from you against your will, at what percent is it not slavery? The answer, of course, is 0%. But it seems around 50% is enough to make people feel free in the land of the free nowadays.

And so people will cheer a black woman being on the $20 (and not even know why she was famous) but not realize that she lost the battle and they are the ones who now don’t even realize they are slaves.

Here at TDV we consider ourselves the digital version of Tubman today, carrying on her tradition and trying to free slaves… but, as she said, most don’t even know they are.

In that sense, having Tubman on the $20 is sad irony.

Truthfully, the only thing that they could print on the dollar that we would get excited about is this:

We’re not holding our breath for that to happen… so in the meantime we are getting rid of all these Federal Reserve Notes as quickly as possible, no matter whose face is printed on them, for precious metals (and bitcoin).

GOLD AND SILVER LOOKING UP

As I’ve written in the past few days, not only is the dollar on its last legs but gold and silver are finally starting to reach better valuations against the US’s crumbling currency.

As I mentioned yesterday, money metals are obviously going to play an important role in the transition of the world from the dollar to something else. And in this Jubilee Year, 2016, we can already see this trend starting to take place. Gold and silver are moving up powerfully. In fact, as I write, silver has just opened and spiked higher aboe $17.60 in Asia!

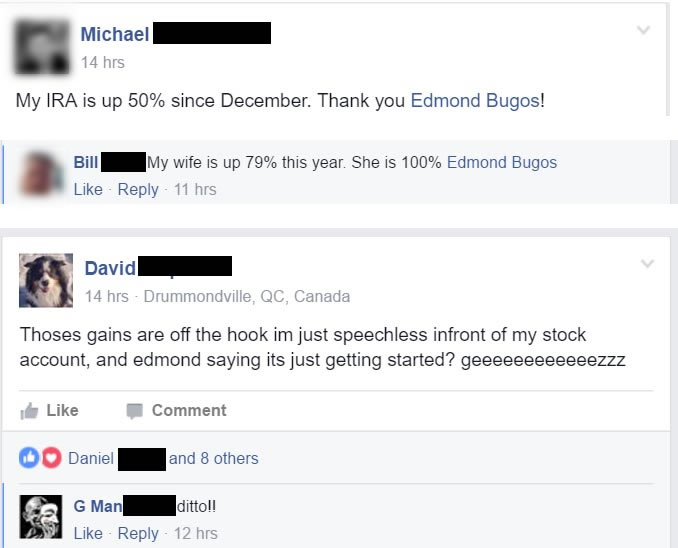

That means our portfolio, managed by Senior Analyst, Ed Bugos, is skyrocketing yet again… here are a few of today’s happy TDV subscriber comments from our private, subscriber-only Facebook Group:

As David mentioned above, our returns have been ridiculously good in the last year but we think it is just the beginning.

If you want to view Ed’s insights for yourself, please subscribe to our TDV newsletter HERE.

This is a once-in-a-lifetime event that is occurring – and it has nothing to do with the faces that Loon wants to put on US currency.

Subscribe today and join us as we continually position ourselves to profit from the ongoing collapse. We’re not fooled by the false strength of the dollar or the new faces with their false histories. We look past all that and try to see what’s REALLY going on.

And don’t forget about bitcoin. It spiked higher again today too. If you want to learn why it might go up massively this year check this out.

In the meantime, how about the mainstream media presstitutes take this opportunity to ask Jacob Lew why there is a masonic/illuminati all-seeing eye pyramid on the back of the $1 bill?

Now, THAT would be something I’d like to hear him try to answer. In the meantime, he can keep painting new pictures on the dollar… and we’ll keep profiting from its destruction.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.