Gold Bullion vs Gold Miners

Commodities / Gold and Silver Stocks 2016 Apr 28, 2016 - 10:07 AM GMTBy: Nick_Barisheff

For thousands of years, gold has been used as money, a store of wealth, fought over and sought after. Over the last 45 years, Western populations have had a mixed impression of gold. A minority of the population understands that gold is a monetary asset that should be held as wealth insurance. A larger percentage of the population is confused about gold because of mainstream sources of information. Many people consider gold a risky investment when in fact gold bullion is not an investment at all, but rather money itself. Just like any fiat currency held in a vault, gold does not pay interest or dividends. Investors often look upon gold mining companies in the same light as physical gold bullion. Gold mining shares are investments, and can be good tactical investments from time to time. However, the characteristics of gold bullion and gold miners are very different. In some ways, those differences are similar to the difference between an insurance policy and shares of an insurance company.

For thousands of years, gold has been used as money, a store of wealth, fought over and sought after. Over the last 45 years, Western populations have had a mixed impression of gold. A minority of the population understands that gold is a monetary asset that should be held as wealth insurance. A larger percentage of the population is confused about gold because of mainstream sources of information. Many people consider gold a risky investment when in fact gold bullion is not an investment at all, but rather money itself. Just like any fiat currency held in a vault, gold does not pay interest or dividends. Investors often look upon gold mining companies in the same light as physical gold bullion. Gold mining shares are investments, and can be good tactical investments from time to time. However, the characteristics of gold bullion and gold miners are very different. In some ways, those differences are similar to the difference between an insurance policy and shares of an insurance company.

It is important to understand the role of gold as money in relation to fiat currency. Governments and banks work hard to ensure that people retain confidence in their debt-backed paper currencies, and in the economy in general. Wall Street's message about the economy and the US dollar's strength has to remain optimistic, because when people are uncertain and skeptical, they do not invest in financial assets, and companies curtail new financings, creating a negative feedback loop. Financing is Wall Street's lifeblood, so it will always see "green shoots" and "recoveries around the corner," just as it did in 1929, 2000 and 2008 while the market crashed around it. Consumer spending and bank lending is what keeps the fiat shell game going, and people do not borrow or spend when they feel uncertain about their financial future. Gold, because it inconveniently serves as the truest, irrefutable long-term indicator of the economy's health, has to be discredited.

There are three essential characteristics of money: it must be a store of value; it must be accepted as a medium of exchange; and it must be a unit of account, meaning that it must be divisible and each unit must be equivalent. Fiat currency has failed as a store of value, and it has no intrinsic worth. How much does it cost to type in zeros on a computer screen or on a piece of paper? Certainly less than it does to dig a mile into the earth to extract and refine two grams of gold from a tonne of rock.

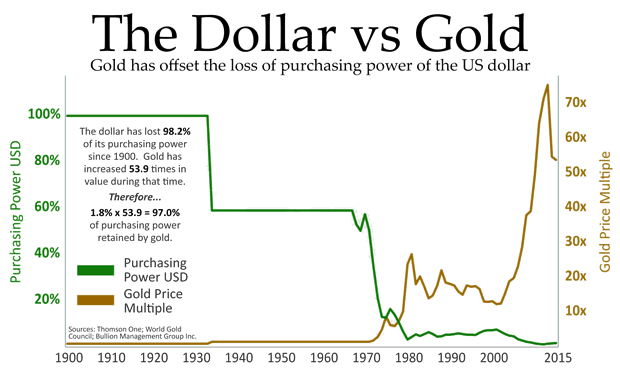

The US Federal Reserve was created in 1913. From its creation through to this day, the US dollar has lost approximately 98.2% of its purchasing power. On the other hand, gold has retained its purchasing power, rising from $20.64 an ounce in 1913 to $1,250 an ounce today. Throughout the ages, whether it be in Roman times, in 1913 or today, one ounce of gold has provided a man with a pair of shoes, a suit and a briefcase, or the equivalent.

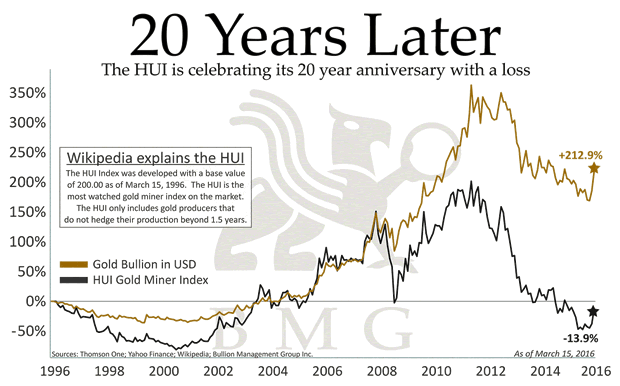

A popular misconception about gold and gold miners being similar has to do with the symbiotic relationship between the two. Mining companies have claims to, or outright ownership of, gold that is in the earth. The gold resources need to be extracted, processed and then sold to cover the costs of operations for the company to make a profit. Gold in the ground is very different than a gold coin that can easily be transferred from a seller to a buyer. Mining companies are dependent on the price of bullion in relation to fiat currencies. Specifically, if gold is too low in price, a mining company is unable to extract the gold from the ground, because it is uneconomical. Subsequently the value of the mining company's shares will trade at lower levels, or the company could go bankrupt. The higher the price of gold, the more economical it becomes to dig for lower-grade sources of gold. Mining shares can move up significantly as gold moves higher, but that is not always the case. Below is a chart of the HUI Gold Miner Index, which contains the top unhedged gold producers in the world, compared to the performance of gold bullion.

While the miners performed well from 2003 to 2007, over the past 20 years the Index shows a loss of 13.9%, whereas gold is up 233%.

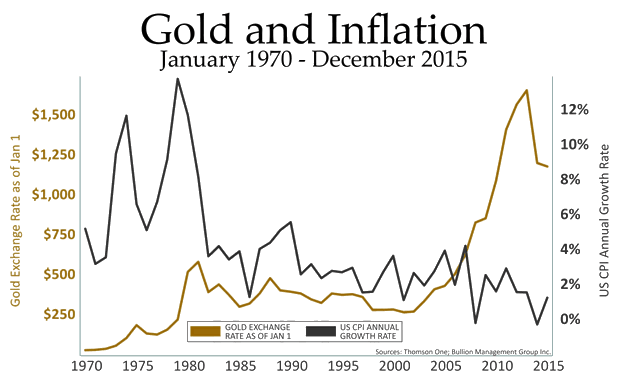

The 1970s provide a good example of how gold and gold miners perform during inflationary time periods. In the late 1960s, Lyndon Johnson's government was escalating the war in Vietnam and increasing government-backed social benefits. This caused the US government to run ever-increasing budget deficits. Prior to 1971, the US dollar, as the world's reserve currency, was tied to gold bullion at US$35 per ounce of gold. Many countries started to redeem their US-dollar reserves for physical gold bullion. The amount of gold being delivered was unsustainable, and in 1971 Richard Nixon closed the "Gold Window," eliminating the ability of countries to exchange their US dollars for gold. Inflation spiked as the US increased its sovereign debt load by funding unsustainable government outlays. By 1980, gold had reached US$850 per ounce. Gold adjusted to the changing environment, and increased in price in relation to the faltering US dollar.

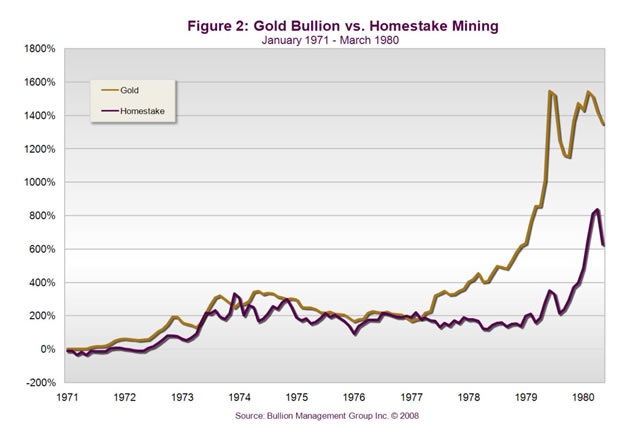

It's interesting to see that gold bullion virtually doubled the return of Homestake Mining Company (the largest gold miner in the world at that time). This is another example of the difference between gold bullion and gold mining shares.

From a risk perspective, there are major divergences between physical gold bullion and shares of gold miners.

Gold Miner Risks

- Exploration risks - no gold, or not enough gold, will be discovered.

- Feasibility risks - a company may discover gold, but at current prices it may be uneconomical to mine.

- Management risks - mining companies face substantial upfront costs and ongoing operating costs, and poor management can destroy an otherwise viable asset.

- Pricing risks - as gold moves up and down in price, individual companies can experience positive leverage-to-price increases, or go out of business if prices fall too low.

- Geopolitical risks - governments can become unstable, leading to unreasonable demands, confiscation of assets, and increasing royalty fees.

- Financing risks - during bear markets, banks often refuse to finance operations and, because the share price of many of these companies is so low, raising equity becomes extremely dilutive to existing shareholders.

- Environmental risks - mining companies often work in remote areas that are ecologically sensitive. As well, dam and leach pad failures happen from time to time, resulting serious environmental degradation, and possible fines and litigation costs.

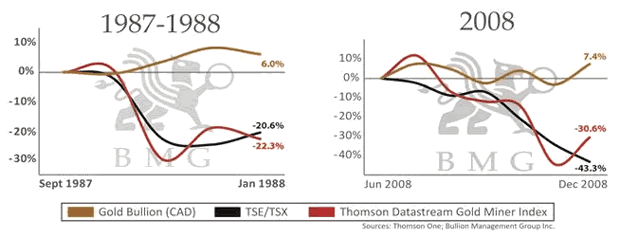

- Stock market volatility - mining shares often correlate with the broad-based equity markets during downturns in the financial markets. Mining shares are extremely volatile and can lack liquidity.

- Productivity and efficiency - mining companies often face major engineering problems such as cave-ins, mill problems, labour issues, increased energy costs, etc.

- Hedging policies - mining companies often lock into price agreements that end up destroying shareholder value when major changes in operating costs related to bullion prices occur.

- Jurisdiction risks - uprisings, war, political upheaval and disasters are all common problems that mining companies face when working around the world.

Gold Bullion Risks

- The risk of losing physical gold is significant if it is not vaulted in a safe location.

- The value of gold is priced in relation to fiat currencies. Monetary and fiscal policies are a major contributor to the fluctuation in currencies.

- Supply and demand fundamentals affect the price and availability. We believe that physical gold will soon be unattainable for the average person, because it will be simply too expensive and rare. Mine output is dropping as ore grades are getting lower and lower. Over the last few years' miners have been processing high-grade resources and leaving low-grade (i.e. uneconomical) resources in the ground.

- Futures contracts bought and sold by institutions such as central banks, hedge funds and banks can adversely affect the price of gold, because there is more paper gold than physical gold.

Portfolio Comparison Guide

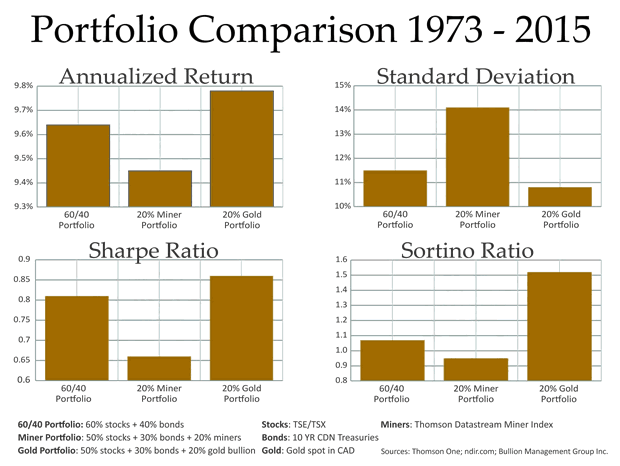

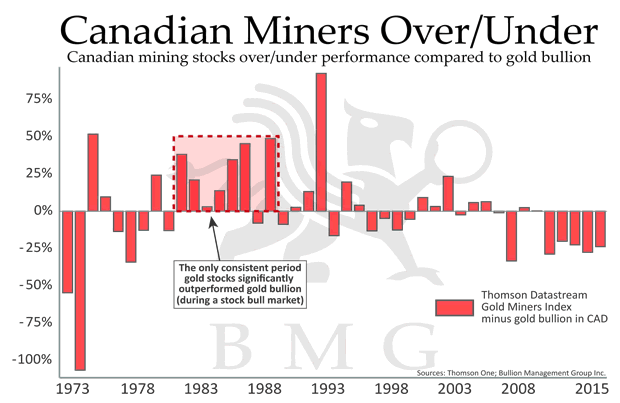

The major difference between physical gold bullion and mining stocks is how they react within a properly diversified portfolio. Gold is the most negatively correlated asset class to traditional financial assets such as stocks and bonds. Physical bullion should be a significant part of the strategic long-term allocation within a portfolio, whereas mining stocks should be a small part of a tactical equity component during certain conditions. Multiple studies show that a portion of physical gold held within an investment portfolio improves returns and reduces risk, whereas shares of gold mining companies increase the amount of risk within a portfolio, and can negatively affect returns over the long run.

It is worth noting that gold bullion has appreciated more in price than gold miners over the past 40 years, with much lower volatility.

Owning gold bullion is a form of wealth insurance, and will protect a portfolio during market declines. Mining stocks can provide leveraged upside returns during a rising dollar price in gold, but can exaggerate downside risks during equity market declines, even though the price of bullion may be rising.

There is a growing realization that all is not well in our world today. The popularity of Donald Trump and Bernie Sanders is a direct result of the decline of the US economy and political process. Globally, people are beginning to lose7 confidence in the system. There are crises brewing all round the world today. Governments, corporations and individuals are all struggling with too much debt. Gold bullion has been trending higher for 15 years, and will continue to do so because monetary and fiscal policies will not fix the structural issues that have been building unsustainably for decades. Debt will continue to grow as government budget deficits continue unabated. Central banks will continue to buy up government debt with currency they have created out of thin air, euphemistically referred to as Quantitative Easing. The value of fiat currencies will continue to erode, because the path we are on is clearly unsustainable. Many gold experts agree that gold will surpass $10,000 per ounce in the coming years.

In summary, mining shares are an investment that can make up a small portion of the overall tactical equity allocation of a sophisticated investor's portfolio. However, the facts show that gold mining shares are not a prudent long-term strategic investment for most individuals. Physical gold has a long history that spans thousands of years, and it should make up a portion of every person's assets. The world's wealthiest people hold bullion to protect their wealth. As Doug Casey, author and institutional investor, says, "The hurricane hit in 2008, we have been sitting in the eye of the storm since the last financial crisis and the full breadth of the storm is beginning to hit us once again." Globally, the problems we face today are markedly worse than those of the Great Recession. In the coming years, portfolios without physical gold to offset losses in financial assets and currencies will suffer.

By Nick Barisheff

Nick Barisheff is the founder, president and CEO of Bullion Management Group Inc., a company dedicated to providing investors with a secure, cost-effective, transparent way to purchase and hold physical bullion. BMG is an Associate Member of the London Bullion Market Association (LBMA).

Widely recognized as international bullion expert, Nick has written numerous articles on bullion and current market trends, which have been published on various news and business websites. Nick has appeared on BNN, CBC, CNBC and Sun Media, and has been interviewed for countless articles by leading business publications across North America, Europe and Asia. His first book $10,000 Gold: Why Gold’s Inevitable Rise is the Investors Safe Haven, was published in the spring of 2013. Every investor who seeks the safety of sound money will benefit from Nick’s insights into the portfolio-preserving power of gold. www.bmgbullion.com

© 2016 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.