Stock Market Getting Ready for the Next Flash Crash

Stock-Markets / Financial Crash May 06, 2016 - 10:50 AM GMT Making sense out of the Wave pattern has been a mind bender. I keep reminding myself, “There is order here. I just have to find it!” The decline since 1500 hours on Monday is not an impulse as I had originally expected.

Making sense out of the Wave pattern has been a mind bender. I keep reminding myself, “There is order here. I just have to find it!” The decline since 1500 hours on Monday is not an impulse as I had originally expected.

What I have come up with is a truncated Wave (ii) scenario for today’s move. This may be otherwise known as a “running” Wave (ii), since Wave c has been effectively stopped by the 4.5-year trendline.

That means we may lose the 50-day support this afternoon or overnight and go into a panic decline that may last up to 4.3 days (30 hours). The monthly employment survey tomorrow morning may very well set it off, if it hasn’t already begun by then. Remember what I said about the measured move. There may be a lot of push-back at 1800.00 to 1810.00 to create the illusion that the market has been “saved” again.

Ever get the feeling that VIX is being squelched? You are seeing it here. However, the “straw that breaks the camel’s back” may be coming overnight to in the morning. By tomorrow, there should be no doubt what is going on. VIX is on a confirmed buy (NYSE sell) signal. The breakout merely confirms it.

Bloomberg has an interesting article on the VIX. The author, Tanvir Sandhu writes, “Don’t let the low U.S. equity volatility fool you. The increasingly steep term structure of Chicago Board Options Exchange Volatility Index, or VIX, futures shows uncertainty remains high amid weak global growth and rising concerns about effectiveness of central bank policies, Bloomberg strategist Tanvir Sandhu writes.

The VIX futures curve’s typical contango, where the term structure is upward sloping, means roll-down costs will erode any returns from outright long positions or even cause losses.

In an era of high hedge-fund redemptions, central bank-induced price distortions, algorithmic trading and regulatory risks, the stock market is susceptible to large flash crash-type selloffs that would bring so-called convexity of volatility into focus. In a convex relationship, volatility accelerates as equity declines.”

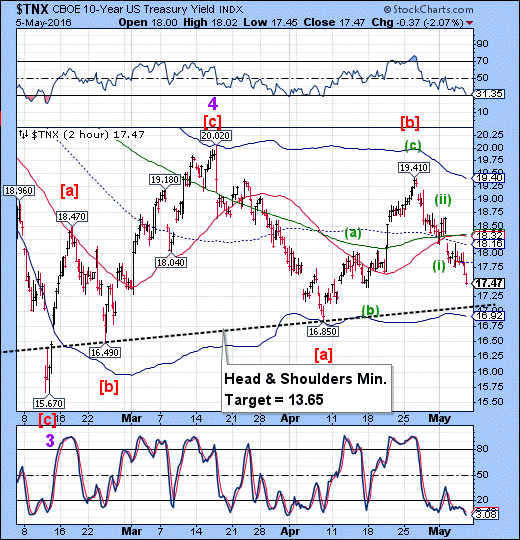

TNX is leading the decline again. This seems to be one of the better leading indicators of the decline. Money is already moving to treasuries, even though it is not as apparent in the SPX.

The NYSE Hi-Lo Index is riding the up-sloping 50-day Moving Average. This indicates a lot of (central bank) institutional buying of Index ETFs. Across-the-board buying of ETFs will keep the Hi-Lo elevated until some large stocks really lose it or until the entire market collapses, which may be the scenario for tomorrow.

The SPX is on a provisional confirmed sell signal, meaning that all the other indicators are on sell except the Hi-Lo. The trade may get awfully crowded if we wait for that indicator to turn down.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.