Bitcoin Price Space for Move up Limited

Currencies / Bitcoin May 10, 2016 - 03:37 PM GMTBy: Mike_McAra

In short: short speculative positions, target at $153, stop-loss at $515.

In short: short speculative positions, target at $153, stop-loss at $515.

A Swiss town is now embracing Bitcoin in an experimental move, we read on the Engadged website:

Most experiments in paying with digital currencies have come from private companies, but the Swiss town of Zug is trying something different. As of July 1st, the community is launching a trial that will let you pay for public services using Bitcoin -- as long as you're shelling out the equivalent of 200 francs ($206 US) or less, you can skip old-fashioned money. The trial will run through the rest of 2016, though whether or not it lives beyond that depends on the town council's findings.

(…)

The real question is whether or not any other cities will bite. While some governments have been warming up to Bitcoin, the currency is still far from a household name. Zug would have to show that there are clear advantages (or at least, few drawbacks) to taking Bitcoin at municipal offices. The technology is secure and can lower transaction costs, but that has yet to be proven on this kind of government scale.

This is not something that would affect the Bitcoin market as a whole and immediately. On the other hand, it also is the first instance when a municipal government, or any kind of governments at that, is making Bitcoin available for citizens to use in contact with the government. So far, Bitcoin has been mostly experimented with by individuals or startups. Only recently have the currency gained more interest from banks, exchanges. The general trend is for financial companies to work together with startups on possible applications of the Bitcoin technology. A municipality accepting Bitcoin is another thing altogether.

We don’t think that Bitcoin will necessarily instantaneously spread into the municipalities the world over or changing the geopolitical landscape. Generally, governments are slow to move. Some governmental agencies don’t even accept credit cards, so Bitcoin acceptance is not even close. On the other hand, the move to accept Bitcoin is a sign that the authorities are taking Bitcoin more seriously than was the case not such a long time ago.

For now, let’s focus on the charts.

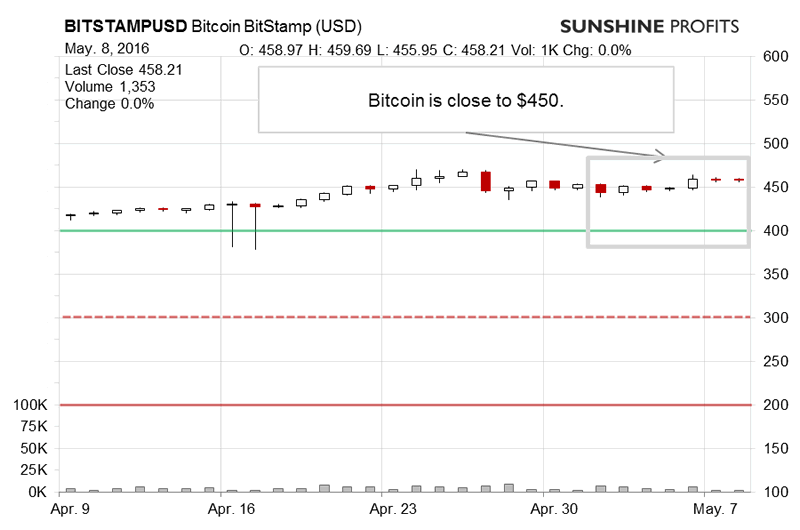

On BitStamp, we haven’t seen much action recently. Bitcoin remained above $450 but not very far from this level. The volume was not spectacular and our recent comments are still up-to-date:

In short, we tend to think that it’s premature to herald a change in the short-term situation. Yes, we saw a more pronounced move higher yesterday and on the day before but this doesn’t necessarily make the situation bullish just yet.

The most important bullish indication is that Bitcoin is now above a possible long-term declining resistance line. This itself makes us reconsider the current position. However, a look at past situations shows that the implications are not as clear. Not all moves above a long-term resistance line resulted in appreciation in the past. Actually, a recent case when Bitcoin moved above the line was in February and the move was followed by declines. There were other cases like this, for instance in May-June 2014.

The move yesterday is a confirmation that the recent appreciation might not be anything more than part of a correction within a long-term downtrend. Today, we have seen relatively volatile action – the volume is already almost as high as it was at the close yesterday (…). We haven’t really seen a decisive move down but the volatility of the move and the lack of a move up suggest that we might be on the cusp of a move down.

The situation is now similar to what we saw yesterday, possibly slightly more bearish as Bitcoin closed below $450. While this is far from sure, it might be sign that Bitcoin is on the verge of moving more significantly.

Bitcoin is back above $450 but we wouldn’t read too much into this. The currency is still below the top established by the recent move. Generally, we haven’t seen any significant indications of a possible move up.

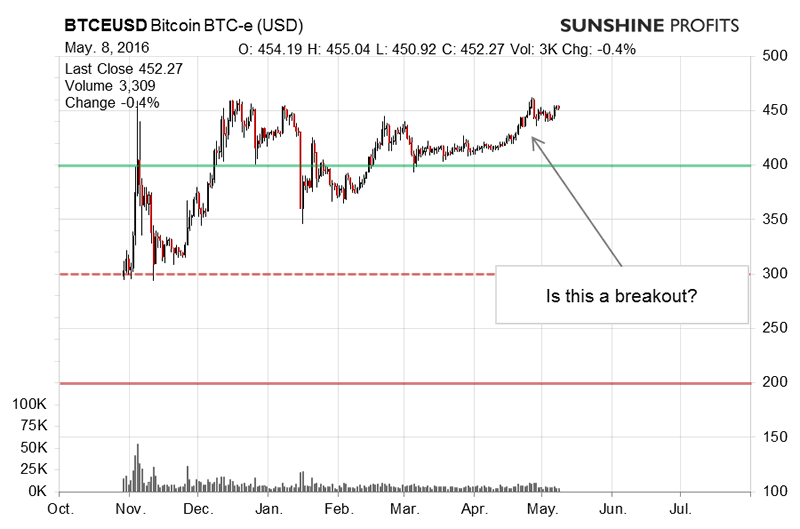

On the long-term BTC-e chart, we see Bitcoin at $450 and the situation is much like it was a couple of days ago:

The one change now is that the long-term resistance line may be redrawn to coincide with the recent top. This might actually be a bearish indication since the support might have just become resistance. In other words, the recent move above a long-term line might have been invalidated. This is a bearish indication. We might have seen a top and the situation remains bearish.

The picture now looks increasingly like one where Bitcoin is after a local top and just before a plunge in line with the general trend. It is still possible that the currency will move up, however, the fact that we’ve seen some bearish indications along with a breakdown below $450 after a failed attempt to move above this level suggests that the next move might be to the downside.

The currency is now above $450 but this doesn’t mean that the situation is bullish. Actually, Bitcoin is still at a possible declining long-term resistance line which is around $460. So, even though we saw a move back to $450, the move might be stopped by the resistance line. This suggests that any appreciation now might be limited and that the situation is still very much bearish.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $515.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.