Gold - Pro-Inflation? Anti-USD?

Commodities / Gold and Silver 2016 May 19, 2016 - 03:51 PM GMTBy: Gary_Tanashian

This is the opening segment from the May 15 edition of Notes From the Rabbit Hole, NFTRH 395. I am releasing it for public viewing because it seems, the title’s question has come roaring to the forefront this week. So the information (including the charts) is slightly dated, but becoming intensely relevant as of now.

This is the opening segment from the May 15 edition of Notes From the Rabbit Hole, NFTRH 395. I am releasing it for public viewing because it seems, the title’s question has come roaring to the forefront this week. So the information (including the charts) is slightly dated, but becoming intensely relevant as of now.

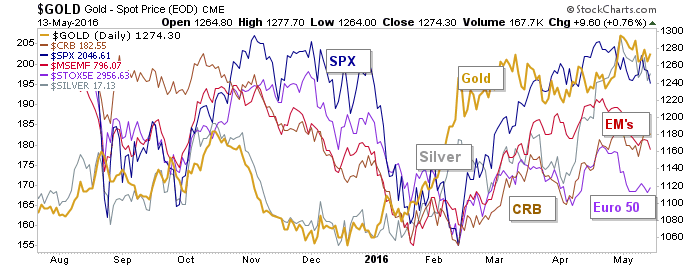

We anticipated an ‘inflation trade’ or Anti-USD asset market bounce and this has been going on since mid-February. That was when silver wrestled leadership from the first mover, gold (which bottomed in December and turned up in January), and a whole host of other global asset markets began to rise persistently.

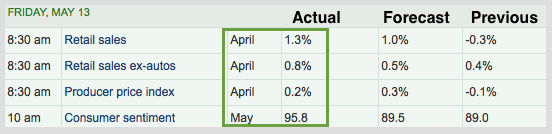

So why again did the US stock market react negatively to good economic data on Friday?

Source: MarketWatch.com

Likely because it puts the Fed back in play in investors’ minds as new fears arise that inflation could become an issue that Policy Central will not ignore.

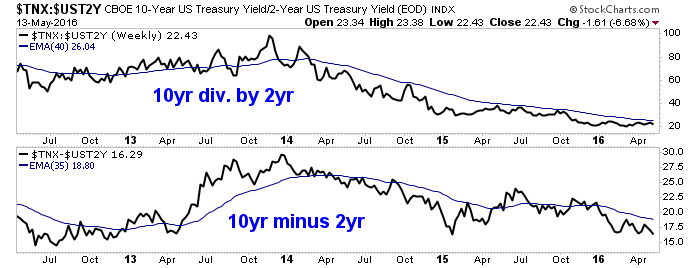

The yield curve has dropped further and there is no indication by this measure that a) the Fed is behind the curve on inflation or b) that imminent systemic risk is in play.

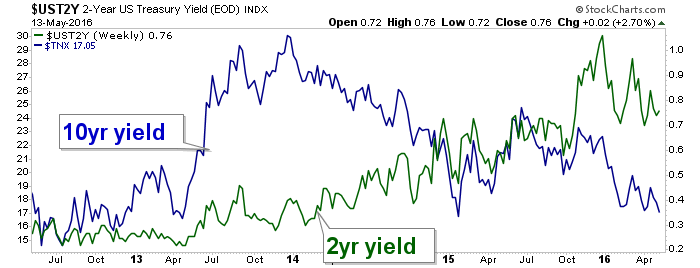

Nominal 2 year yields remain in an uptrend from 2013 and 10 year yields remain in a downtrend. That folks, is still an ongoing Goldilocks trend even though as we have noted for all of 2016, Goldilocks has been suspended while 2 year yields drop and inflation expectations rise.

Below is the 10yr Breakeven rate, which acts similar to the TIP-TLT ratio as an ‘inflation expectations’ gauge.

We have had a hard bounce off of an intense and unsustainable bout of deflationary fears. This bounce in inflation expectations has been a reaction to that. But here we note two things; the 10yrBIR is in a downtrend since 2013 and the bounce is in danger of dropping below levels we noted as resistance at around 1.6%, which is the current level.

Source: St. Louis Fed

In remaining aloft during this inflationary burst while the US dollar has declined, gold may have forfeited its right to rise with USD if it continues to bounce (as a result of inflation fears unwinding). Recall that there are times in certain macro conditions that gold and USD can rise or fall together. This is probably not one of those times.

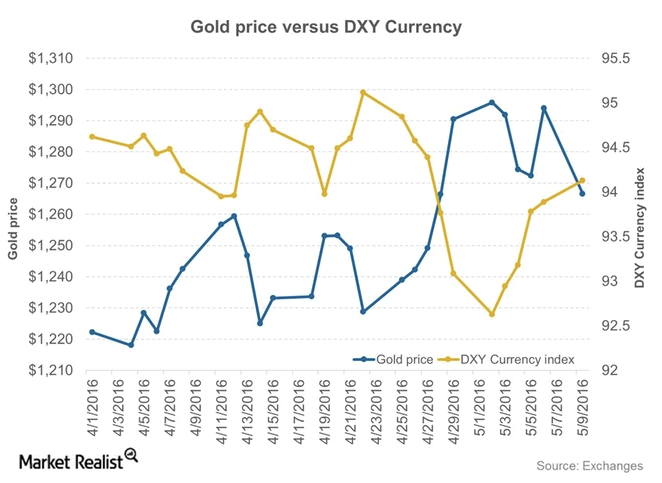

Source: Market Realist

Referring to the chart on page 1 [1st chart above], most asset markets would drop if the USD bounce continues past the 94.50 area, which we have defined as a reasonable ‘bounce’ objective. In a way it seems silly mentioning the Fed and ‘policy tightening’ in the same segment, but we have always got to check our assumptions, especially where a seemingly confused, definitely confusing and probably manipulative policy entity is concerned.

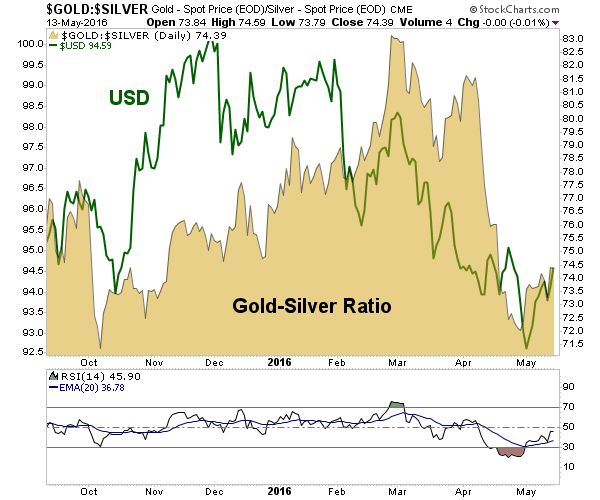

So we continue to keep a close eye on the gold-silver ratio (GSR), which may have bottomed. It is no coincidence that both the GSR and USD have bounced together.

Bottom Line

A post at nftrh.com last Tuesday titled Inflationist Gold Bugs Have Driven the Rally made the point that if the GSR has bottomed then the US dollar may have put in something more than just a bounce (to 94.50 or so). It is time to watch gold vs. silver very closely.

What’s more, while the gold-silver ratio can and probably would rise if USD rises, gold is not a candidate to rise along with it at this time. That is because after leading most markets out of the deflationary phase to begin the new year gold has been an also ran among anti-USD items. So it would probably not decline as badly as many items if the buck firms further, but it would not be expected to remain bullish on the short-term.

Rest assured however, the point I have tried to make consistently is that such an environment would re-fuel the gold stock sector’s fundamentals, which have been somewhat compromised of late. Witness the first chart to the Precious Metals segment… [in which we take a good hard look at the sector with no cheer leading, only facts]…

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.