Protecting Mortgage Giants from Slingshots

Housing-Market / Government Intervention Jul 18, 2008 - 04:52 PM GMTBy: Doug_Wakefield

Whether he intended to or not, Treasury Secretary Henry Paulson's statements, in a July 15th Bloomberg article titled, “Paulson Sees Fannie, Freddie Share Purchase Only If Necessary,” show the weakness of our current financial markets.

Whether he intended to or not, Treasury Secretary Henry Paulson's statements, in a July 15th Bloomberg article titled, “Paulson Sees Fannie, Freddie Share Purchase Only If Necessary,” show the weakness of our current financial markets.

“Fannie Mae and Freddie Mac ‘represent the only functioning secondary mortgage market,' Paulson said in written testimony today to the Senate Banking Committee. ‘Our plan is aimed at supporting the stability of financial markets, not just these two companies.'”

And, evidently this “only functioning secondary mortgage market” is not “functioning” all that well either.

“Treasury Secretary Henry Paulson said the government would buy shares in Fannie Mae and Freddie Mac ‘only if necessary' and called on Congress to approve his plan to shore up confidence in the two largest sources of U.S. mortgage financing.”

Similarly, in a CFO.com article titled, “SEC Declares War on Short Selling,” SEC Chairman Christopher Cox's statements to the Senate Banking Committee, on July 15 th 2008 , show that he is also fighting to bolster confidence in the financial markets.

“‘I think that if someone knowingly starts a rumor or passes on a rumor, they should go to jail,' Cox said. ‘This is even worse than insider trading. This is a deliberate and malicious destruction of the value and people's lives.'”

And, Bernanke is doing his part to provide cover for that little derivatives market, which according to the Office of Comptroller of the Currency's Q1 2008 report, now stands at $180 Trillion dollars . In a July 15 th 2008 UK Reuters' article titled, “Bernanke Wants No Big Change in OTC Derivative Oversight,” we read:

“They [over-the-counter derivatives markets] help with risk sharing, they provide liquidity to hedges, so I am not advocating any major change in the way we look at those particular instruments other than to make sure that we clear them and sell them properly," Bernanke told the Senate Banking Committee.”

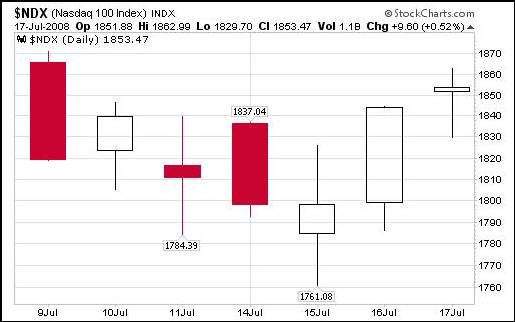

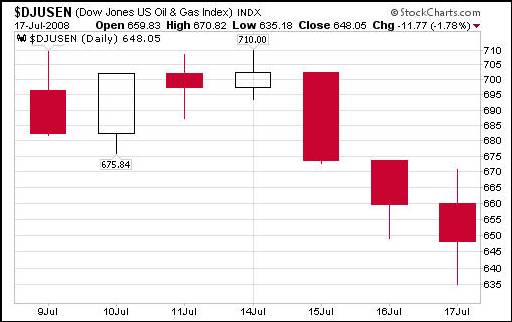

So, after reading these statements, if you were going to invest somewhere on Tuesday, where would it be? Technology? Oil? Banking? Okay. Let's take a look at a few charts, prepared on July 17 th , just two days later.

I know, I know. Banks stocks were oversold, and energy stocks were overbought. And clearly, both of these statements are true. But, the timing of it all continues to impress me. I mean, these speeches look to have had a profound impact on some very specific sectors in our markets. Of course, this dovetails nicely with the hypothesis presented in my last public article – The Day Free Markets Died. In that article, we noted that every bottom that has occurred since our financial leaders first uttered the words “credit crisis,” has come in the week of, or the week after, options expiration week, with the strongest breakouts occurring in the banking and brokerage sectors.

And, as we can see from the charts above, in what looks to be the fifth major bottom since August of 2007, this has happened again. Now, I ask you, what are the probabilities that the three “most authoritative” officials in the U.S. financial system just randomly gave speeches on a single day, which just randomly coincides with the July options expiration week, and the markets and specific market sectors just randomly happened to bottom on that day, just three days prior to options expiration?

Now before you answer, remember, according to page 272 of the seventh edition of the textbook used by the College of Financial Planning – Investments: An Introduction, “Security prices themselves are rationally and efficiently determined by such fundamental considerations as earnings, interest rates, dividend policy, and the economic environment.” Remember the Efficient Market Hypothesis is built on the premise that markets are efficient ? Well, maybe not that efficient.

Because his comments most certainly entered into the market psychology on Tuesday, July 15 th , we again draw our attention to Chairman Cox's SEC Press Release titled, “ SEC Enhances Investors Protection Against Naked Short Selling .”

“The Securities and Exchange Commission today issued an emergency order to enhance investor protections against ‘naked' short selling in the securities of Fannie Mae, Freddie Mac, and primary dealers at commercial and investment banks.

The SEC's order will require that anyone effecting a short sale in these securities arrange beforehand to borrow the securities and deliver them at settlement. The order will take effect at 12:01 a.m. ET on Monday, July 21. In addition to this emergency order, the SEC will undertake a rulemaking to address these issues across the entire market.

‘The SEC's mission to protect investors, maintain orderly markets, and promote capital formation is more important now than it has ever been,' said SEC Chairman Christopher Cox. ‘Today's Commission action aims to stop unlawful manipulation through “naked” short selling that threatens the stability of financial institutions. We will continue our vigorous commitment to investors by working within the SEC and in close cooperation with our regulatory counterparts to promote the continued health and vibrancy of our markets.'

The Commission's emergency order, pursuant to its authority under Section 12(k)(2) of the Securities Exchange Act of 1934, will be effective at 12:01 a.m. ET on July 21, 2008 and will terminate at 11:59 p.m. ET on July 29, 2008 . The Commission may extend the order to continue it in effect thereafter if the Commission determines that the continuation of the order is necessary in the public interest and for the protection of investors, but for no more than 30 calendar days in total duration.”

Since many within the general and investing public have no experience with it, the term “short selling” has no relevance. Many who've invested for as long as 30 or 40 years have never used tools designed for the short side of markets. Still, short selling is a normal market function and is a process that investment banks and primary dealers take part in daily in order for our markets to function.

Consider the following, taken from our Federal Register in 2003, when the SEC was preparing for rule changes that would address the problem of naked short selling, which is illegal, versus short selling, which is perfectly legal:

Short selling provides the market with at least two important benefits: market liquidity and pricing efficiency.\21\ Market liquidity is generally provided through short selling by market professionals, such as market makers (including specialists) and block positioners , who offset temporary imbalances in the buying and selling interest for securities. Short sales effected in the market add to the selling interest of stock available to purchasers and reduce the risk that the price paid by investors is artificially high because of a temporary contraction of selling interest. Short sellers covering their sales also may add to the buying interest of stock available to sellers. [Italics mine, page 62974 ]

So if the central focus of the SEC's emergency order was to stop naked short selling, I am certain the professionals who practice legal short selling support this action. But why stop with such a short list of companies for this special treatment? Haven't other companies asked the SEC to do something about the problem of illegal short selling before July 15 th of 2008 ? I mean, as the SEC's historical records reveal, this problem has most certainly been around for a while. Consider the following comments, regarding naked short selling, from page 117 of Riders on the Storm:

“Though we may not know the size and the scope of the problem, we do know it is large enough that the SEC felt it necessary to investigate the issue and enact the SHO regulations to attempt to curtail these activities. In November 2003 , the Federal Register notes:

‘Naked short selling can have a number of negative effects on the market, particularly when the fails to deliver persist for an extended period of time and result in a significantly large unfulfilled delivery obligation at the clearing agency where trades are settled.'

What should be clear from reading the comments so far is that naked short selling has been a problem for years, and that the timing of this “remedy” combined with the small group of stocks given to which these special privileges are to be extended, casts suspicion on the SEC's actions. Are these actions intended to boost investor confidence?

The trouble that I have repeatedly had with investment commentary over the last few years is that very few bring the historical perspective to light. In fact, it seems to me that the more information sources we have, the more confused we get, and the more we function collectively, almost like rats waiting for the next bit of dopamine news. We never seem to be able to step away from the daily noise and ask, “Was this a problem ten or twenty years ago,” and, “why are we just now addressing this?”

Now, consider the following comments from the SEC's own Pollack Report. If you are in the industry, and you have never heard of it, don't be surprised. Were it not for James Chanos having his firm, Kynikos Associates, obtain a copy of it for me from the Library of the SEC, I would have never seen it either. The Pollack Report, which was released 22 years ago, constitutes the most thorough research ever done by the SEC regarding short selling regulations. The following series of quotes from this report are found on page 92 and 93 in our research paper on short selling, Riders on the Storm: Short Selling in Contrary Winds:

“In certain case studies, substantial price increases occurred which were not based on fundamental financial results. Rather, buying and selling were based upon favorable publicity regarding unproven and untested products and speculation regarding the companies' potential success. The professional short sellers, through their research and investigative activities, arrived at the judgment that the companies would eventually fail to meet investor expectations. As later discussion will show, their judgments were often correct. Indeed, a principal of one of these short-selling firms stated that his firm only shorts companies that it expects to fail completely. (Pollack Report, page 60)

Of the 11 case studies, two did not have significant short selling. Nine experienced extensive short selling; and in six of these, subsequent corporate developments and resulting lower price levels demonstrated short sellers to be substantially correct in their assessment of the company. In the remaining three companies, the mastication of short sellers was clearly based on conflicting opinion and appraisals of future profit potential in a particular industry. Short sellers apparently misjudged the market for these companies. (Pollack Report, page 60)

Therefore, their activities can be expected to contribute to the efficiency of the pricing process in the market. If management disclosures are overly optimistic or such that they permit investors to become overly optimistic, then the pessimistic appraisals of professional short sellers invariably help to reduce the extreme price rises that would otherwise occur and protect the market and investors from excessive optimism or defective or inadequate disclosure of both . (Pollack Report, page 60, Italics mine)

So long as these sales are not accompanied by violations of delivery and settlement requirements or by fraudulent or manipulative conduct, they are not improper or abusive. (Pollack Report, page 15) The economic motivation of short sellers is no different from that of any other investor or trader – ‘buying low and selling high.' In the case of the short seller, the sequence of the transactions is simply reversed.” (Pollack Report, page 14)

While this may seem a bit archaic for some who are not professional traders, when we look at the list of companies given special privileges from July 21 st to July 29 th , one has to ask, “Was the real motive for the July 15 emergency order to stop naked short selling, or to stop financial stocks from their massive decline?”

On July 18 th of 2008, Bob Lang, of Lang Asset Management , notes:

“The emergency order regarding naked short selling does not impact our business operations. We have never taken a naked short position on a security. It is illegal and our broker dealer does not allow it. We only engage in short selling where shares are borrowed with prior approval. Our take on this emergency order was that it was more gloss, and that this was done to placate the public that something was being done about the falling markets.”

So if the very banks that seek emergency orders to stop “naked” short selling in their own stocks are also engaged in short selling activities as part of their daily market operations, what long-term directional changes will come from Tuesday's actions? Even more to the point, is it possible that these primary brokers and investment bankers own trading and investment desks have used shorting tools to improve their own profits ? As you read these comments, by Dr. Nouriel Roubini , ask yourself if you would sell or sell short this business model? “In the old ‘originate & hold' model [of banking] (before securitization) financial institutions made money from the investment income of holding the credit risk of loans and mortgages. But in the brave new world of securitization where you “originate & distribute” the credit risk, rather than hold it on balance sheet, an increasing fraction of the income of financial institutions was coming from the fees and commissions involved in this securitization process. This food chain of fees on top of fees is now broken: securitization of mortgages, that was running at the annual rate of $1,000 billion in January of 2007, was down 95% to an annual rate of $50 billion by January of 2008. So the process of generating fees and commissions is broken.”

What should be obvious to anyone at this stage is that while the SEC has always had an obligation to clean up naked short selling – and I support orderly markets which must punish illegal activity – a more pertinent issue remains. We are all watching a credit crisis, and that crisis was fueled, at the root level, by the very players who today demand special privileges from our market regulators and government leaders.

So, let me close with another time period where a government “came to the rescue” to clean up the “problem” with those “vicious” individuals, short sellers, as quoted from Kathryn Staley's The Art of Short Selling , at the beginning of section 5 of our research paper on short selling, Riders on the Storm: Short Selling in Contrary Winds.

“Short Sellers became common in the earliest organized markets – the Amsterdam exchanges. Around 1610, joint stock companies were created to fund new ventures, such as the Dutch East India Company, for exploration in the New World . A speculative frenzy arose. As the bubble burst, the directors of the company launched attacks on short sellers for causing the decline. They wrote a memorandum to the government stating that ‘bear attacks, which generally assume the form of short selling, have caused and continue to cause immeasurable damage to innocent stockholders, among whom one will find many widows and orphans.”

s you read this article, please understand, I am not the CEO of a fortune 500 company, a national political figure, or a leader, at the national level, in our markets. My objective is the same as many people I have met in the last 4 years: to use my financial capital to try to stay alive in what is unfolding as the most dangerous times in my life to invest. If you are interested in learning what you are missing from listening to the daily news without a historical perspective, consider joining our group of worldwide readers. To subscribe to our research, click here . To learn more about our research and advisory services, click here . A current subscription to our research gains an individual access to all of our educational writings back to Jan06, as well as our industry research paper on short selling, Riders on the Storm: Short Selling in Contrary Winds.

By Doug Wakefield and Ben Hill

President

Best Minds Inc. , A Registered Investment Advisor

3010 LBJ Freeway

Suite 950

Dallas , Texas 75234

doug@bestmindsinc.com

phone - (972) 488 -3080

alt - (800) 488 -2084

fax - (972) 488 -3079

Copyright © 2005-2008 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.