George Soros Was Once a Dollar Vigilante, Now a Ring Wraith Buying Gold

Commodities / Gold and Silver 2016 May 20, 2016 - 05:32 PM GMTBy: Jeff_Berwick

One of the inspirations for our name, The Dollar Vigilante, was what used to be called the Bond Vigilantes.

One of the inspirations for our name, The Dollar Vigilante, was what used to be called the Bond Vigilantes.

Last seen in full force in the inflationary early 1980s, bond vigilantes were anti-establishment figures who were said to have rebelled. They had decided to keep central banks and governments honest by raising long term interest rates in the open market. They would do so whenever the authorities kept their own interest rates too low, or let budget deficits grow out of control.

It was in 2010 that I overheard the term "bond vigilante" on a radio program once again and laughed for a moment, saying in my own head, Ah, yes, with interest rates at near zero or negative percent, Quantitative Easing to infinity and budget deficits in the US stretching the boundaries of belief, where are the bond vigilantes now?

And I thought to myself, "I guess the system is so far out of control now that you can't sell bonds to keep central banks or government under control as they'll just print up unlimited money to keep buying it."

I then had an epiphany and told myself, "What we need today are dollar vigilantes!"

That's what started this all...

In a sense, George Soros is a fellow dollar vigilante. An outsider who once tried to break the system... and he did.

On September 16, 1992, Black Wednesday, he sold short more than US$10 billion worth of pounds (which is just play money today but back then it was a massive amount) against the Bank of England. He was betting on its reluctance to raise its interest rates or float its currency.

The BoE finally withdrew the currency from the European Exchange Rate Mechanism, devaluing the pound sterling, and earning Soros an estimated US$1.1 billion. He was dubbed "the man who broke the Bank of England”.

And for that, we cheer(ed) him! What happened, in my estimation is that the ring of power (that's what the Lord of the Rings, by anarchist J.R.R. Tolkien was all about) is so strong that no one can be uncorrupted by it.

Anyway, George was called to Buckingham palace to see the Ring Master herself, the Queen of England. That must have been quite a conversation. Afterwards, George became a ring wraith. He started his foundation and became the leftist power he is today.

He became part of the New World in other words.

These days he clearly functions at the highest (public) levels, overthrowing countries to support the coming global order. And he raises funds to support organizations like Black Lives Matter to keep the people divided and chaotic. The more social turmoil there is, the easier it is to manipulate people and even whole societies. That's how globalism is achieved.

SO WE MEET AGAIN

Now we meet George again. Not as a dollar vigilante but as a wring wraith and fellow gold buyer. He's heavily long on gold and short the US stock market.

He's plunging into gold buying 19 million shares from Barack Gold valued at over $260 million. He's purchased 1.05 million shares of the SPDR Gold Trust ETF and doubled his short-sell on the U.S. S&P 500 Index.

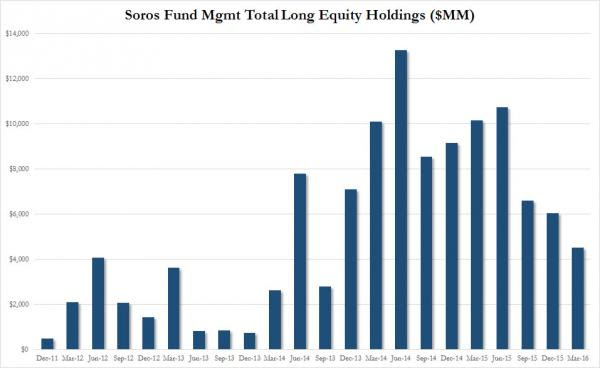

You can see the dramatic sell-off of long equity holdings here:

Notice that the most recent sell-off began in September 2015, at the end of the Shemitah Year and beginning of the current Jubilee Year.

Buying and selling the same things as George Soros is a somewhat queasy idea for us here at TDV.

But, while we both expect to profit massively, his intention is to use his profits to further push the new world order agenda. Ours is to help others survive and profit and be ahead of the game... and create additional freedom wherever we can.

Perhaps our ever-growing worldwide network of dollar vigilantes can help topple the system before it reaches its ultimate end. If so, we have stated our attention is to throw the ring of power (governments and central banks) into Mount Doom if we have the chance. Frodo showed, however, no matter how well intentioned, the ring is too powerful for any mortal.

We'll have to deal with that if we get there. In the meantime, we'll be positioning ourselves and subscribers just like George (Sauron) Soros.

You'll find our positions in our TDV newsletter. Not only do we present profitable positions every month that our subscribers have acted on, we have anticipated Soros by months and, in some ways, even by years.

Subscribe to the TDV newsletter today... it's the fastest growing newsletter in the world, and the only one written for dollar vigilantes. We're fighting the system by selling the dollar and buying gold and gold-related securities amongst many other innovate approaches.

In The Lord of the Rings, remember that the ring was a metaphor for government/central banks and top down control of all of Middle Earth written by an anarchist. If you never realized it, its a whole different movie.

In the real world, we're the men, elves, dwarfs and the hobbits trying to survive. We're hunkered down in the Shire preparing for a great battle as the NSA all seeing eye tries to watch everything we do, the ring wraiths (the intelligence agencies) and the army of orcs (the military industrial complex) ready themselves to try and take over.

Both sides are preparing by accumulating precious metals, gold stocks, bitcoin, hard assets and shorting the system that soon will cease to exist after the upcoming Great War. Whose side are you on?

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.