Slow Death Of Markets

Stock-Markets / Financial Markets 2016 Jun 07, 2016 - 10:29 AM GMTBy: InvestingHaven

In our May webinar, we discussed how hard markets have become, and how to invest in them. The key trend we identified is that central banks are distorting market behavior and capital flows. As our webinars are actionable, we analyzed several ways to deal with these markets and still be profitable.

In our May webinar, we discussed how hard markets have become, and how to invest in them. The key trend we identified is that central banks are distorting market behavior and capital flows. As our webinars are actionable, we analyzed several ways to deal with these markets and still be profitable.

The video embedded below provides a summary of the 6 most valuable insights that came out of that webinar:

- Slow death of markets

- Tactical tips for stock market investors

- The threat of zero interest rate policies

- Tips on trading the stock market

- Are treasuries an interesting investment?

- Should investors prefer stocks, bonds or commodities?

We really recommend to listen and absorb the information that was provided. As a teaser, we picked out two charts with the accompanying insights, which we discuss below.

Slow death of markets

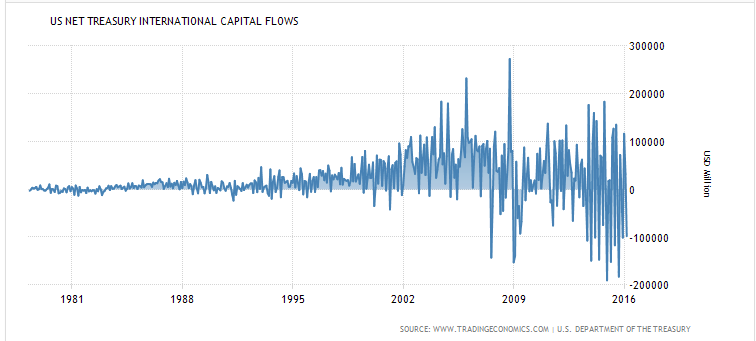

The first chart below, which was discussed in the first section of the webinar, displays the net amount of foreign currencies coming into the U.S. to buy Treasuries. 95% of the time money was flowing into the U.S. to buy Treasuries. Since some 4 years, however, money is flowing out of the U.S. That is probably what Quantitative Easing is about: before, money was financing U.S. debt, but that is not happening anymore which is the primary objective of Quantitative Easing.

The key insight out of the above chart is that this process will turn in (a) either a collapse in a 2008-alike fashion or (b) a very slow death of markets. It appears that scenario (b) is playing out: a slow death of markets.

Should investors prefer stocks, bonds or commodities?

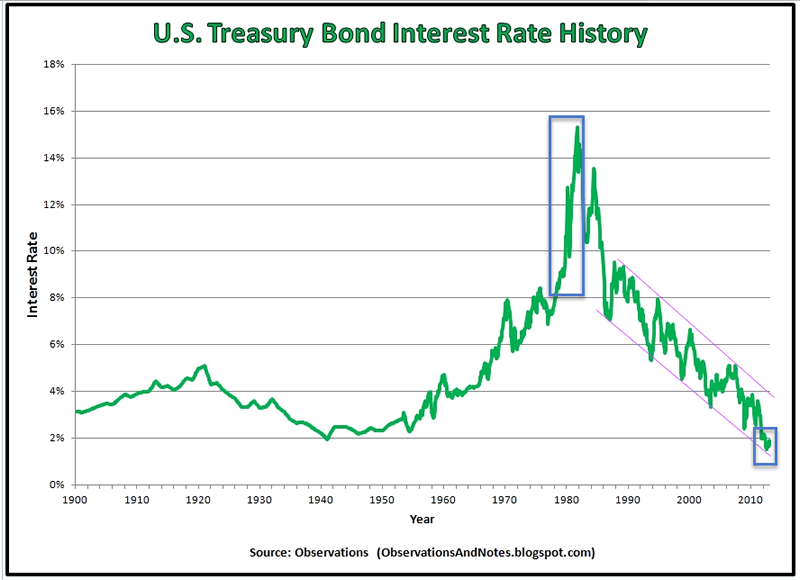

The second chart, which is the long term Treasury yield chart below, shows a clear trend pattern. Though this pattern can continue for a while, there is a chance that something similar will happen as in 1978. The years before 1978, there was a similar trend channel, though in the opposite direction of today, and a true explosion took place in 1979 and 1980. There is a real chance that a similar parabolic move lower could take place shortly, for instance “true” negative interest rates. So, today, we are at a tipping point, where the bond market is at an uptrend, stocks are at resistance, which could result in an outflow from stocks into bonds.

Opportunities

Two markets were identified as short to mid-term low risk high reward opportunities, though not integrated in the video. First, soybeans had an excellent chart setup when we conducted the webinar. Since then, soybeans are trading 30% higher. Similarly, sugar was identified as an opportunity, and, there again, listeners who took a position are looking back at 25% higher sugar prices.

Watch the summary with 6 great insights from our May webinar

This is a 25 minute version of the live session which nicely highlights the 6 insights outlined above in the introduction. Listeners can skip to their preferred section(s) without listening to the full video.

The next live webinar: How To Include Central Banks Policies In Your Investment Strategy?

Our next session is going to take place June 8th, at 1pm EST. The webinar will last 30 minutes, and attendance is free. If you would like to receive the recording, you should simply register here.

Analyst Team

The team has +15 years of experience in global markets. Their methodology is unique and effective, yet easy to understand; it is based on chart analysis combined with intermarket / fundamental / sentiment analysis. The work of the team appeared on major financial outlets like FinancialSense, SeekingAlpha, MarketWatch, ...

Copyright © 2016 Investing Haven - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.