Bitcoin after Nonfarm Payroll Data

Currencies / Bitcoin Jun 07, 2016 - 05:41 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Bitcoin is on the move up and this is the most prominently featured piece of news as far as the digital currency is concerned. On CoinDesk, we read:

Petar Zivkovski, director of operations at bitcoin trading platform Whaleclub, told CoinDesk that in his view, this correlation with the yuan is being used to sell headlines, and that it may not paint a portrait of what is happening on the ground.

"The theory that the Chinese are buying bitcoin due to yuan devaluation is a nice story to tell, but is in our view incomplete,” he told CoinDesk, adding:

“Bitcoin is a speculative asset and Chinese residents who are looking to preserve the value of their holdings can turn to USD or EUR, which are much more stable currencies."

Zivkovski said that he believes the bigger story is not negativity to the yuan, but rather improved market sentiment toward bitcoin. Data provided by Whaleclub suggests 94% of volume – as measured by position size – was long.

This is yet another suggestion that the yuan devaluation story is not the complete description of the recent rally. Of course, positive sentiment in the Chinese market and a possible devaluation of the yuan are not necessarily mutually exclusive. And now, we have yet another possible reason mentioned on the Internet.

The recent nonfarm payrolls were a huge disappointment for those who expected the economy to be on the right track for a rate hike in the summer. The weak job data might also have something to do with the recent move up, since Bitcoin shot up on Friday, the day of the nonfarm payrolls release. So, it might be the case that the Bitcoin trade is now also about the interest rate hike.

For now, let’s focus on the charts.

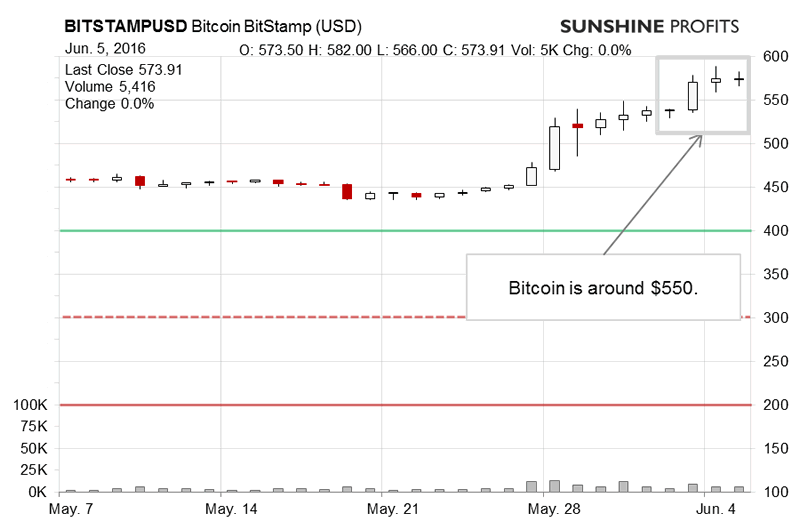

On BitStamp, we saw a move up on Friday, and relatively little action afterwards. What might this mean for the Bitcoin market? Recall our recent comments:

(…) we saw a decisive move to the upside over two days and on visibly larger volume – Friday and Saturday. Sunday was a day of action suggesting a possible reversal. The volume was weaker which also supported the reversal hint. Today, however, we’ve seen some appreciation, which is not a clear sign of a move down. From a short-term point of view, we are now in overbought territory, after a day of a possible reversal followed by appreciation on decreased volume. This is a bearish indication. For the time being, the fact that we are above the November 2015 high still makes the situation relatively risky. If we see a move back below this level, we might re-renter short positions.

At the moment, it seems that the decision not to go short has paid off as Bitcoin appreciated over the weekend, most of the appreciation taking place on Friday, coinciding with the release of the nonfarm payroll data. Other than that, the currency didn’t move much to the upside later on. The volume has been on the downside which is not a particularly strong bullish suggestion. Actually, it is a bearish hint.

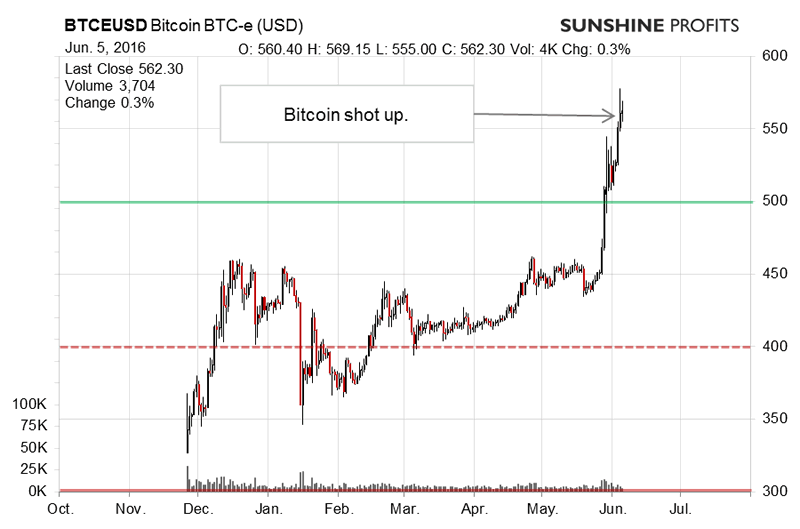

On the long-term BTC-e chart, we see Bitcoin after a violent move to the upside. Recall our recent remarks:

(…) we see the magnitude of the move up above $500. Actually this level is even more important as it is above the November 2015 high (on BTC-e). Bitcoin came close to $550 before reversing. Currently, the currency is around $520 and the breakout above $500 is still waiting for confirmation. Based on the violent swings, particularly on Sunday, we still might see the currency slip below $500. If this is the case, the top in Bitcoin might be confirmed and a move up could be underway. This is not the case yet, so we are waiting for a bearish hint here.

We saw a possible confirmation of the move above $500. The situation is one with most appreciation occurring on Friday and possibly driven by the Fed data. Apart from that, the move up seems to be losing momentum. The situation is not yet bearish for the short term but it might become so in the next couple of days.

Summing up, in our opinion no speculative short positions are suggested.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.