USDCAD Set To Resume Bear Rally

Currencies / Canadian $ Jun 08, 2016 - 04:20 AM GMTBy: Austin_Galt

The USDCAD looks just about ready to head back up which will be the next leg of the bear rally that commenced in early May 2016. Let's check out the action using the weekly and daily charts.

The USDCAD looks just about ready to head back up which will be the next leg of the bear rally that commenced in early May 2016. Let's check out the action using the weekly and daily charts.

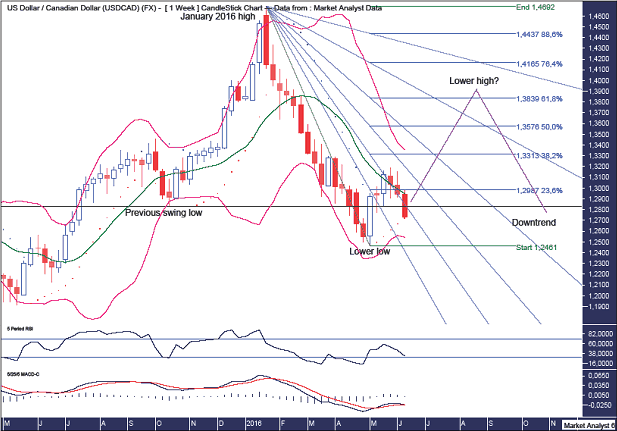

USDCAD Weekly Chart

The horizontal line denotes the previous swing low set in October 2015 and we can see the recent low at 1.2461 breached that level thereby creating a lower low. I now believe price is tracing out a significant bear rally that still has plenty of time and price still to play out.

The Bollinger Bands show price has encountered some resistance around the middle band and has been sliding down with it over the past few weeks. I believe decision time is upon us and price will make a decision any day now to leave this middle band and head up to the upper band and beyond.

The PSAR indicator is bullish with the dots at 1.2723. This is my tight setting and these dots that represent support often act like a magnet for price and I expect the higher low to be right around the 1.2723 level. Considering it is my tight setting, it is quite possible price to stage a fake out move whereby price busts the dots before turning back up. It is really neither here nor there and today's low of 1.2732 has so far held this support.

I have drawn a Fibonacci Fan from the January 2016 high to recent low. It shows price finding resistance at the 38.2% angle and trading back down in tandem with this angle with the angle now looking more like it is providing support. I expect price to lift off this angle at any time now and surge higher.

I have added Fibonacci retracement levels of the move down and I am targeting the final bear rally high to be at least up around the 61.8% level at 1.3839. The 76.4% level at 1.4165 is also worth considering.

The RSI showed a bullish divergence at the recent low and it looks to be building strength with a pattern of higher highs and higher lows.

The MACD indicator is bullish although the averages have come back together again and that is often the exact moment when a trend resumes.

Let's now look in a bit closer with the daily chart.

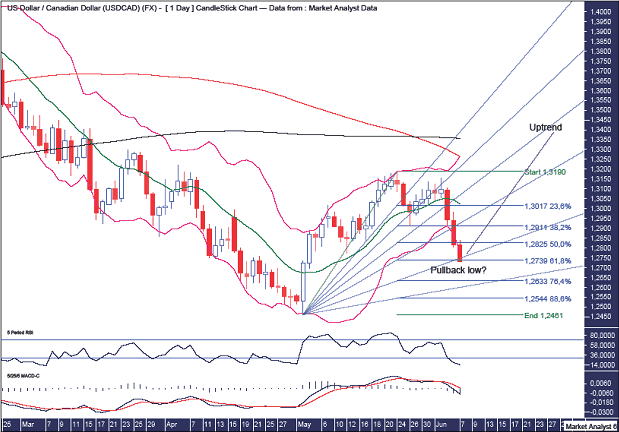

USDCAD Daily Chart

The Bollinger Bands show price now pushing into the lower band and this should act like a rubber band once price decides to bounce back up, assuming it does of course.

I have drawn a Fibonacci Fan from the low to recent high and this shows price right around support from the 76.4% angle. It is this angle where I expect the pullback low to form.

I have added Fibonacci retracement levels of the recent move up and I am looking for a low to form around support from the 61.8% level at 1.2739. Today's low of 1.2732 has marginally clipped that level so I would suggest it is alert stations for the bulls!

I have added moving averages with time periods of 100 (red) and 200 (black) and these have recently made a bearish crossover which adds support that this current move is a bear rally only.

The RSI is back in oversold territory while the MACD indicator is bearish although that is coming off a nice move up.

So, we just await a low followed by an impulsive reversal back up and I believe that will occur at any time now. One to watch!

By Austin Galt

Austin Galt is The Voodoo Analyst. I have studied charts for over 20 years and am currently a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts, there seemed to be a dearth of technical analysts. My aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

Email - info@thevoodooanalyst.com

© 2016 Copyright The Voodoo Analyst - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Austin Galt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.