Former Fed President: All My Very Rich Friends Are Holding a Lot of Cash

Stock-Markets / Investing 2016 Jun 13, 2016 - 03:18 PM GMTBy: John_Mauldin

BY TONY SAGAMI : If you put together a list of the world’s most brilliant, most famous investment experts… they were all at John Mauldin’s Strategic Investment Conference last month.

BY TONY SAGAMI : If you put together a list of the world’s most brilliant, most famous investment experts… they were all at John Mauldin’s Strategic Investment Conference last month.

My head is still spinning with all the information and investment ideas I heard at the conference, but the consensus among the majority of speakers was that things are going to get ugly.

Lacy Hunt, David Rosenberg, Neil Howe, Jim Grant, Mark Yusko, Gary Shilling, and even John Mauldin (watch video interviews with these speakers on Mauldin Economics’ Youtube channel) painted a very pessimistic picture for the stock market—but the most alarming comment came from Richard Fisher.

The rich are hoarding cash

Fisher was president of the Federal Reserve Bank of Dallas and a voting member of the Federal Open Market Committee (FOMC) from 2005 to 2015. You couldn’t find anyone more wired into the Fed and the state of the economy than Fisher.

He is worried about the $19 trillion US government debt (up $11 trillion since 2008) because the Fed has fired all its monetary bullets and can’t expand the balance sheet any further.

But Fisher’s most telling comment came during the Q&A session when he was asked how his personal portfolio was positioned. Fisher’s response: “In the fetal position.”

Moreover, he also said (paraphrasing as closely as I can), “All my very rich friends are holding a lot of cash.”

Not some.

Not many.

Prepare your portfolio before it’s too late

That is the same cautious message I’ve been repeating since 2014 and a growing number of Wall Street folks are starting to echo.

But maybe you don’t share that cautious view and think your portfolio is packed with great stocks.

Not so fast! No matter how good an investor you are, it isn’t easy making money in the stock market… even when times are good.

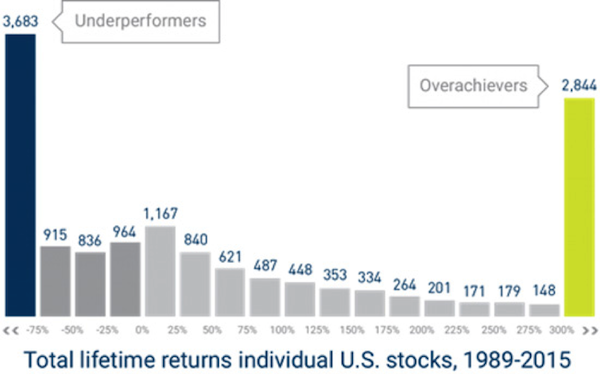

According to the people at Longboard Asset Management who studied the performance of more than 14,000 stocks between 1989 and 2015:

• 1,120 stocks (7.7% of all active stocks) outperformed the S&P 500 Index by at least 500%.

• 976 stocks (6.8% of all active stocks) lagged behind the S&P 500 by at least 500%.

• The remaining 12,404 stocks performed above, at, or below the same level as the S&P 500.

• 3,431 stocks (23.7% of all) dramatically underperformed the S&P 500 by 200% or more during their lifetimes.

As you can see, the key to making money in the stock market is to avoid the dogs, but that’s easier said than done and almost impossible when the stock market is falling.

That doesn’t mean you should sell all your stocks tomorrow morning. It does mean, however, that you should have some type of defensive strategy in place to protect you when things hit the fan.

That could be as simple as increasing your allocation of cash (like Fisher’s rich friends), using stop loss to limit your downside risk, or buying some portfolio insurance in the form of inverse ETFs or put options.

Subscribe to Tony’s Actionable Investment Advice

Markets rise or fall each day, but when reporting the reasons, the financial media rarely provides investors with a complete picture. Tony Sagami shows you the real story behind the week’s market news in his free weekly newsletter, Connecting the Dots.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.