Bonds And Stocks At All-Time Highs: Are Markets Confused Or Broken?

Stock-Markets / Stock Markets 2016 Jun 20, 2016 - 04:05 AM GMTBy: InvestingHaven

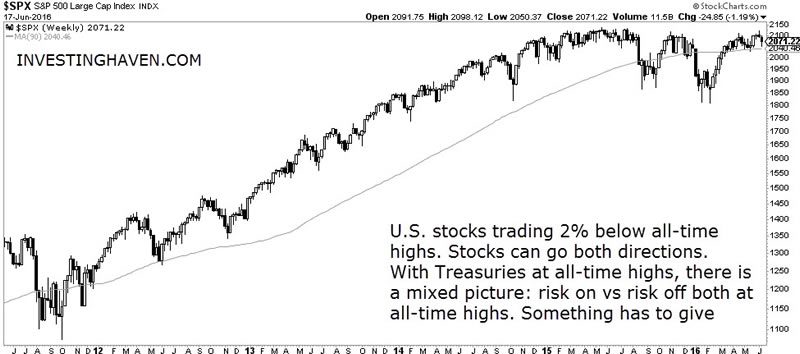

We observe odd trends in the market, the most important one being Treasuries and stocks both trading near all-time highs. That is definitely not ‘normal’ (whatever that term means nowadays), as bonds stand for ‘risk off’ (a safe haven asset) while stocks are only performing in a ‘risk on’ environment.

We observe odd trends in the market, the most important one being Treasuries and stocks both trading near all-time highs. That is definitely not ‘normal’ (whatever that term means nowadays), as bonds stand for ‘risk off’ (a safe haven asset) while stocks are only performing in a ‘risk on’ environment.

We all know that central banking policies have distorted markets. Interestingly, as the U.S. Fed talks about rising interest rates, the market keeps on pushing bond prices higher, which implies that interest rates are pushed lower by the market.

Now this is an important dynamic, and that could have huge implications for investors.

One way to interpret this is that central banking policies are not effective anymore. If that were true, we could expect a cataclysmic event similar to 2008.

The other interpretation is less ‘gloom and doomish’. Though it is also based on the fact that markets are heavily distorted because of central banking interventions, it suggests that markets are in a trendless state (because of interventions), trying to figure out whether the next trend is based on safety or risk.

Basically, the question is this: are markets so distorted that they are broken or are they looking for a trend?

We believe the latter is the case, and we also believe we will get an answer very, very soon. Our belief is based on intermarket analyis, i.e. the bonds to stocks ratio (chart below). The ratio suggests that markets arrived at a critical juncture. It is decision time, right here right now.

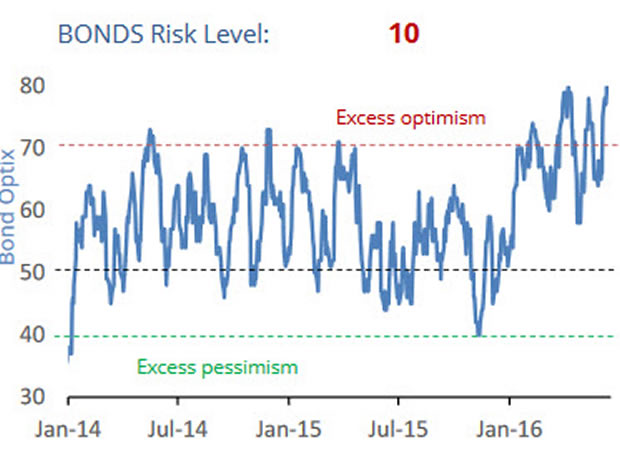

It is hard to forecast which direction markets will choose. If anything, bonds seem to be in extreme territory, based on the Sentimentrader optimism index. This is what Sentimentrader discovered a couple of days ago:

The Optimism Index for the broad bond market moved to a new all-time high this week, dating back to 1991. That’s a remarkable feat. The other times it has exceeded 80, bonds had a lot of trouble sustaining further short-term gains. It has not been a great short-term indicator, but has been quite effective in the medium-term and risk in government bonds is exceptionally high.

The bond market optimism index has reached extremes not seen in many decades. That suggests a correction is coming, which would imply that capital would flow to risk assets, most likely to stock markets.

CONCLUSION:

The market is giving a very strange message: both ‘risk on’ and ‘risk off’ assets seem to be in favor. However, when looking in more detail, it seems that markets are looking for direction. That does not suggest a doomsday scenario. Based on the bond optimism index, we believe that bonds are extremely overbought. As the bonds to stocks ratio is at a decision point, the odds favor a correction of bond markets, which would send stocks considerably higher in 2016.

Analyst Team

The team has +15 years of experience in global markets. Their methodology is unique and effective, yet easy to understand; it is based on chart analysis combined with intermarket / fundamental / sentiment analysis. The work of the team appeared on major financial outlets like FinancialSense, SeekingAlpha, MarketWatch, ...

Copyright © 2016 Investing Haven - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.