BREXIT Day – Markets Becalmed – Gold Panic Prelude

Commodities / Gold and Silver 2016 Jun 23, 2016 - 03:36 PM GMTBy: GoldCore

BREXIT Day and the UK EU referendum is upon us today and investors are expecting more choppy trading in financial markets in the coming hours. The City of London is bracing itself for potentially the most volatile night since the sterling devaluation on Black Wednesday.

BREXIT Day and the UK EU referendum is upon us today and investors are expecting more choppy trading in financial markets in the coming hours. The City of London is bracing itself for potentially the most volatile night since the sterling devaluation on Black Wednesday.

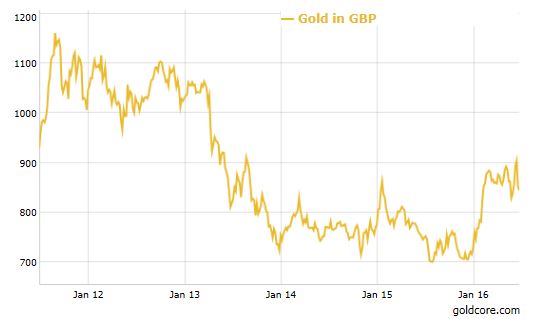

Gold in GBP – 5 Years

This morning, as British voters headed to the polls, sterling hit a 2016 high versus the dollar and gold in sterling terms fell to £844 per ounce, down 10% from a high of £928.85 per ounce just 5 trading days ago on June 16.

While the gold market is on the surface becalmed, there has been very significant high net worth and institutional demand in recent weeks and this is leading to an, as of yet, unacknowledged and unappreciated “panic” in the interbank gold market due to unprecedented conditions and “supply issues” as we revealed yesterday.

Gold and silver may come under further selling pressure in the short term, especially if the remain side wins the referendum. However, any weakness is likely to be short term due to the increasing risks of a global recession, risks posed by negative interest rates and bail-ins and many geo-political threats throughout the world. Illiquidity and supply issues in the London Good Delivery inter bank gold market also bode very well for gold.

A vote to stay could be considered priced in to markets now. In the event of a leave vote, stock markets will sell off sharply and safe haven gold and silver will likely rally especially against the euro and sterling.

World stocks remain very buoyant despite the risks and have climbed for a fifth day running. Risk appetite remains high and markets appears somewhat complacent about the still real risks of a vote to leave the EU and indeed other global risks.

Despite the most recent polls clearly showing the result is set to be extremely close, markets are very much pricing in a vote to remain. This creates the real risk that a vote to leave leads to dislocations, sharp corrections and potentially crashes in stock markets. A Brexit vote would likely lead to a very sharp correction, with the FTSE 100 plummeting. Swiss bank UBS has warned of sharp falls to levels of between 4,900 and 5,500, wiping off around £350 billion from the market.

The official result is not expected until 0600 GMT or later on Friday morning. The markets will begin to react, potentially very rapidly, from when the first results are announced in or around 0100 GMT, especially if they are showing the leave camp in the lead.

Some hedge funds have commissioned their own exit polls in order to get vital intelligence ahead of the market. Thus, sharp moves ahead of the official results may be perceived as certain market participants having advance knowledge of the result. Market manipulation and the usual trading ‘shenanigans’ are to be expected. Another reason to avoid the short term noise and focus on the long term and the importance of owning quality, value assets in a diversified portfolio.

Our trading desk will be open until 1900 BST today and from 0700 BST tomorrow morning (Friday 24th), if you need to buy or sell precious metals.

Gold Prices (LBMA AM)

23 June: USD 1,265.75, EUR 1,112.22 & GBP 850.96 per ounce

22 June: USD 1,265.00, EUR 1,122.31 & GBP 862.98 per ounce

21 June: USD 1,280.80, EUR 1,129.67 & GBP 866.72 per ounce

20 June: USD 1,283.25, EUR 1,132.08 & GBP 877.49 per ounce

17 June: USD 1,284.50, EUR 1,142.05 & GBP 899.41 per ounce

16 June: USD 1,307.00, EUR 1,161.14 & GBP 922.01 per ounce

15 June: USD 1,282.00, EUR 1,141.49 & GBP 903.04 per ounce

Silver Prices (LBMA)

23 June: USD 17.29, EUR 15.16 & GBP 11.61 per ounce

22 June: USD 17.20, EUR 15.23 & GBP 11.72 per ounce

21 June: USD 17.36, EUR 15.34 & GBP 11.78 per ounce

20 June: USD 17.34, EUR 15.30 & GBP 11.85 per ounce

17 June: USD 17.37, EUR 15.43 & GBP 12.19 per ounce

16 June: USD 17.71, EUR 15.79 & GBP 12.54 per ounce

15 June: USD 17.41, EUR 15.51 & GBP 12.26 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.